TF-IDF Weighting

|

Term Frequency-Inverse Document Frequency: Where:

Effect: Upweights rare, discriminative words; downweights common words |

|

Cosine Similarity

|

Measuring document similarity: Properties:

Why preferred in NLP? Focuses on direction (topic), not magnitude (length) |

|

Financial Sentiment Dictionaries

Domain-specific lexicons for finance:

| Dictionary | Description | Example Words |

|---|---|---|

| Loughran-McDonald | Finance-specific sentiment | "liability", "litigation" (−) |

| Harvard GI | General sentiment | "good" (+), "bad" (−) |

| VADER | Social media optimized | Handles emojis, slang |

Key insight: General dictionaries misclassify financial terms

- "Risk" is neutral in finance, negative in general (Source: Loughran & McDonald, 2011)

Loughran & McDonald (2011)

参考文献:When Is a Liability Not a Liability Textual Analysis, Dictionaries, and 10-Ks

Text Regression Framework

Using text features for prediction:

Where:

- High-dimensional:

Solutions to dimensionality:

- Penalized regression (LASSO, Ridge, Elastic Net)

- Random forests for variable selection

- Sentiment aggregation using dictionaries

High‑Dimensional Text / Factor Regression: General Pipeline

- Start from a corpus of

- Build a high‑dimensional representation:

- Document–term matrix

- Or lower‑dimensional factors from SVD, topics, or embeddings

- Document–term matrix

- Optionally compress: select columns (dictionary, sentiment index) or average token embeddings into document‑level vectors

- Stack text features with structured covariates

- Estimate a predictive or causal model, e.g.

- Fit with high‑dimensional ML (penalized regression, trees, nets), evaluate out‑of‑sample, then interpret coefficients or factors.

High‑Dimensional Sparse Modeling and Cross‑Fitting

- In text/factor regressions, the feature dimension

- OLS is ill‑posed, so we use sparse modeling:

- Lasso / elastic net to select a small set of informative features

- Penalized likelihood (e.g., penalized logit) for classification

- Regularization controls variance and overfitting when

- Dimensionality reduction acts as structured sparsity:

- Low‑rank factor models (SVD) or topic models (LDA) factor

- Low‑rank factor models (SVD) or topic models (LDA) factor

- For causal parameters, combine ML with cross‑fitting:

- Split data into folds; estimate nuisance components (text‑based controls, propensities, outcome models) on other folds

- Plug predictions into orthogonal / debiased estimating equations on the held‑out fold

- Aggregating across folds delivers valid inference in big‑data settings.

Prediction vs Causality with Big, High‑Dimensional Data

- The pipeline is naturally predictive: turn text into features and estimate

- Causal questions instead target structural effects (policy, treatment, latent concept). Text can serve as:

- High‑dimensional controls for confounding

- Proxies for latent variables (tone, ideology, uncertainty)

- High‑dimensional ML helps approximate nuisance functions but does not create identification; assumptions still come from design (unconfoundedness, instruments, natural experiments)

- Risks of confusing prediction and causality:

- Highly predictive text features may capture selection or anticipation, not causal channels

- Overfitting can generate spurious “important words”

- A principled workflow separates:

- ML for prediction/adjustment (controls, propensities)

- Econometric methods for causal parameters, with orthogonal moments and cross‑fitting to reduce bias.

Case: News Sentiment and Stock Returns

|

Research finding: Real-time sentiment indices from news and social media predict:

Effect strongest during market stress periods. |

Trading application: Sentiment-based strategies outperform around earnings announcements. |

Limitations of One-Hot Encoding

Problems with sparse word vectors:

- Inefficient storage — Dimension

- No semantic similarity — All distinct words equidistant

- Curse of dimensionality — Joint probability estimation fails

Solution: Learn dense, low-dimensional word embeddings

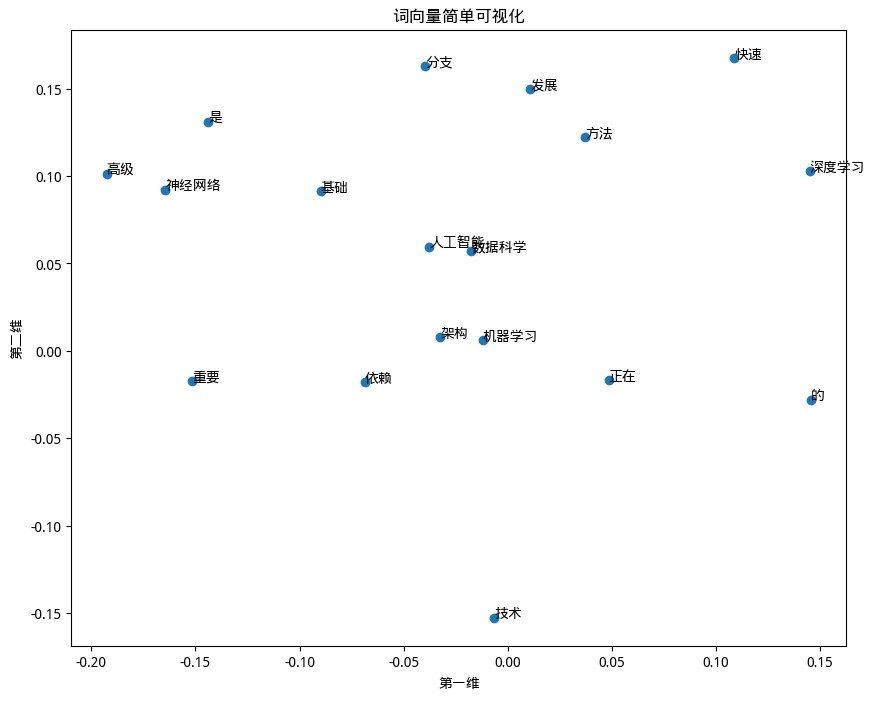

Word Embeddings: Distributional Hypothesis

|

Core idea:

Word embeddings:

Famous example: |

|

Word2Vec: Skip-gram Model

|

Predict context from target word: Training objective: Maximize probability of observed context words Computational trick: Negative sampling avoids full vocabulary sum |

|

Word2Vec: CBOW Model

|

Predict target from context (inverse of Skip-gram): Where Comparison:

|

|

Word2Vec Example

|

|

Mikolov et al. (2013)

参考文献:Efficient Estimation of Word Representations in Vector Space

Topic Models: Latent Dirichlet Allocation

|

Discovering latent themes in document collections:

Generative process:

Estimation: Gibbs sampling or Variational EM |

|

Topic Modeling Techniques for Financial Texts

|

Hybrid Topic Models

|

Financial Applications

BERTopic Code Example |

参考文献:Business News and Business Cycles

Case: FOMC Transparency Study

Research question: Does transparency change Fed deliberations?

Method:

- LDA topic model on 46,169 FOMC documents

- Natural experiment: 1993 tape revelation

Finding:

- After transparency increased, committee members showed conformist behavior

- Less diverse opinions relative to chairman's view

Implication: Transparency may reduce deliberation quality

Hansen, McMahon & Prat (2017)

参考文献:Transparency and Deliberation Within the FOMC A Computational Linguistics Approach

Embedding Applications in Finance

Financial research using word embeddings:

| Study | Method | Finding |

|---|---|---|

| Hoberg & Phillips (2016) | 10-K cosine similarity | Data-driven industry definitions |

| Kozlowski et al. (2019) | Cultural embeddings | Gender/class associations in text |

| Ash et al. (2025) | Judge embeddings | Judicial sexism measurement |

Key insight: Embeddings capture latent concepts not explicit in text

Financial Text Applications Overview

|

Asset Pricing:

|

Risk Management:

|

Kozlowski et al. (2019)

参考文献:The Geometry of Culture Analyzing the Meanings of Class through Word Embeddings

Ash et al. (2025)

参考文献:Ideas Have Consequences The Impact of Law and Economics on American Justice

Case: Earnings Calls and Firm Uncertainty

Building uncertainty indices from transcripts:

- Extract MD&A sections from earnings calls

- Identify uncertainty language (hedging, modal verbs)

- Construct firm-level uncertainty index

- Validate against realized volatility

Results:

- Textual uncertainty predicts future stock volatility

- Incremental to standard risk measures

- Useful for options pricing and risk management

FinBERT: Domain-Specific Language Model

BERT fine-tuned on financial texts:

- Training corpus: News, SEC filings, analyst reports

- 5-10% accuracy improvement over general BERT

Variants:

| Model | Specialization |

|---|---|

| FinBERT-tone | Sentiment analysis |

| FinBERT-SEC | Regulatory filings |

| FinBERT-ESG | ESG disclosure analysis |

Note: Transformer details in subsequent lectures

Practical Challenges in Financial NLP

Key implementation issues:

- Labeling — Expert annotation is expensive

- Domain adaptation — General models underperform

- Language drift — Financial terminology evolves

- Evaluation — Ground truth often unavailable

Best practices:

- Use domain-specific preprocessing

- Validate on out-of-sample financial data

- Monitor model performance over time

NLP 2.0: The LLM Revolution in Finance

From task‑specific models → general financial intelligence

Core paradigm shift:

|

|

|

NLP 1.0 vs NLP 2.0

|

Financial LLM Use Cases:

Examples: |

Part 3 · Image Analytics in Finance

- Foundations of Image Data and Computer Vision

- Remote Sensing and Satellite Imagery

- Document Image Analysis and OCR

- Image-Based Risk, Fraud, and ESG Analytics

What is an Image? Data Perspective

|

Image as numerical array:

Example: 1024×768 RGB image = 2.36 million values Financial image types:

|

|

Core Computer Vision Tasks

| Task | Description | Financial Application |

|---|---|---|

| Classification | Assign image to category | Document type identification |

| Detection | Locate objects in image | Car counting in parking lots |

| Segmentation | Pixel-level labeling | Chart region extraction |

| Recognition | Identify specific instances | Face verification for KYC |

Convolutional Neural Networks (CNNs)

Key components:

- Convolutional layers — Extract local features with filters

- Pooling layers — Reduce spatial dimensions

- Activation (ReLU) — Introduce nonlinearity

- Fully connected — Final classification/regression

Advantages:

- Local receptive field — Captures spatial patterns

- Weight sharing — Parameter efficiency

- Hierarchical features — Low → high level abstraction

- Translation invariance — Position-independent detection

CNN Architecture Intuition

Input Image → [Conv → ReLU → Pool] × N → Flatten → FC → Output

Layer progression:

| Layer | Learns |

|---|---|

| Early conv | Edges, textures |

| Middle conv | Shapes, patterns |

| Late conv | Objects, scenes |

| FC layers | Task-specific decisions |

Popular architectures: VGG, ResNet, EfficientNet, Inception

Transfer Learning for Financial Images

Leveraging pretrained models:

- Feature extraction — Freeze pretrained layers, train new classifier

- Fine-tuning — Unfreeze top layers, retrain on financial data

Why transfer learning?

- Financial image datasets are small

- ImageNet features generalize to many domains

- Dramatically reduces training time and data needs

Challenge: Financial images differ from natural images

- Solution: Gradual unfreezing of layers

Financial Image Data Types

|

Market & Trading:

Documents:

|

Remote Sensing:

Biometric & Security:

|

Satellite Imagery for Economic Signals

Capturing real economic activity from space:

| Data Source | Economic Indicator |

|---|---|

| Night lights (VIIRS, DMSP) | GDP, urbanization |

| Parking lots | Retail sales, foot traffic |

| Oil tank shadows | Crude inventory levels |

| Shipping traffic | Trade flows, supply chain |

| Agricultural land | Crop yields, commodity prices |

Advantage: Real-time, unbiased, global coverage

Case: Parking Lot Car Counting

|

Method:

Results:

|

Trading strategy: Hedge funds analyze 4.8M images across 67,000 retail stores. Accurate sales prediction enables profitable positioning. |

Katona et al. (2025)

参考文献:On the Capital Market Consequences of Big Data Evidence from Outer Space

Satellite Image Analysis Pipeline

End-to-end workflow:

Image Acquisition → Tiling → Preprocessing → Feature Extraction → Aggregation

Steps:

- Acquisition — Commercial providers (Planet, Maxar)

- Tiling — Split large images into manageable patches

- Preprocessing — Cloud removal, normalization

- Feature extraction — CNN or manual features

- Aggregation — Temporal and spatial aggregation

Challenges: Weather effects, acquisition frequency, spatial alignment

Case: Oil Tank Inventory Monitoring

Predicting crude oil inventories:

- Floating-roof tanks cast measurable shadows

- Shadow length indicates fill level

- Daily imagery → continuous inventory estimates

Application:

- Predict EIA weekly inventory reports

- Trade crude oil futures ahead of announcements

- Monitor geopolitical supply disruptions

Accuracy: 2-3 day lead time over official data

Document Image Analysis Overview

Processing scanned financial documents:

| Stage | Task | Methods |

|---|---|---|

| Acquisition | Scanning, photography | Mobile capture, bulk scanners |

| Preprocessing | Deskew, denoise, binarize | Image processing techniques |

| OCR | Text extraction | Tesseract, cloud APIs |

| Layout analysis | Structure understanding | Deep learning models |

| Field extraction | Key-value pairs | NER, template matching |

OCR in Financial Operations

Optical Character Recognition applications:

- KYC/AML — ID document verification

- Credit underwriting — Extract income from tax forms

- Accounts payable — Invoice processing automation

- Audit — Contract and receipt digitization

Pipeline:

Scan → Deskew → OCR → Field Extraction → Validation → Integration

Benefits: Cost reduction, speed, error minimization

Case: Automated Loan Application Processing

SME lending automation:

- Upload scanned financial statements, tax documents

- OCR extracts text and tables

- NLP parses financial metrics

- Validation cross-checks extracted data

- Scoring feeds into credit model

Results:

- Processing time: days → minutes

- Manual review reduced by 70%

- Error rate decreased significantly

Financial Chart Recognition

Automated extraction from chart images:

Tasks:

- Chart type classification — Line, bar, candlestick, pie

- Axis detection — Hough transform, edge detection

- Data extraction — Point/bar measurement

- Pattern recognition — Technical analysis patterns

Technical patterns detected:

- Head and shoulders

- Double tops/bottoms

- Triangles, flags, wedges

Case: (Re-)Imag(in)ing Price Trends

ML on stock price charts:

Method:

- Train CNN on labeled price chart images

- Learn predictive visual patterns (not predefined)

- Extract features that forecast returns

Key findings:

- Patterns yield more accurate predictions than traditional factors

- Short-term patterns work on longer scales

- US-learned patterns effective internationally

Jiang, Kelly & Xiu (2023)

参考文献:(Re-)Imag(in)ing Price Trends

Image-Based Fraud Detection

Visual anomaly detection in finance:

| Application | Method | Target |

|---|---|---|

| Check fraud | Signature verification | Forged endorsements |

| ID verification | Face matching + liveness | Synthetic identities |

| Document tampering | Pixel analysis | Altered invoices |

| Counterfeit detection | Texture analysis | Fake documents |

Models: CNN-transformer hybrids for anomaly detection

Biometric Authentication in Finance

Identity verification workflow:

- Capture — Photo of face and ID document

- Extraction — Face detection, document parsing

- Matching — Compare live face to ID photo

- Liveness — Detect presentation attacks

- Decision — Accept/reject/manual review

Considerations:

- Privacy — Biometric data protection regulations

- Bias — Demographic performance disparities

- Explainability — Audit trail for decisions

Image-Based Property and Climate Risk

Insurance and real estate applications:

- Property valuation — Aerial imagery for condition assessment

- Catastrophe modeling — Pre/post disaster comparison

- Climate risk — Flood, fire, storm exposure mapping

- Claims processing — Automated damage assessment

Example:

Insurer uses drone imagery for post-hurricane claims.

Pre-event images enable accurate loss estimation.

Ethics in Image-Based Finance

Key ethical considerations:

- Privacy — Consent for image collection and use

- Surveillance — Balancing security vs. civil liberties

- Bias — Demographic disparities in recognition accuracy

- Transparency — Explainable AI for regulated decisions

Best practices:

- Regular bias audits across demographics

- Clear disclosure of AI-based decisions

- Human oversight for high-stakes applications

Part 4 · Integration, Implementation, and Outlook

- Combining Text, Images, and Structured Data

- Practical Project Workflow

- Limitations, Ethics, and Research Frontiers

Multimodal Learning in Finance

Combining multiple data modalities:

Text Features ─┐

├─→ Fusion Layer → Prediction

Image Features ┘

Fusion strategies:

| Strategy | Description |

|---|---|

| Early fusion | Concatenate raw features |

| Late fusion | Combine model predictions |

| Attention fusion | Learn modality importance |

Example: Combine news sentiment + satellite signals + fundamentals

Case: Multi-Signal Equity Model

Integrated alternative data approach:

Inputs:

- Analyst reports (text sentiment)

- Web traffic data (consumer interest)

- Satellite parking lot data (sales proxy)

- Traditional fundamentals (structured)

Model:

- Feature extraction per modality

- Late fusion with learned weights

- Output: Stock selection signals

Benefit: Diversified signal sources reduce model risk

Practical Project Workflow

From idea to deployment:

| Phase | Key Activities |

|---|---|

| 1. Problem framing | Define business question, success metrics |

| 2. Data collection | Source, clean, validate datasets |

| 3. Labeling | Expert annotation or weak supervision |

| 4. Modeling | Feature engineering, model selection |

| 5. Evaluation | Backtest, out-of-sample validation |

| 6. Deployment | Integration, monitoring, maintenance |

Best Practices Checklist

Documentation and reproducibility:

- [ ] Version control for code and data

- [ ] Experiment tracking (MLflow, W&B)

- [ ] Clear data lineage documentation

- [ ] Model cards with performance metrics

Team collaboration:

- Quants

Domain experts

Engineers

Risk managers

- Regular model review meetings

- Clear ownership and escalation paths

Student Project Ideas

Feasible term paper / capstone projects:

| Project | Data | Methods |

|---|---|---|

| News sentiment analysis | Financial news API | TF-IDF, VADER, FinBERT |

| Earnings call tone | SEC EDGAR transcripts | Sentiment, topic modeling |

| Invoice OCR system | Synthetic invoices | Tesseract + field extraction |

| Chart pattern detector | Yahoo Finance charts | CNN classification |

Tools: Python, scikit-learn, PyTorch, spaCy, Tesseract

Limitations of Text and Image Analytics

Key challenges:

- Data quality — Noise, missing data, inconsistency

- Sample selection — Survivorship bias, coverage gaps

- Non-stationarity — Markets and language evolve

- Model robustness — Adversarial attacks, distribution shift

Mitigation:

- Rigorous out-of-sample testing

- Ensemble methods for stability

- Continuous monitoring and retraining

Ethical and Legal Considerations

Responsible AI in finance:

| Issue | Consideration |

|---|---|

| Privacy | Data minimization, consent management |

| Fairness | Demographic parity, equal opportunity |

| Transparency | Model explainability, audit trails |

| Accountability | Clear ownership, human oversight |

Regulatory trends:

- Increasing scrutiny of AI in lending decisions

- Requirements for algorithmic impact assessments

Research Frontiers

Emerging themes in financial AI:

- Robust LLMs — Domain-adapted large language models

- Synthetic data — Augmenting scarce financial datasets

- Human-in-the-loop — Hybrid AI-human decision systems

- Causal ML — Moving beyond prediction to causation

- Multimodal foundation models — Unified text-image-tabular

Reading list: See course website for recent surveys

Summary and Key Takeaways

Core messages:

- Text and images are increasingly valuable for financial analysis

- NLP pipeline — From preprocessing to embeddings to prediction

- Computer vision — Satellite, documents, charts offer unique signals

- Integration — Multimodal approaches enhance robustness

- Responsibility — Ethics, bias, and governance are critical

"The future belongs to analysts who can extract insights from all data modalities."

Further Reading

Recommended resources:

- Gaillac, C., & L’Hour, J. (2024). Machine Learning for Econometrics. Oxford University Press. ISBN 978‑0‑19‑891882‑0., Ch. 12-13

- Gentzkow, M., Kelly, B. T., & Taddy, M. (2019). Text as Data. Journal of Economic Literature, 57(3), 535‑574.

- Jiang, J., Kelly, B., & Xiu, D. (2023). (Re‑)Imag(in)ing Price Trends. Journal of Finance, 78(4), 1781‑1827.

- Loughran, T., & McDonald, B. (2016). Textual Analysis in Accounting and Finance: A Survey. Journal of Accounting Research, 54(4), 1187‑1230.

Surveys on AI in Finance:

- Cao, L. (2022). AI in Finance: Challenges, Techniques, and Opportunities. Communications of the ACM, 65(8), 96‑105.

- Bartram, S. M., Branke, J., & Motahari, M. (2020). Artificial Intelligence in Asset Management. CFA Institute Research Foundation.

Others

Katona, Z., Painter, M., Patatoukas, P., & Zeng, J. (2025). On the Capital Market Consequences of Big Data: Evidence from Outer Space. Journal of Financial and Quantitative Analysis, 58(4), 1123‑1154.

Loughran, T., & McDonald, B. (2011). When Is a Liability Not a Liability? Textual Analysis, Dictionaries, and 10‑Ks. Journal of Finance, 66(1), 35‑65.

Mikolov, T., Chen, K., Corrado, G., & Dean, J. (2013). Efficient Estimation of Word Representations in Vector Space. arXiv preprint arXiv:1301.3781.

Hansen, S., McMahon, M., & Prat, A. (2017). Transparency and Deliberation within the FOMC: A Computational Linguistics Approach. Quarterly Journal of Economics, 133(2), 801‑870.

Hoberg, G., & Phillips, G. M. (2016). Text‑Based Network Industries and Endogenous Product Differentiation. Journal of Political Economy, 124(5), 1423‑1465.

Kozlowski, A. C., Taddy, M., & Evans, J. A. (2019). The Geometry of Culture: Analyzing Meaning through Word Embeddings. American Sociological Review, 84(5), 905‑949.

Ash, E., Chen, D. L., Naidu, S., & Rhode, P. W. (2025). Ideas Have Consequences: The Impact of Law and Economics on American Justice.* Quarterly Journal of Economics.

Questions and Discussion

Discussion topics:

- How might text/image signals be arbitraged away over time?

- What are the fairness implications of satellite-based trading?

- Should regulators require disclosure of alternative data use?

- How do you evaluate the quality of a sentiment indicator?

Thank You

Big Data in Finance: Text and Image Analytics

Questions welcome!