L03 Volatility and Mortgage-Backed Securities Risk

- L03 Volatility and Mortgage-Backed Securities Risk

Managing Volatility Risk

Historical Volatility & Historical Correlation

Volatility

-

Can define as std of returns

-

Helpful to standardise on an annualised basis

-

If volatility is constant, we can derive longer-period volatility from (in)famous 'square-root rule'

-

Important for derivatives pricing, hedging, and risk measurement

Historical Vol Forecasts

-

One forecasting rule is the historical MA

-

This gives unbiased estimate

-

If data period is daily, mean return will be low and we can set this to zero

-

This usually reduces variance

-

Change from to n in denominator makes little difference

-

These approaches give each observation the same weight, then no weight, in forecast

-

Easy to use

-

Problems

- If true vol is constant, any differences are due only to sampling error

- Can’t allow for changes in true vol

- More distant events in sample period have same weight as more recent ones

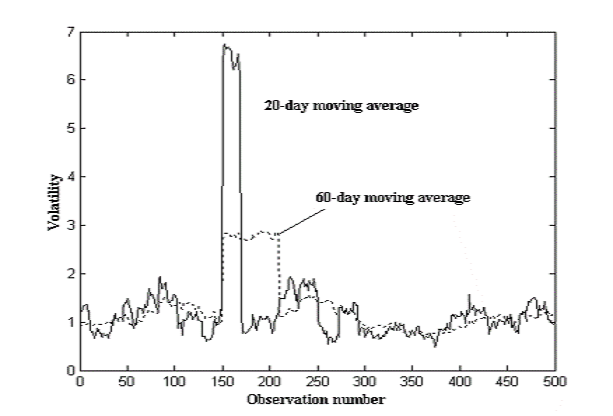

Some illustrative H vols

- Figure gives two alternative H estimators, using and

- For large , vol estimate is smoother and less responsive

- When shock occurs, both jump and remain high

- For high , plateau is lower but longer lasting

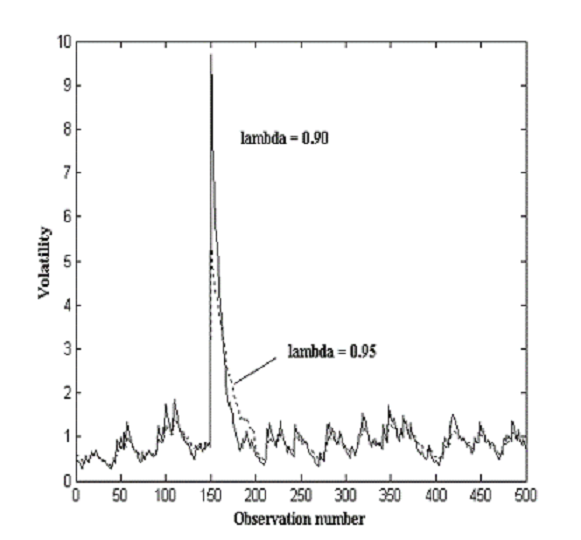

EWMA

-

Can ameliorate some of these problems using an exponential weight

-

Weight attached to observation decays over time

-

Can also be rewritten as updating rule

- Higher means weight declines slowly

- For daily data, RiskMetrics uses

- Figure shows how low- rises most after shock, but decays faster

EWMA Forecasting

-

Can use EWMA to forecast:

for any -

EWMA forecast is same as current value

-

But flat vol forecast not very appealing

- Ignores other information; not plausible

GARCH models

-

EWMA models also take to be constant

-

This is implausible and not appealing

-

Popular alternative is a GARCH

-

This fits nicely with some stylised features of returns

- Returns show vol clustering

- Returns show leptokurtosis – heavy tails

-

GARCH can accommodate both of these

-

Basic GARCH model

for and -

Errors are often normal, in which case return are conditionally normal

-

Returns can be also

GARCH

-

Most popular is GARCH

-

High implies that vol is persistent and takes a long time to change

-

High means that vol is spikey and quick to react

-

Often is over 0.7 and less than 0.25

Properties of GARCH

-

GARCH depends on same variables as EWMA, but has three parameters not 1

-

EWMA is special case with , and

-

GARCH with positive intercept allows vol to be mean-reverting

- This is appealing

- Long run vol tends to revert to

Forecasting with GARCH

-

Letting , can show that period ahead forecast is

-

Since , this means vol forecast converges to

-

Can also apply to vol term structure

Estimating GARCH models

-

Run data through a preliminary filter (e.g., ARMA) to remove serial correlation

-

ARMA model should be as parsimonious as possible

-

Select particular candidate GARCH specification (e.g., based on PACs)

-

Estimate model using ML

-

Check model adequacy by testing whether standardised innovations are idd and follow assumed distribution

-

Pass or fail model

-

If model fails, try another GARCH

Other GARCH models

-

IGARCH is applicable when returns not stationary

- EWMA is special case where

-

Components GARCH

- Lets vol converge to a long-term vol that changes over time

-

Factor GARCH

- This links returns from n assets to one or more underlying factors (e.g., as with CAPM)

- This leads to

- This links returns from n assets to one or more underlying factors (e.g., as with CAPM)

Covariances and correlations

-

Covarance between and is

-

Correlation is

-

Correlation only good measure of dependency is returns are elliptical

Only defined if vols exist – need to check for this -

Estimate correlation

- Equal-weighted covariance/correlation

- EWMA covariances/correlation

- GARCH covariances/correlation

Implied Volatility & Implied Correlation

Implied Volatility

-

Black-Scholes model

where

-

Implied volatility

-

Quote ISD vs premium

- ISD is more intuitive (similar to quotting bonds with yield instead of price)

- reflect the market's view

- ISD is a risk-neutral volatility

-

These are volatilities generated from option prices

-

Given that other variables (price, etc.) are observable, can infer implied vol from option price (e.g., Black-Scholes)

-

Implied vol is a forward-looking estimator

- Takes account of all information, not just historical backward-looking information

-

Implied vols generally regarded as better than historical ones

-

mplied vols are dependent on option-pricing model

- Possible problems due to holes in Black-Scholes, volatility smiles/smirks, etc.

-

Also, implied vols only exist for assets on which options have been written

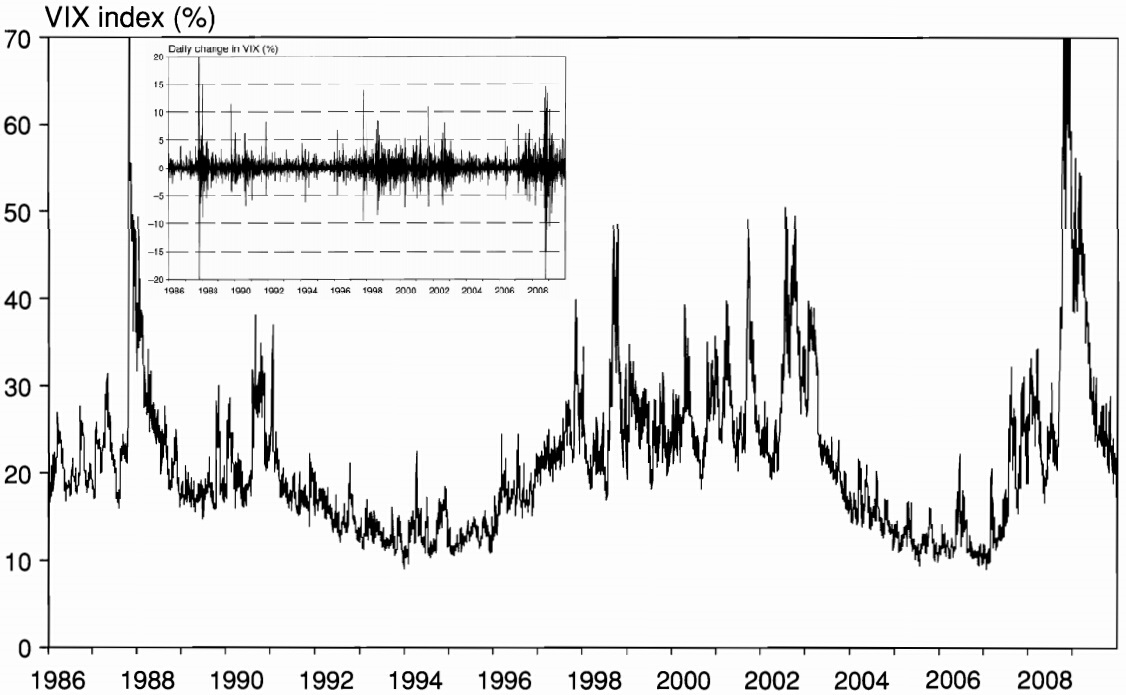

VIX

- VIX is a popular measure of the implied volatility of S&P 500 index options

- Properties about VIX

- average value: on the order of 21%; daily change: about 2.4%

- assuming normal distribution: daily movements should be within

- the actual distribution is far from normal

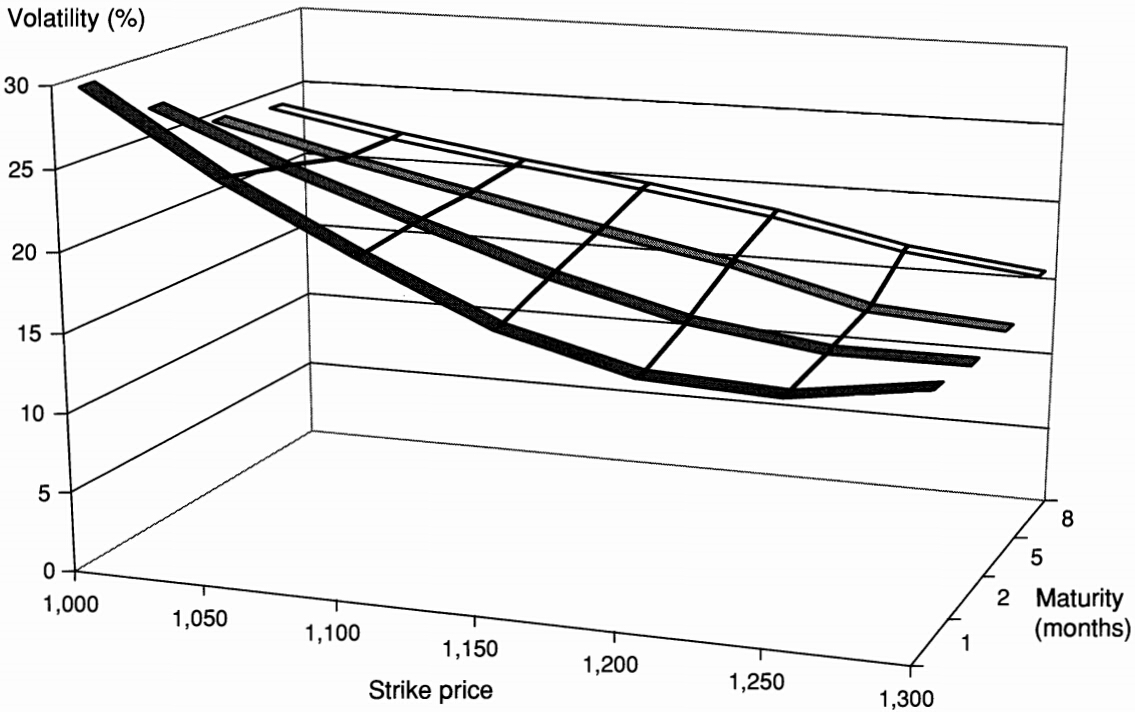

Implied Volatility Surface

-

If B-S were correct, the ISDs should be constant across strike prices and maturities

-

If we plot ISDs agaist strike prices and maturities we obtain the implied volatility surface

- volatility smile (ISDs vs. strike prices)

- term structure of volatility

- spot & forward volatility

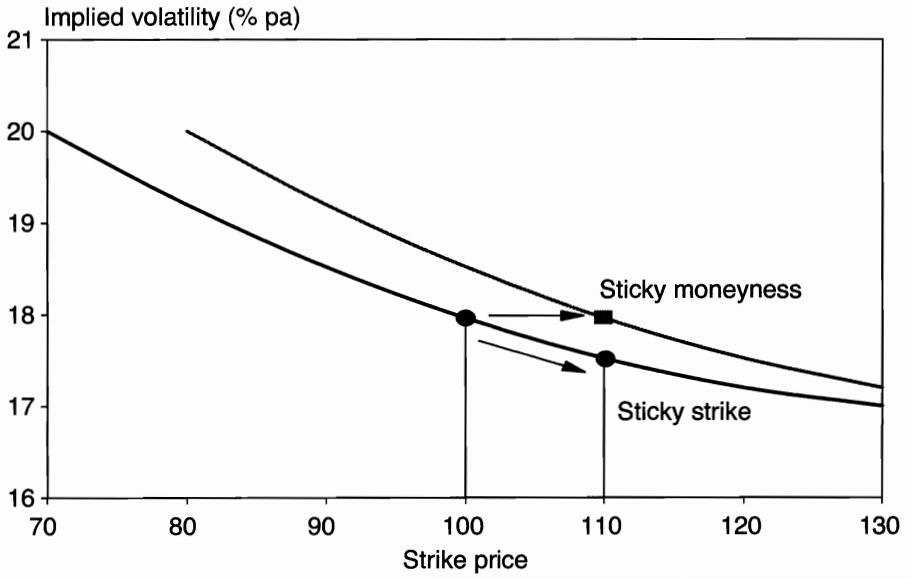

Prediction of the Volatility Surface

-

Sticky strike

- there is no structural change in the volatility curve

- peice movement is largely temporary

-

Sticky moneyness

- permanent shift in the volatility curve

Implied Correlation

-

These are directly analogous to implied volatilities

-

But can only use if relevant options exist

-

Need two or more options, or spread options

-

Have same pros and cons as implied vols, and also be unstable

-

Exchange option involves the surrender of an asset (B) in exchange for acquiring another (A). The payoff on such a call is

-

The valuation formula (**Margrabe Model})

- replace by the price of asset B ()

- replace the risk-free rate by the yield on asset B ()

- the volatility is

-

Rainbow Option: exposed to two or more sources of uncertainty

- e.g. An option on a basket

Currency Implied Correlation: A Triplet of Currency Options

-

Exchange rates are expressed relative to a base currency (usually USD)

-

The cross rate is the exchange rate between two currencies other than the reference currency

-

Example: let be the dollar price of GBP and be the doller/euro rate. Then the euro/pound rate is

the volatility of the cross rate is

Portfolio Average Correlation

-

Expressing portfolio ISD by the ISD of its components through the average correlation

- the average correlation is a summary measure of diversification benefits across the portfolio

- all else equal, an increasing correlation in creases the total portfolio risk

-

A dispersion trade takes a short position in index volatility, which is offset by long position in the volatility of the index components

Covariance Matrices

Forecasting covariance matrices

-

Estimated cov or corr matrices must be positive definite or positive semi-definite

- This imposes constraints on how we can estimate them

- Can’t estimate parameters independently, and then hope for this condition to be satisfied

-

Historical covariance matrices

-

Straightforward to estimate:

- Choose window size, and estimate parameters simultaneously

-

Drawbacks

- Only accurate if true matrix constant

- Can suffers from ghost effects

-

-

Multivariate EWMA

- This is more flexible and has smaller ghost effects

- Must choose same decay factor for all terms

- If we don’t, there is no guarantee that matrix will be PD or PSD

-

Multivariate GARCH

-

This can be difficult

- Can need a lot of parameters

- High dimensions hard to handle

- Problems of convergence of routines, etc.

-

Can use methods such as orthogonal GARCH to get around some of these problems

-

Generating PD or PSD covariance matrices

-

One way to ensure PD or PSD matrices is to adjust eigenvalues, and then recover matrix from adjusted eigenvalues

- If we want PD, eigenvalues must be positive

- If we want PSD, eigenvalues must be non-negative

-

Obtain eigenvalues, adjust any –ve (and maybe 0) ones using some rule

-

Adjusted matrix satisfies our requirements

Computational problems

-

Even if true matrix is PD (or PSD), estimated matrix might not be

-

Risk factors might be highly correlated

-

This can produce 0 or –ve estimated eigenvalues

-

These problems can be aggravated if covariance matrix is used for trading or risk management

-

Possible answers:

- Choose risk factors that are not too highly correlated

- Don't choose too many risk factors

- Alternatively, can adjust eigenvalues

Variance Swaps

Variance Swaps

-

A variance swap is a forward contract on the realized variance, the payoff is

- it can be written on any asset (usually equities or equity indices)

- A correlation swap is similar to a variance swap, however its payoff is tied to the realized average correlation in a portfolio over the selected period

-

e.g. A one yield contract on S&P 500 index: , . If , the payoff to the long position is

-

Market value of an variance swap

-

Correlation trading

Dynamic Trading

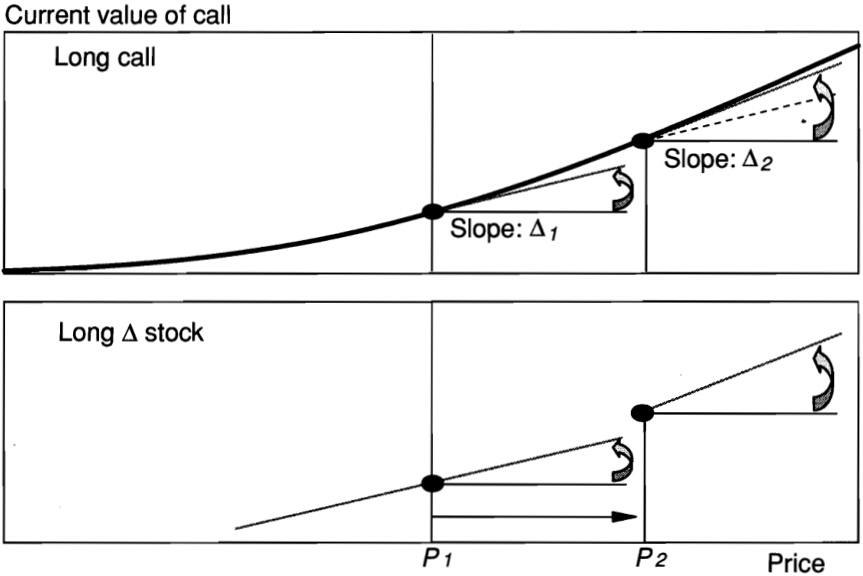

Dynamic Optoin Replication

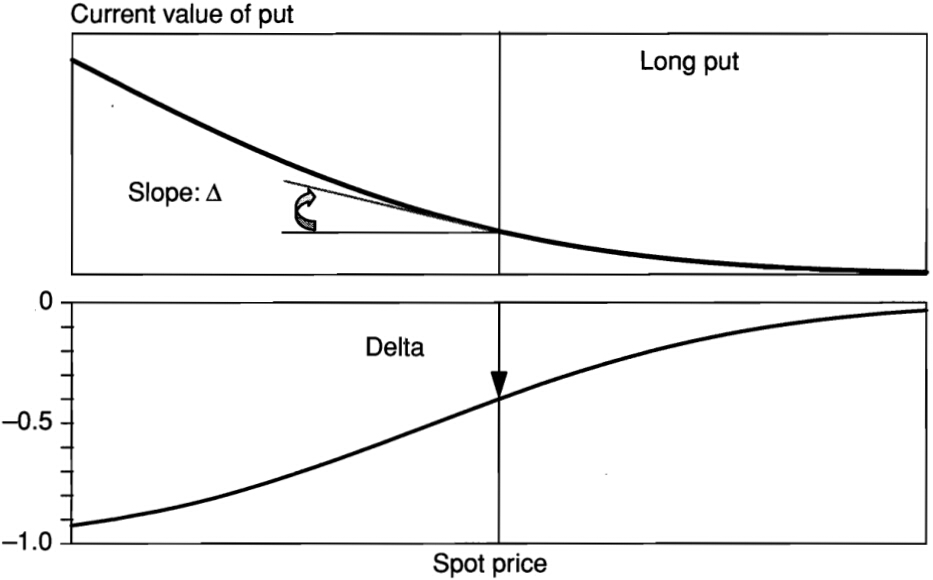

Holding a call option is equivalent to holding a fraction of underlying asset

Dynamic replication of a put

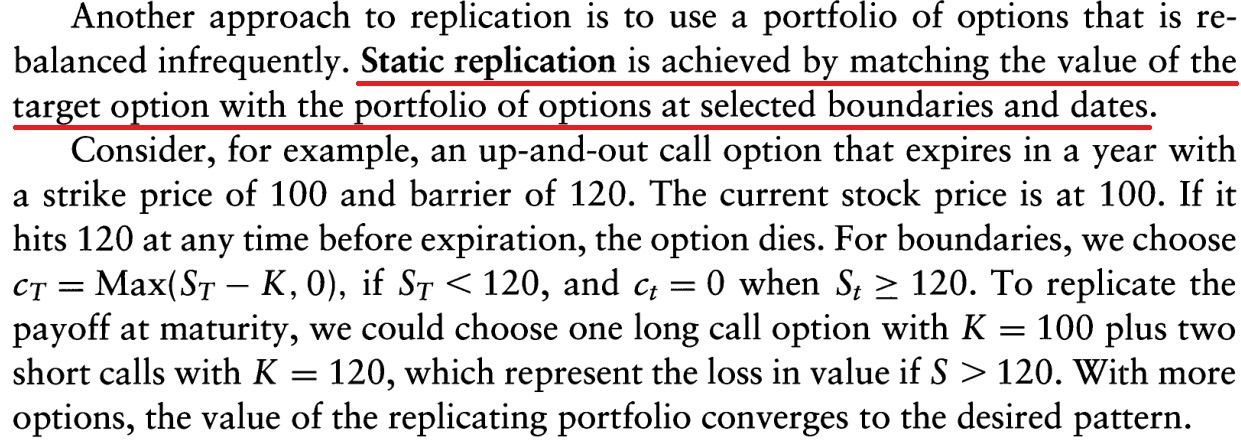

Static Optoin Replication

Implications for Trading

-

Dynamic replication of a long option is bound to loss money

- it buys the asset *after} the price has gong up (too late)

- the loss of each transaction will culmulate to an option premium, which is driven by the realized valotility

-

Selling an option and dynamically hedging it using the underlying instrument

- the strategy is delta-neutral

- revenue from selling an option: a function of implied volatility

- cost from dynamic hedging: a function of realized volatility

- in equity markets, implied volatility tends to be greater than the realized volatility

-

More general implications

- large scale automatic trading system have the potential to be destabilizing

- selling an asset after its price has gong down is similar to prudent risk-management practices

Mortgage-Backed Securities Risk

Prepayment Risk

Mortgage as Annuities

-

Mortgages can be structured to have fixed or floating payments. Assuming a fixed monthly payment ,the price-yield relationship is

-

Life of bond

- maturity

- average life (AL):

- duration:

-

When dealing with pool of mortgages, we use

- weighted average maturity (WAM)

- weighted average maturity coupon (WAC)

- weighted average maturity life (WAL)

Prepayment Speed

-

Factors which affect mortgage refinancing patterns / prepayment speed

- spread between the mortgage rate and current rates

- age of the loan

- refinancing incentives

- previous path of interest rates

- level of mortgage rate

- economic activity

- seasonal effects

-

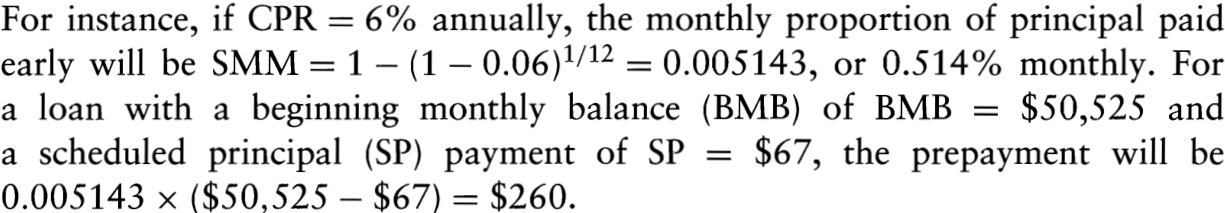

Conditional prepayment rate (CPR) & single month mortality (SMM)

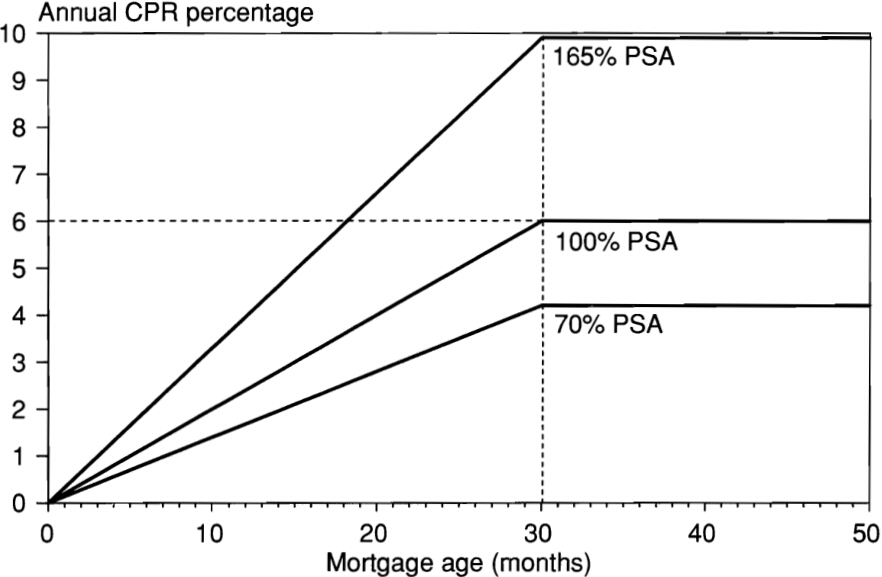

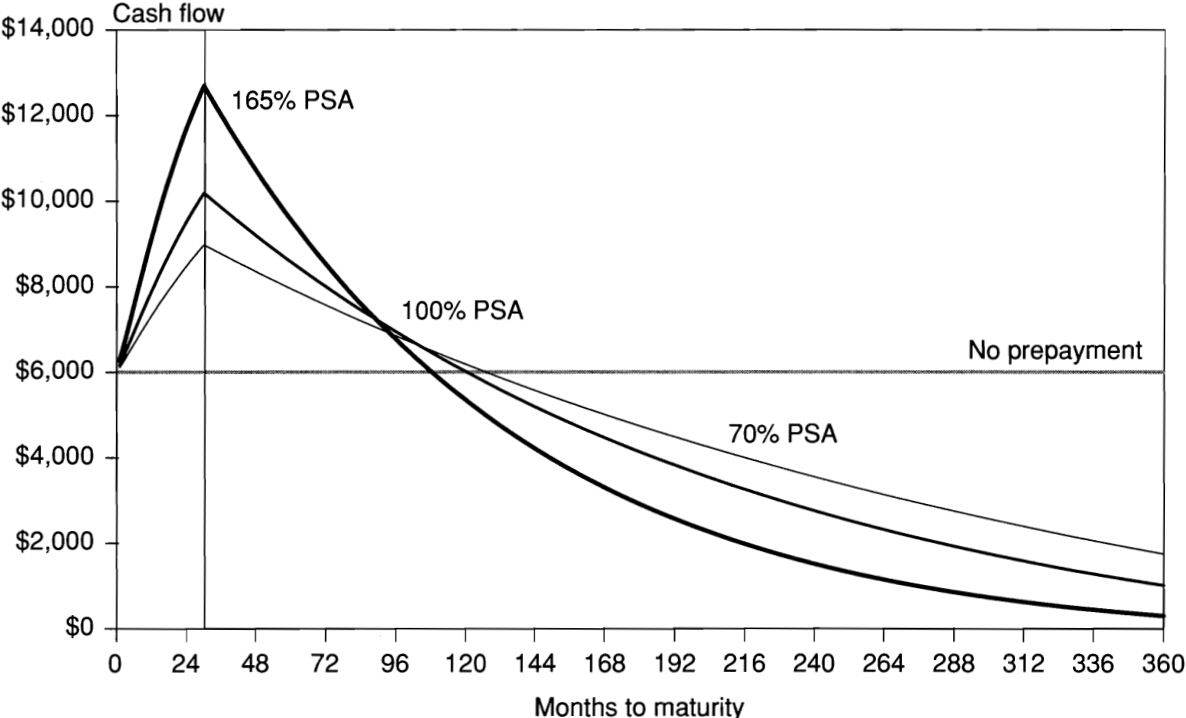

Public Securities Association (PSA) Prepayment Model:

By converntion, prepayment patterns are expressed as a percentage of the PSA speed.

Project cash flows based on the prepayment speed pattern.

Measuring Prepayment Risk}

-

Prepayment risk

- contraction risk: low rate more prepayment shorter average life

- extension risk: high rate less prepayment longer average life

-

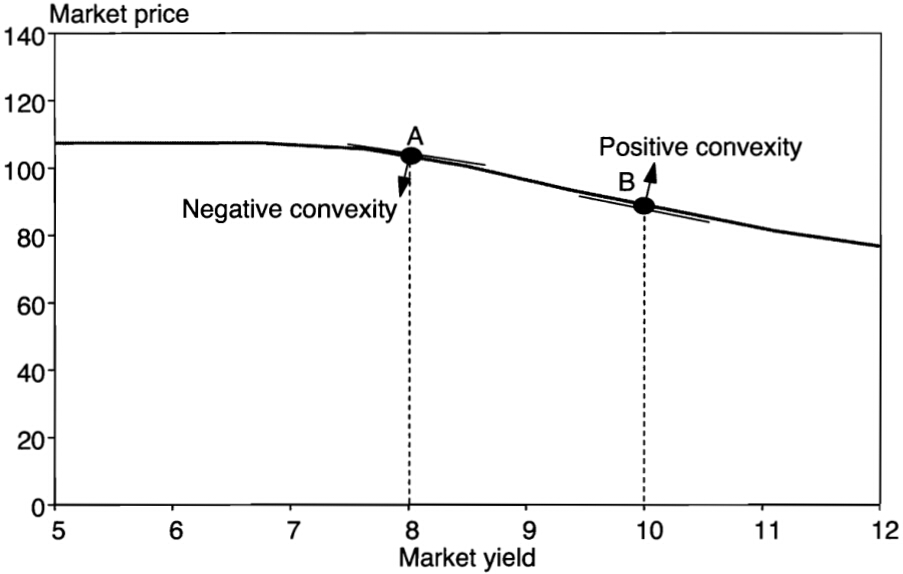

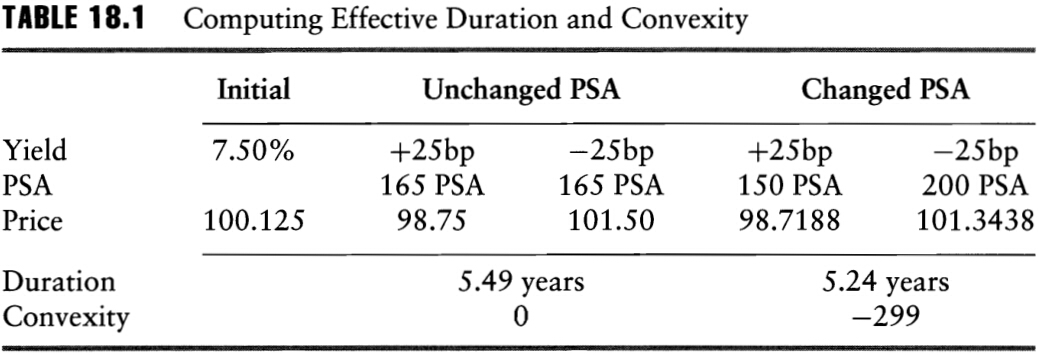

Dealing with the changing cash-flow pattern

- effective duration

- effective convexity

- effective duration

-

The option component

- prepayment represents a long position in option for the borrower

- prepayment represents a short position in option for the lender

-

Option-Adjusted Spread (OAS)

- static spread (SS): the difference between the yield of the MBS and that of a Treasury note with the same weighted average life

- zero spread (ZS): a fixed spread added to zero-coupon rate so that the discounted value of the projected cash flows equals the current price

- The OAS method involves running simulations of various scenarios and prepayments to establish the option cost

Securitization

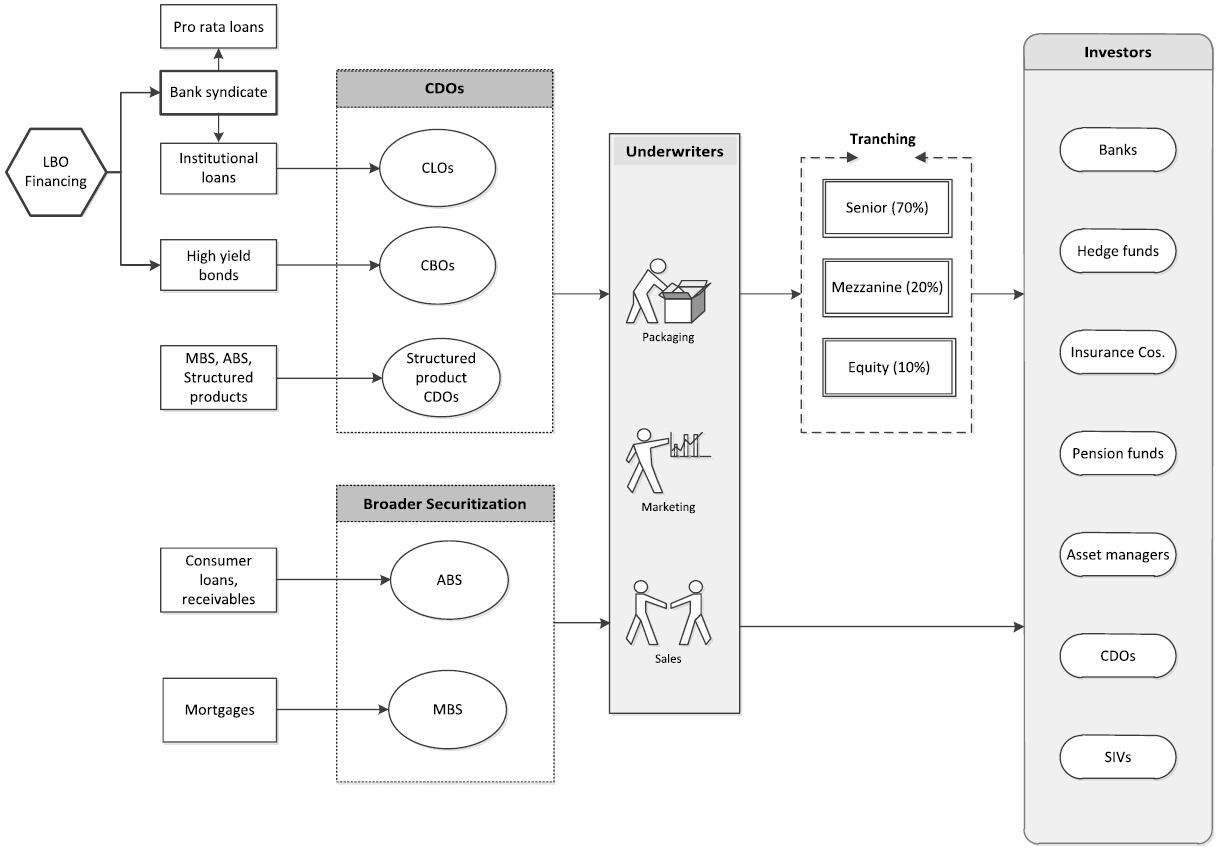

Priciples of Securitization

-

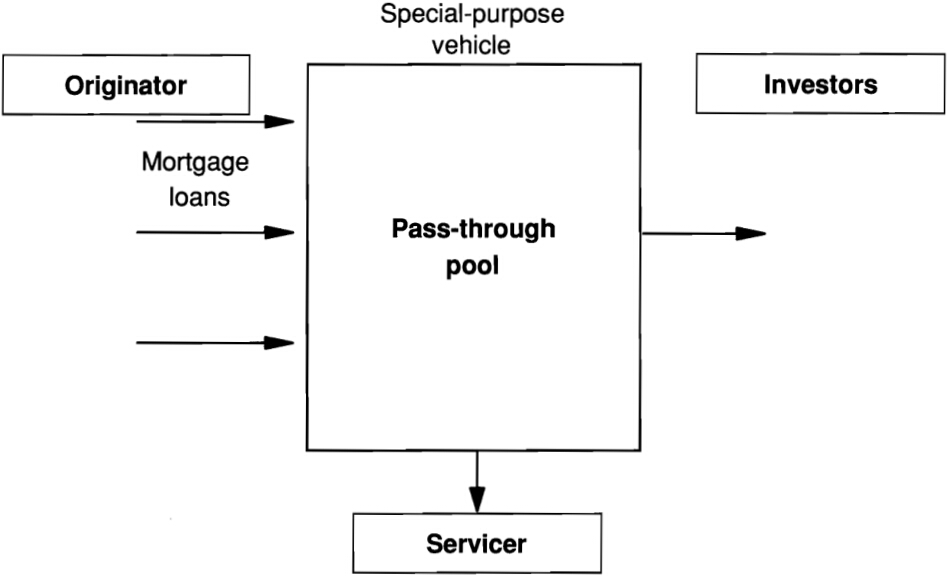

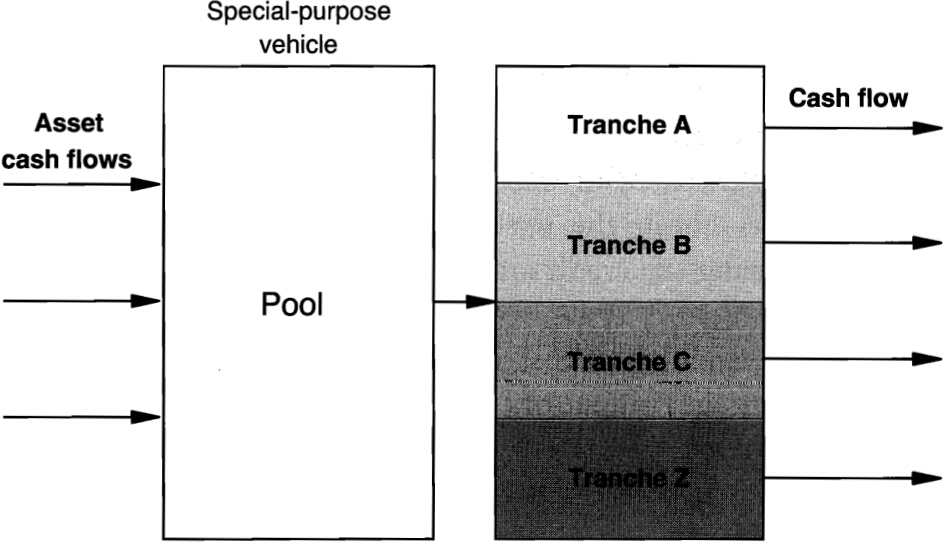

Procedures of securitization (off-balance-sheet)

- create a special purpose vehicle (SPV), or special-purpose entity (SPE)

- the originator pools a group of assets and sells them to the SPV

- SPV issues tradable claims, or securities, that are backed by the financial assets

-

Advantage of this structure

- it shields the asset-backed security (ABS) investor from the credit risk of the originator

- pooling offers ready-made diversification across many assets

-

All sorts of assets (collateral) can be included in ABSs

- mortgage loans, student loans, credit card receivables, account receivables, debt obligations, and etc.

- RMBSs: backed by residential mortgage loan

- CMBSs: backed by commercial mortgage loan

- the cash flow of RMBSs and CMBSs is subject to interest rate risk, prepayment risk, and default risk

-

Structure of securitization

- pass-through: the SPV issues single class of security

- tranching: the SPV issues different classes of securities

-

On-balance-sheet securitizations (covered bonds or Pfandbriede in Germany)

- banks originates the loans and issues securities secured by these loans, which are kept on its books

- investors have recourse against the bank in the case of defaults on the motgage

- banks provides a guarantee against credit risk

Issues with Securitization

-

The moral hazard problem

-

The adverse selection problem

-

cerdit rating fails for securitization that with complex structures

-

Securitization pushes housing prices away from their fundamental values

-

When the securitization markets froze, many banks and loan originators were stuck with loans that were warehoused, or held in a pipeline that was supposed to be temporary

Rethinking Securitization

Tranching

Concept

-

Cash flows are redistributed to fit investors' need

- however, cash flows and risks are fully preserved

- they are only redistributed across tranches

- weighted duration & convexity of the portfolio of tranches must add up to the original duration and convexity

-

This structure applies to collateralized mortgage obligations (CMOs), collateralized bond obligations (CBOs) collateralized loan obligations (CLOs), collateralized debt obligations (CDOs)

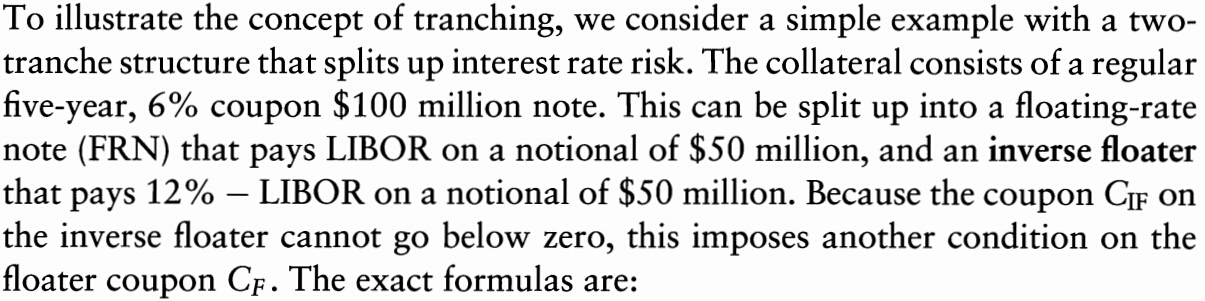

Inverse Floaters

- Try to verify that the outgoing cash flows exactly add up to the incoming cash flows

- Suppose the dollar duration of the original five-year note is 4.5 years, try to analyze the duration of the floater and the inverse floater just before a reset

- What if the coupon is tied to twice LIBOR, i.e. ?

CMOs

-

Sequential-pay tranches: defined by prioritizing the payment of principal into different tranches

-

Planned amortization class (PAC)

- PAC bonds offer a fixed redemption schedule as long as prepayments on the collateral stays within a specified PSA range (say 100 to 250 PSA), called the **PSA collar}

- the principal payment is set at the minimum payment of these two extreme values for every month of its life

- all prepayment risk is transfered to other bonds in the CMO structure, called **support bonds}.

-

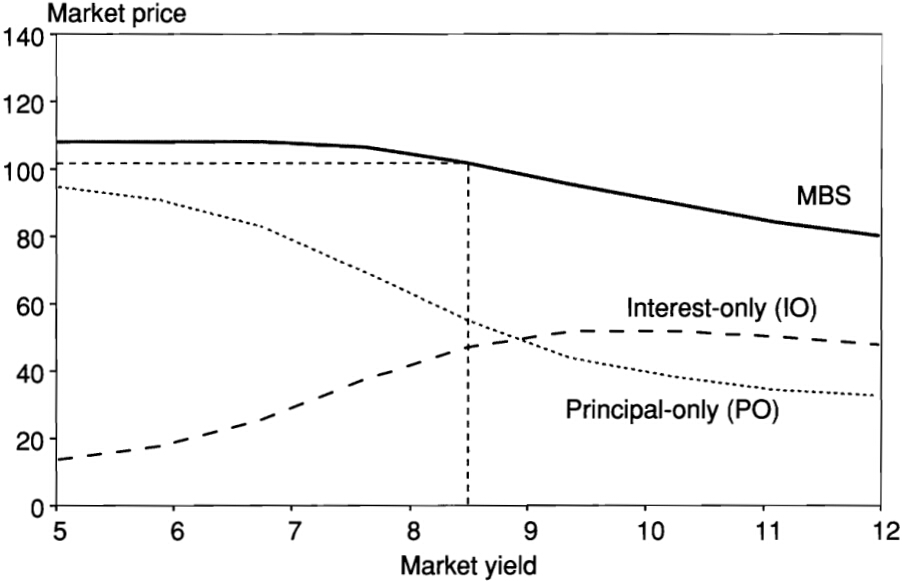

IO/PO structure: strips the MBS into two components

- the **interest-only (IO)} tranche receives only the interest payments on the underlying MBS

- the **principal-only (PO)} tranche receives only the principal payments on the underlying MBS

- interest rate fall principal payments come early PO appreciate in value while IO depreciate in value