Measurement of Credit Risk

-

Measurement of Credit Risk

- Notional amounts, adding up simple exposures

- Risk-weighted amounts, adding up exposures with a rough adjustment for risk

- Notional amounts combined with credit rating, adding up exposures adjusted for default probabilities

- Internal portfolio credit models, integrating all dimensions of credit risk

-

Credit Risk versus Market Risk

Item Market Risk Credit Risk Sources of risk Market risk only Default risk, recovery risk, market risk Distributions Mainly symmetrical, perhaps fat tails Skewed to the left Time horizon Short-term (days) Long-term (years) Aggregation Business/trading unit Whole firm vs. counterparty Legal issues Not applicable Very important

Measuring Credit Risk

Credit Losses

Default mode: suppose all losses are due to the effect of defaults only.

The distribution of cresit losses (CLs) from a portfolio of

If

If assuming

The variance can be derived using the following formula

So we have

When

Measuring Actuarial Default Risk

Credit Event

Definition of default by Standard & Pool's

The first occurrence of a payment default on any financial obligation, rated or unrated, other than a financial obligation subject to a bona fide commercial dispute; an exception occurs when an interest payment missed on the due date is made within the grace period.

Definition of credit event by International Swaps and Derivatives Association (ISDA)

- Bankruptcy, which is defined as a situation involving either of the following:

- The dissolution of the obligor (other than merger)(债务人的解散)

- The insolvency, or inability to pay its debt(无力偿债或无法偿还债务)

- The assignment of claims(债权转让/债权让与)

- The institution of bankruptcy proceeding(破产程序的启动/破产程序的提起)

- The appointment of receivership(指定接管人/委任接管人)

- The attachment of substantially all assets by a third party(第三方查封实质上全部资产/第三方扣押基本全部资产)

- Failure to pay, which means failure of the creditor to make due payment; this is usually triggered after an agreed-upon grace period and when the payment due is above a certain amount.

- Obligation/cross default(义务违约/交叉违约), which means the occurrence of a default (other than failure to make a payment) on any other similar obligation.

- Obligation/cross acceleration(义务加速到期/交叉加速到期), which means the occurrence of a default (other than failure to make a payment) on any other similar obligation, resulting in that obligation becoming due immediately.

- Repudiation(拒绝履行/否认债务)/moratorium(延期偿付/暂停偿付), which means that the counterparty is rejecting, or challenging, the validity of the obligation.

- Restructuring(债务重组), which means a waiver, deferral, or rescheduling of the obligation with the effect that the terms are less favorable than before.

Other events sometimes included are

- Downgrading(信用评级下调/评级下降), which means the credit rating is lower than previously, or is withdrawn.

- Currency inconvertibility(货币不可兑换/汇率管制), which means the imposition of exchange controls or other currency restrictions by a governmental or associated authority.

- Governmental action(政府行为/政府措施), which means either (1) declarations or actions by a government or regulatory authority that impair the validity of the obligation, or (2) the occurrence of war or other armed conflict that impairs the functioning of the government or banking activities.

Default Rates & Credit Ratings

-

A credit rating is an ''evaluation of creditworthiness'' issued by a credit rating agency (CRA).

-

The major U.S. bond rating agencies are

- Moody's Investors Service

- Standard and Pool's (S&P)

- Fitch Ratings

-

Moody's definition of a credit rating

Opinion of the future ability, legal obligation, and willingness of a bond issuer or other obligor to make timely payments on principal and interest due to investors.

-

Ratings represent objective (or actuarial) probabilities of default

- published default frequencies can be used to convert ratings to default probabilities

|

|

- Accounting ratios & credit ratings

Rating Leverage:

(Percent)Cash Flow Coverage:

(Multiplier)Total Debt/Capital EBITDA/Interest EBIT/Interest AAA 12 32.0 26.2 AA 35 19.5 16.4 A 37 13.5 11.2 BBB 45 7.8 5.8 BB 53 4.8 3.4 B 73 2.3 1.4 CCC 99 1.1 0.4

-

Multiple Discriminant Analysis (MDA)

- MDA constructs a linear combination of accounting data that provides the best fit with the observed states of default and non-default for the sample firms

-

- working capital over other assets,

- retained earnings over total assets,

- EBIT over total assets,

- market value of equity over total liabilities,

- net sales over total assets.

Historical Default Rates

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

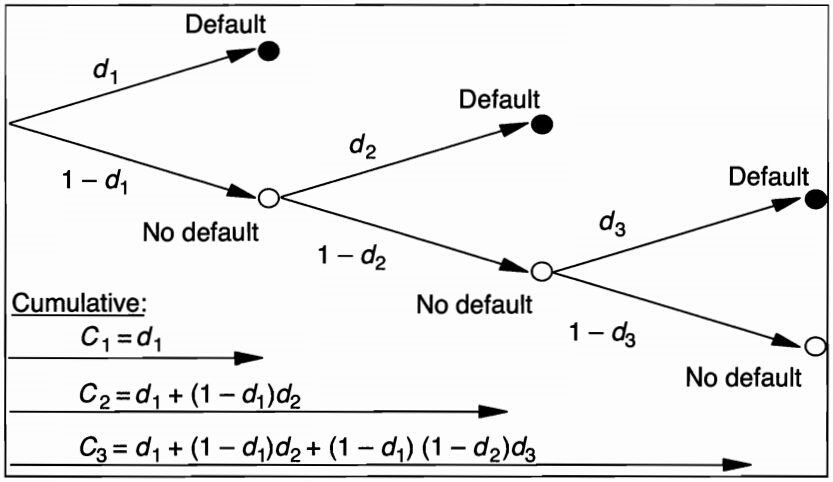

Cumulative and Marginal Dafault Rates

-

Cumulative default rates measure the total frequency of default at any time between the starting date and year

-

Notations

- Calculating rates

- Marginal Default Rate during Year

- Survival Rate:

- Marginal Default Rate from Start to Year

- Cumulative Default Rate:

- Average Default Rate:

- Average Default Rate for different compounding frequencies:

- Marginal Default Rate during Year

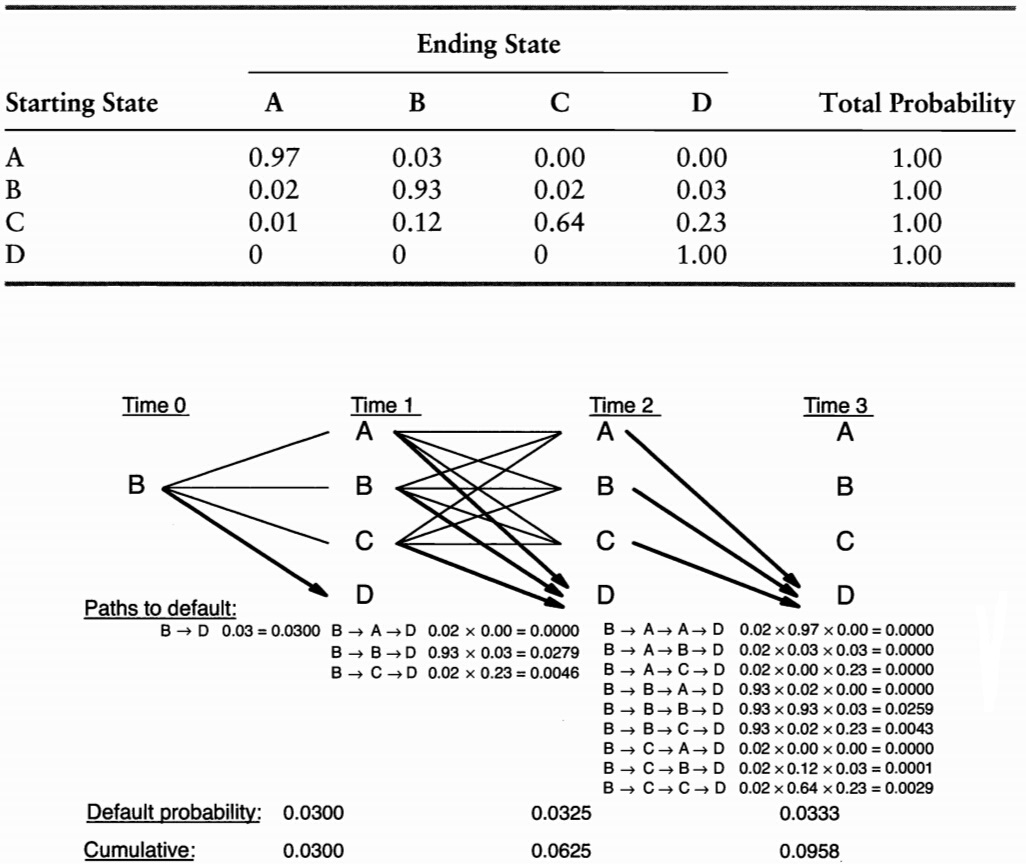

Transition Probabilities

Recovery Rates

The Bankruptcy Processes

Pecking order for a company's creditor:

| Seniority | Type of Creditor |

|---|---|

| Highest (paid first) | 1. Secured creditors (up to the extent of secured collateral) |

| 2. Priority creditors | |

| • Firms that lend money during bankruptcy period | |

| • Providers of goods and services during bankruptcy period (e.g., employees, lawyers, vendors) | |

| • Taxes | |

| 3. General creditors | |

| • Unsecured creditors before bankruptcy | |

| Lowest (paid last) | • Shareholders |

Estimates of Recovery Rates

The recovery rate depends on the following factors:

- The status or seniority of the debtor. Claims with higher seniority have higher recovery rates. More generally, a greater debt cushion, or the percentage of total company debt below the instrument, also leads to higher recovery rates.

- The state of the economy. Recovery rates tend to be higher when the economy is in an expansion, and lower when in a recession.

- The obligor's characteristics. Recovery rates tend to be higher when the borrower's assets are tangible and when the previous rating was high. Utilities have more tangible assets, such as power-generating plants, than other industries and consequently have higher recovery rates. Also, companies with greater interest coverage and higher credit ratings typically have higher recov ery rates.

- The type of default. Distressed exchanges, as opposed to bankruptcy proceedings, usually lead to higher recovery rates. Unlike a bankruptcy proceeding, which causes all debts to go into default, a distressed exchange involves only the instruments that have defaulted.

The recovery rate for corporate debt.

| Priority | Count | Mean | S.D. | Min. | 10th | Median | 90th | Max. |

|---|---|---|---|---|---|---|---|---|

| All bank loans | 310 | 61.6 | 23.4 | 5.0 | 25.0 | 67.0 | 90.0 | 98.0 |

| Equipment trust | 86 | 40.2 | 29.9 | 1.5 | 10.6 | 31.0 | 90.0 | 103.0 |

| Senior secured | 238 | 53.1 | 26.9 | 2.5 | 10.0 | 34.0 | 82.0 | 125.0 |

| Senior unsecured | 1,095 | 37.4 | 27.2 | 0.3 | 7.0 | 30.0 | 82.2 | 122.6 |

| Senior subordinated | 450 | 32.0 | 24.0 | 0.5 | 5.0 | 27.0 | 60.5 | 123.0 |

| Subordinated | 477 | 30.4 | 21.3 | 0.5 | 5.0 | 27.1 | 60.0 | 102.5 |

| Junior subordinated | 22 | 23.6 | 19.0 | 1.5 | 3.8 | 16.4 | 48.5 | 74.0 |

| All bonds | 2,368 | 36.8 | 26.3 | 0.3 | 7.5 | 30.0 | 80.0 | 125.0 |

Source: Adapted from Moody's, based on 1982-2002 defaulted bond prices.

The legal environment is also a main driver of recovery rates.

| Instrument | Europe | North America |

|---|---|---|

| Bank loans | 47.6 | 61.7 |

| Bonds | ||

| Senior secured | 52.2 | 52.7 |

| Senior unsecured | 25.6 | 37.5 |

| Senior subordinated | 24.3 | 32.1 |

| Subordinated | 13.9 | 31.3 |

| Junior subordinated | NA | 24.5 |

| All bonds | 28.4 | 35.3 |

| Preferred stock | 3.4 | 10.9 |

| All instruments | 27.6 | 35.9 |

Source: Adapted from Moody's, from 1982-2002 defaulted bond prices.

| Instrument | Trading Prices 15-45 Days | Discounted Recovery |

|---|---|---|

| Bank loans | 58.0 | 81.6 |

| Senior secured bonds | 48.6 | 67.0 |

| Senior unsecured bonds | 34.5 | 46.0 |

| Senior subordinated bonds | 28.4 | 32.4 |

| Subordinated bonds | 28.9 | 31.2 |

Source: Adapted from S&P, from 1988-2002 defaulted debt.

- Trading prices of debt shortly after default can be used as an estimator of recovery rate, however, they are on average lower than the discounted recovery rates

- clienteles for the two markets are different

- risk premium in trading price

- An opportunity: buying the defaulted debt and working through the recovery process

- distress securities funds

- distress securities funds

Measuring Default Risk from Market Prices

Corporate Bond Prices

Spreads and Default Risk: Single Period

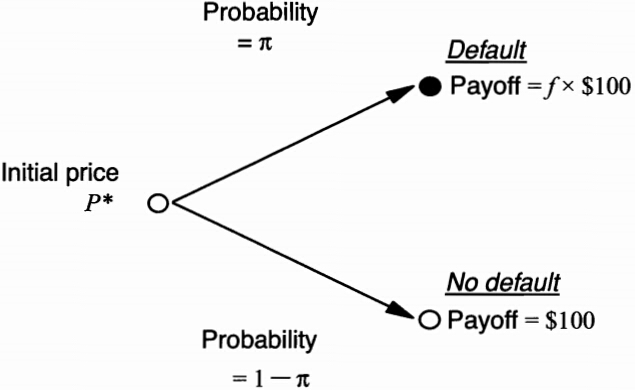

Suppose a bond has a single payment $100 in one period, the market-determined yield

We apply risk-neutral pricing:

Spreads and Default Risk: Multiple Periods

We compound interest rates and default rates over each period.Let

If we use the cumulative default probability

A very rough approximation:

Risk Premium

In the previous analysis we assume risk neutrality. As a result,

Assuming

The risk premium (

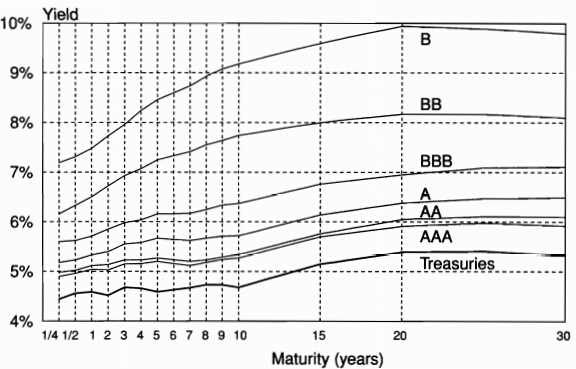

Cross-Section of Yield Spreads

- The transition from Treasuries to AAA credit most likely reflects other factors, such as liquidity and tax effects, rather than actuarial credit risk

- We can use information in corporate bond yield to make inferences about credit risk

- Movements in corporate bond prices tend to lead changes in credit ratings

Time Variation in Credit Spreads

Part of default risk can be attributed to common credit risk factors such as

-

General Economic conditions

- growth

- slow down

-

Volatility

- investors require more risk premium in a more volatile environment

- liquidity may dry up

-

The effect of volatility through an option channel

- a callable bond = bond + (short) a call

- the value of call increases in a more volatile environment

Equity Prices

The Merton Model

-

The Merton (1974) model views equity as akin to a call option on the assets of the firm, with an exercise price given by the face value of debt

-

Consider a firm with total value

- equity can be viewed as a call option on the firm value with strike price equal to the face value of debt

- the current stock price embodies a forecast of default probability in the same way that an option embodies a forecast of being exercised

- corporate debt can be viewed as risk-free debt minus a put option on the firm value

Pricing Equity and Debt

Firm value follows the geometric Brownian motion

The value of firm can be decompose in to the value of equity (

The equity value is

Stock Valuation

where

Firm Volatility

Bond Valuation

Risk-Neutral Dynamics of Default

Pricing Credit Risk

Credit Option Valuation

Applying the Merton Model

-

the KMV approach: the company sells expected default frequencies (EDFs) for global firms

-

Advantages

- it relies on the price of equities, which are more actively traded than bonds

- correlations between equity prices can generate correlations between bonds

- it generates movements in EDFs that seems to \textit{lead changes in credit ratings

-

Disadvantages

- it can not be used to price sovereign credit risk

- it relies on a static model of the firm's capital and risk structure

- management could undertake new projects that increases not only the value if equity but also its volatility

- the model fails to explain the magnitude of credit spreads we observe on credit-sensitive bonds

A Detailed Example

It is instructive to work through a simplified example. Consider a firm with assets worth

The horizon is

Working through the Merton analysis, one finds that the current stock price should be

which implies a yield of

The analysis also generates values for

Finally, let us decompose the expected loss at expiration from Equation (21.30), which gives

This combines the probability of default with the expected loss upon default, which is

Note that the model needs very high leverage, here

With lower leverage, say

课堂练习

假设某3年期企业债券每年支付7%的券息,每半年付息一次,收益率为5%(以每半年复利计)。所有期限的无风险债券的收益率均为4%(以每半年复利计)。假设违约事件可能每半年发生一次(刚好在债券每次付息之前),回收率为45%。请在以下假设下估计违约概率:

- 在每个可能违约的日期,无条件违约概率均相同;

- 在每个可能违约的日期之前无违约的条件下,发生违约条件概率均相同。

课堂练习

请根据以下条件分析债券的违约概率和到期收益率:

- 无风险利率为每年4%,某信用债券的收益率为每年6%。假设若该债券违约,回收率为70%。请估计该债券一年内发生违约的概率为多少?;

- 某风险分析师尝试估计一个BB级债券的收益率。如果无风险利率为每年3.5%,BB级债券的违约概率为7%,违约损失率(Loss given default)为70%。请估计该债券的到期收益率。

Credit Exposures

Credit Exposore by Instrument

-

Credit exposure:

- current exposure is the value of the asset at the current time

- potential exposure represents the exposure on some future date, or set of dates

- current exposure is the value of the asset at the current time

-

Loans or Bonds

- loans or bonds are balance sheet assets whose current and potential exposure basically is notional, or amount lent or invested

- the exposure is also notional for receivables and trade credits, as the potential loss is the amount due

-

Garantees

- guarantees are off-balance-sheet contracts whereby the bank has underwritten, or agrees to assume, the obligations of a third party.

- the exposure is the notional amount

- it is irrevocable

-

Commitments

- Commitments are off-balance-sheet contracts whereby the bank commits to a future transaction that may result in creating a credit exposure at a future date

- irrevocable commitments vs. revocable commitments

- Swaps or Forwards

- Swaps or forwards contracts are off-balance-sheet items that can be viewed as irrevocable commitments to purchase or sell some asset on prearranged terms

- the current and potential exposure will vary from zero to a large amount depending on movements in the driving risk factors

- similar arrangement are sale-repurchase (repos)

-

Long Options

- Options are off-balance-sheet items that may create many credit exposure

- the current and potential exposure will vary from zero to a large amount depending on movements in the driving risk factors

- there is no possibility for options to have negative values

-

Short Options

- the current and potential exposure for short options is zero because the bank writting the option can incur only a negative cash flow, assuming the option premium has been fully paid

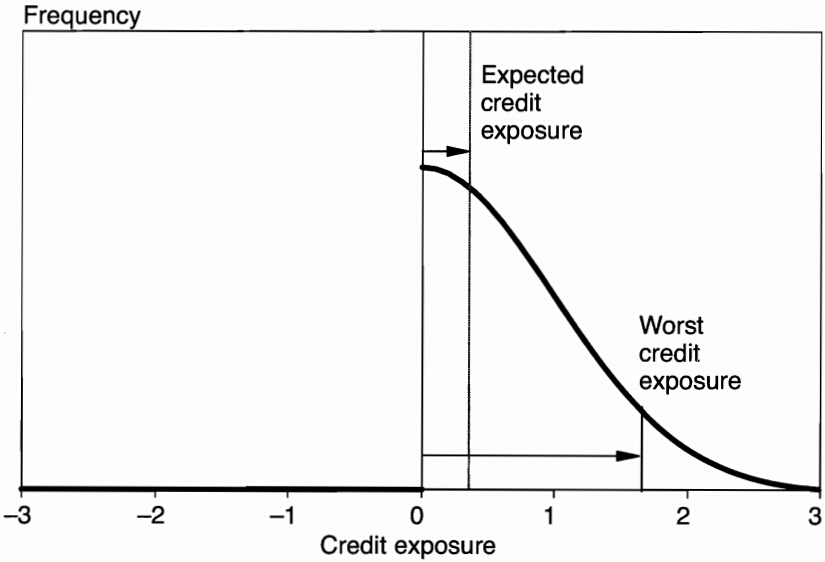

Distribution of Credit Exposure

Expected & Worse Exposure

The expected credit exposure (ECE) is the expected value of the asset replacement value

The worse credit exposure (WCE) is the largest (worst) credit exposure at some level of confidence. It is implicitly defined as the value that is not exceeded at the given confidence level

To model the potential credit exposure, we need to

-

model the distribution of risk factors

-

evaluate the instrument given these risk factors

-

the process is identical to a market value at risk computation

-

the aggregation takes place at the counterparty level if contracts are netted

Time Profile

The average expected credit exposure (AECE) is the average of the expected credit exposure over time, from now to maturity

The average worst credit exposure (AWCE) is defined similarly:

Exposure Modifiers(敞口调整因子/风险敞口修正系数)

Marking-to-Market (MTM)

-

involves settling the variation in the contract value on a regular basis

- it is called two-way marking to market if the treatment is symmetrical across the two counterparties

- if one party settles losses only, it is called one-way marking to market

-

Daily MTM reduces the current credit exposure to zero, however there is still potential exposure because the value of the contract would change before the next settlement. Potential exposure arises from:

- the time interval between MTM periods

- the time required for liquidating the contract when the counterparty defaults

- MTM introduces other types of risks

- operational risk, which is due to the need to keep track of contract values and to make or receive payments daily

- liquidity risk, because the institution now needs to keep enough cash to absorb variations in contract value

Margins

-

Margins represent the cash or securities that must be advanced in order to open a position

- the purpose of these funds is to provide a buffer against potential exposure

- initial margin vs. maintenance margin

-

Margins are set in relation to price volatility and to the type of position, speculation or hedging

- margins increase for more volatile contracts

- margins are typically lower for hedgers

Collateral

- OTC markets may allow posting securities as collateral instead of cash

- the amount of collateral will exceed the funds owed by an amount known as haircut(折扣率/减值系数), which reflects both default risk and market risk.

- collateral is typically managed within the International Swap and Derivatives Association (ISDA) credit support annex (CSA)(信用支持附件/担保品管理协议)

Exposure Limits(敞口限额)

- Credit exposure can also be managed by setting position limits on the exposure to a counterparty

- To enforce limits, information on transactions must be centralized in middle-office systems

- These limits can also be set at the instrument level

Recouponing (债券重组/重新附息)

- Recouponing refers to a clause in the contract requiring the contract to be marked to market at some fixed dates. It involves

- exchanging cash to bring the MTM value to zero

- resetting the coupon or the exchange rate to prevailing market value

Netting Arrangements((净额结算安排/轧差安排)

-

It reduces the exposure to the net value for all the contracts covered by the netting agreement

-

Nettings can be classified into three types:

- payment netting(支付净额结算/付款轧差) involves the daily offsetting of several claims in the same currency

- novation netting(更新轧差/新债轧差) involves the cancellation of several contracts between the two parties, resulting in a replacement contract with new, net payments

- close-out netting(提前终止净额结算/违约轧差) involves the cancellation of all transactions under the master agreement in the event of bankruptcy or any other specified default event

Other Modifiers

- third-party guarantees

- purchasing credit derivatives

Credit Risk Modifiers(信用风险调节因子/信用风险修正因子)

- Credit triggers(信用触发条件/信用触发机制) specify that if either counterparty's credit rating falls below a specified level, the other party has the right to have the swap cash settled

- these are not exposure modifiers, but rather attempt to reduce the probability of default on that contract

- these triggers are useful when the credit rating of a firm deteriorates slowly, because few firms jump directly from investment grade into bankruptcy

-

Time puts(定时卖出期权/时间卖出条款), or mutual termination options(双方终止期权/互相终止选择权), permit either counterparty to terminate the transaction unconditionally on one or more dates in the contract.

- the feature decreases both the default risk and exposure

- it allows one counterparty to terminate the contract if the exposure is large and the other party's rating starts to slip

-

Triggers and put, which are types of contingent requirements(或有要求/条件性要求), can cause serious trouble

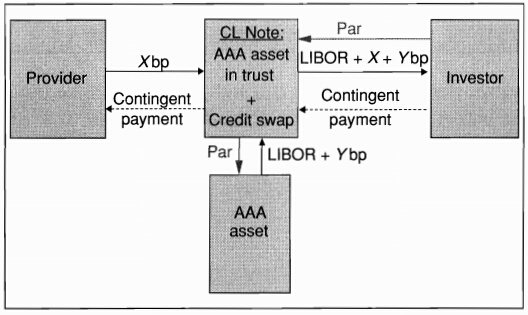

Credit Derivatives and Structured Products

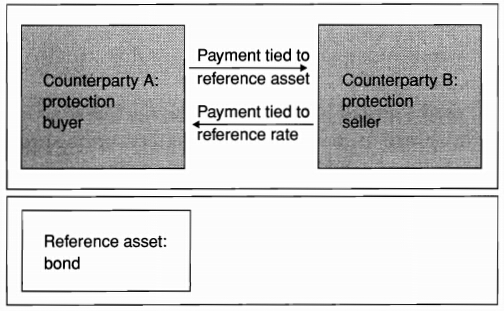

Introduction

-

Credit derivatives provide an efficient mechanism to echange credit risk

- credis risk can not be perfectly diversified for banks

- banks can keep the loans on their books and to buy protection with credit derivatives

-

Credit derivatives are over-the-counter contracts that allow credit risk to be exchanged across counterparties. They can be classified in terms of the following

- The underlying credit, which can be a single entity (single name) or a group of entities (multiname)

- The exercise conditions, which can be a credit event (such as default or rating downgrade, or an increase in credit spreads)

- The payoff function, which can be a fixed amount or a variable amount with a linear or nonlinear payoff

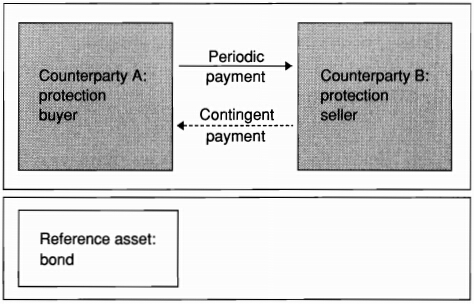

Credit Default Swaps

|

|

An example of CDS

The protection buyer, call it A, enters a one-year credit default swap on a notional of $100 million worth of 10-year bonds issued by XYZ. The swap entails an annual payment of 50bps. The bond is called the reference credit asset.

At the beginning of the year, A pays $500,000 to the protection seller. Say that at the end of the year, company XYZ defaults on this bond, which now trades at 40 cents on the dollar. The counterparty then has to pay $60 million to A. If A holds this bond in its portfolio, the credit default swap provides protection against credit loss due to default.

-

Most CDS contracts are quoted in terms of an annual spread, with the payment made on quarterly basis

-

Default swaps are embedded in many financial products, for example:

A long position in a defaultable bond is economically equivalent to a long position in a default-free bond plus a short position in a CDS on the same underlying credit.

Settlement

- The payment (

- cash settlement, or a payment equal to the strike minusthe prevailing market value of the underlying bonds

- physical settlement of the defaulted obligation in exchange for a fixed payment

- a lump sum, or a fixed amount based on some pre-agreed recovery rate. (if the CE occurs, the recovery rate is set at 40%, leading to a payment of 60% of the notional)

-

The payoff of a CDS is

- binary credit default swap(二元信用违约掉期/数字式信用违约掉期):

- with physical settlement, the contract defines a list of bond, which can trade at different prices but must be exchanged for their face value, that can be delivered (delivery option)

- cash settlement can be conducted through an auction, which defines the recovery rate

- binary credit default swap(二元信用违约掉期/数字式信用违约掉期):

Pricing

CDS contracts can be priced by considering the present value of the cash flows on each side of

| Year t |

Probability (%) | Discount Factor PVt |

Payoff Payments | Spread Payments | |||||

|---|---|---|---|---|---|---|---|---|---|

| Cumul. Ct |

Annual dt |

Marg. kt |

Survival St |

Expected kt(1-f) |

PV | Expected sSt-1 |

PV | ||

| 1 | 2.64 | 2.640 | 2.640 | 0.9736 | 0.9434 | 1.584 | 1.494 | s1.000 | s0.943 |

| 2 | 5.48 | 2.917 | 2.840 | 0.9452 | 0.8900 | 1.704 | 1.517 | s0.974 | s0.867 |

| 3 | 8.57 | 3.269 | 3.090 | 0.9143 | 0.8396 | 1.854 | 1.557 | s0.945 | s0.794 |

| 4 | 11.89 | 3.631 | 3.320 | 0.8811 | 0.7921 | 1.992 | 1.578 | s0.914 | s0.724 |

| 5 | 15.43 | 4.018 | 3.540 | 0.8457 | 0.7473 | 2.124 | 1.587 | s0.881 | s0.658 |

| Total | 15.430 | 4.2124 | 7.733 | s3.986 | |||||

The value

The default probabilities used to price the CDS contracts must be risk-neutraal probabilities, not real-world probabilities.

The CDS swap spread should approximately equal the yield on a corporate bond issued by the same obligor minus the risk-free yield.

Counterparty Risk

- A CDS does not eliminate credit risk entirely.

- the protection buyer decreases exposure to the reference credit Y but assume new credit exposure to the CDS seller

- correlation between the default risk of the underlying credit and of the couterparty is important

| Correlation | Counterparty Credit Rating | |||

|---|---|---|---|---|

| AAA | AA | A | BBB | |

| 0.0 | 194 | 194 | 194 | 194 |

| 0.2 | 191 | 190 | 189 | 186 |

| 0.4 | 187 | 185 | 181 | 175 |

| 0.6 | 182 | 178 | 171 | 159 |

| 0.8 | 177 | 171 | 157 | 134 |

- A CDS is unfunded

- unfunded(无资金担保): each party is resposible for making payments without recourse to other assets

- unfunded: the protection seller makes a payment that could be used to settle any potential redit event

Other Contracts

CDS Variants

-

The first-of-basket-to-default swap(追索权首次违约篮子互换/可追索首违篮子掉期) gives the protection buyer the right to deliver one and only one defaulted security out of a basket of selected securities

- the contract will be more expensive than a single credit swap, all else kept equal

- the price of protection also depends on the correlation between credit events

-

With an

-

CDS indices are widely used to track the performance of this market

- the iTraxx indices cover the most liquid names in European and Asian credit markets

- the North American and emerging markets are covered by the CDX indices

Total Return Swaps

|

A total return swap (TRS) is a contract where one party, called the protection buyer, makes a series of payments linked to the total return on a reference asset. In exchange, the protection seller makes a series of payments tied to a reference rate, such as the yield on an equivalent Treasury issue (or LIBOR ) plus a spread.

|

|

An Example of TRS

Suppose that a bank (call it bank A) has made a $100 million loan to company XYZ at a fixed rate of 10%. The bank can hedge its exposure by entering a TRS with counterparty B, whereby it promises to pay the interest on the loan plus the change in the market value of the loan in exchange for LIBOR plus 50bp. If the market value of the loan decreases, the payment tied to the reference asset will become negative, providing a hedge for the bank.

Say that LIBOR is currently at 9% and that after one year, the value of the loan drops from $100 million to $95 million. The net obligation from bank A is the sum of

- Outflow of 10% × $100 = $10 million, for the loan's interest payment

- Inflow of 9.5% × $100 = $9.5 million, for the reference payment

- Outflow of

This sums to a net receipt of -10 + 9.5 - (-5) = $4.5 million. Bank A has been able to offset the change in the economic value of this loan by a gain on the TRS.

Credit Spread Forwards and Option

In a credit spread forward contract(信用利差远期合约/信用价差远期协议), the buyer receives the difference between the credit spread at maturity and an agreed-upon spread, if positive. Conversely, a payment is made if the difference is negative. The payment is,

Or, equivalently

In a credit spread option contract, the buyer pays a premium in exchange for the right to put any increase in the spread to the option seller at a predefined maturity:

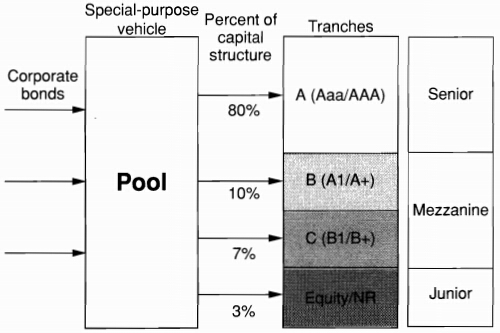

Structured Products

|

|

Collateralized Debt Obligations(担保债务凭证/抵押债务债券)

|

The waterfall structure of CDO |

|

Managing Credit Risk

Measuring the Distribution of Credit Losses

Default mode (DM): considering only losses due to defaults instead of changges in market values

For a portfolio of

The net replacement value (NRV)(净重置价值)

-

A typical distribution of credit profits & losses (P&L)

-

The distribution of P&L is highly skewed to the left

- similar to a short position in an option

- Merton model:

- Major features

- The Expected credit loss (ECL) represents the average credit loss. The pricing of the portfolio should be such that it covers the expected loss

- The Unexpected credit loss (UCL) represents the loss that will not be exceeded at some level of confidence, typically 99.9%. Taking the deviation from the expected loss gives the unexpected credit loss. The institution should have enough equity capital to cover the unexpected loss.

The effect of correlations

-

Correlations across default event

-

Correlations across default event and exposure

-

wrong-way trades(逆向风险交易/错向风险交易): exposure is positively correlated with the probability of default

-

right-way trades(正向风险交易/顺向风险交易) occurs when the transaction is a hedge for the counterparty

Credit risk is lowered for right-way trades, where the counterparty is using the trade as a hedge. Conversely, wrong-way trades create a positive correlation between the credit exposure and the probability of default.

-

Measuring Expected Credit Loss

Expected Loss over a Target Horizon

Assuming independency,

The Time Profile of Expected Loss

The present value of expected credit losses (PVECL):

It can be simplified by adopting the average default probability and average exposure over the life of the asset:

An even simpler approach, when ECE is constant, considers the final maturity

Measuring Credit VaR

-

Credit VaR over a Target Horizon

- At a given confidence level

- Credit VaR is defined as the unexpected credit loss at some confidence level, which is measured as the deviation from ECL:

- It should be viewed as the economic capital to be held as a buffer against unexpected losses

- At a given confidence level

-

Using Credit VaR to Manage the Portfolio

- rationales on trades: profitability vs. credit risk (credit VaR)

- the marginal contribution to risk can be used to analyze the incremental effect of a proposed trade on the total portfolio risk

- the marginal analysis can also help to establish the renumeration of capital(资本报酬率) required to support the position

Portfolio Credit Risk Models

Approaches to Portfolio Credit Risk Models

- Model Type

- Top-down models group credit risks using single statistics. They aggregate many sources if risk viewed as homogeneous into an overall portfolio risk, without going into the details of individual transactions. It is appropriate for retail portfolios with large numbers of credits, but less so for corporate or sovereign loans.

- Bottom-up models account for futures of each instrument. It is most similar to the structural decomposition of positions that characterizes market VaR systems. It is appropriate for corporate and capital market portfolios. It is also most useful for taking corrective action, because the risk structure can be reverse-engineered to modify the risk profile

-

Risk Definitions

- Default-mode models consider only outright default as a credit event

- Mark-to-market (MTM) models consider changes in market values and ratings changes, including defaults

-

Models of Default Probability

- Conditional models incorporate changing macroeconomic factors into teh default probability through a functional relationship

- Unconditional models have fixed default probabilities and tend to focus on borrower-or factor-specific information

-

Models of Default Correlations

- Structural Models explain correlations by the joint movements of assets

- Reduced-form models explain correlations by assuming a particular functional relationship between the default probability and background factors

- Comparison of Credit Risk Models

| CreditMetrics | CreditRisk+ | Moody's KMV | Credit Portfolio View | |

|---|---|---|---|---|

| Originator | JPMorgan | Credit Suisse | KMV | McKinsey |

| Model type | Bottom-up | Bottom-up | Bottom-up | Top-down |

| Risk definition | Market value (MTM) | Default losses (DM) | Default losses (MTM/DM) | Market value (MTM) |

| Risk drivers | Asset values | Default rates | Asset values | Macro factors |

| Credit events | Rating change/default | Default | Continuous default probability | Rating change/default |

| Probability | Unconditional | Unconditional | Conditional | Conditional |

| Volatility | Constant | Variable | Variable | Variable |

| Correlation | From equities (structural) | Default process (reduced-form) | From equities (structural) | From macro factors |

| Recovery rates | Random | Constant within band | Random | Random |

| Solution | Simulation/analytic | Analytic | Simulation | Simulation |

Credit VaR 算例

算例设定

目标资产:某银行对公司A的贷款

- 本金 (Principal): ¥10,000,000

- 当前评级: BBB

- 剩余期限: 1年

- 违约损失率 (LGD): 45%

- 置信水平: 99%

- 无风险利率: 3%

方法一:蒙特卡罗模拟法 (Monte Carlo Simulation)

|

背景与基本思想 核心思想:

|

数学模型

|

|

|

|

扩展到投资组合

|

方法二:CreditMetrics方法

|

背景与基本思想 核心思想:

数学模型

|

|

|

|

|

扩展到投资组合

|

方法三:CreditRisk+方法

|

背景与基本思想 核心思想:

数学模型

|

期望违约次数: λ = Σp_i 其中: |

单一资产参数: 步骤2:损失离散化 最大可能损失 = 10,000,000 × 45% = ¥4,500,000 损失分布: 步骤3:泊松分布计算 参数设定: 损失概率分布: |

步骤4:VaR计算 累积分布函数: 99%分位数: 但这显然不合理,需要调整方法... 修正计算(考虑连续性修正): Credit VaR = ¥4,500,000 - EL |

扩展到投资组合

组合损失建模

-

组合参数:

- 总体违约强度: Λ = Σλ_i

- 损失严重度分布: 各资产损失大小可能不同

-

递推公式:

P(L = k) = (1/k) × Σ(j=1 to k) j × P(损失=j) × P(L = k-j)

其中损失严重度概率需要独立估计

方法四:结构化方法 (Structural Approach)

|

背景与基本思想 核心思想:

数学模型

其中: |

其中: 当前公司价值: V_0 = ¥12,000,000 (估计值) |

|

步骤2:违约概率计算 根据Merton模型: 违约概率: 计算: PD = Φ(-1.815) = 0.0347 = 3.47% |

步骤3:损失率计算 Expected Loss Given Default: 通过数值积分或解析解: 预期损失: 99% VaR估计(通过蒙特卡罗): 99% VaR = ¥5,200,000 - ¥180,440 = ¥5,019,560 |

各方法比较总结

计算结果对比

| 方法 | Credit VaR | 预期损失 | 计算复杂度 | 适用场景 |

|---|---|---|---|---|

| 蒙特卡罗 | ¥4,491,900 | ¥8,100 | 高 | 灵活性要求高 |

| CreditMetrics | ¥4,883,295 | ¥24,472 | 中等 | 评级数据充足 |

| CreditRisk+ | ¥4,491,900 | ¥8,100 | 低 | 大型组合 |

| 结构化方法 | ¥5,019,560 | ¥180,440 | 高 | 上市公司 |

方法特点

|

|

实务应用建议

- 监管资本计算:优先使用CreditRisk+或简化CreditMetrics

- 风险管理决策:推荐蒙特卡罗方法

- 组合优化:结合多种方法进行敏感性分析

- 模型验证:使用历史数据回测各方法准确性