无收益资产远期合约定价

例子

- 一个无股息股利的股票的现价为$40

- 3个月的远期价格为US$43

- 1年期的无风险利率为5% (以连续复利计算)

存在套利机会吗?如何套利?

如果远期价格为US$39呢?

|

远期价格 = $43

|

远期价格 = $39

|

|

现在:

以5%利率借入,期限3个月 以$40买入一单位标的资产 签订三个月后以$43卖出标的资产的远期合约 |

现在:

卖空一单位标的资产,获得$40 以5%投资$40,期限3个月 签订三个月后以$39买入标的资产的远期合约 |

|

3个月时:

以$43卖出资产 以$40.50偿还贷款和利息 |

3个月时:

以$39买入资产 平仓空头头寸 从投资中获得$40.50 |

|

实现利润 = $2.50

|

实现利润 = $1.50

|

定价公式

- 如何套利?(零投资,低买高卖,获得套利利润)

-

均衡时无套利机会:所有套利方式得到的利润都非正

- 若远期被低估:买远期卖现货,套利利润为

- 若远期被高估:卖远期买现货,套利利润为

- 无套利机会(现货-期货平价定理):

- 若远期被低估:买远期卖现货,套利利润为

-

如果卖空不被允许,公式对投资性资产依然成立

- 拥有资产的投资者仍然可以套利

- 不拥有资产但拥有投资能力的个人/机构可以卖出套利策略

定价公式:另一种理解(复制)

The big idea: 用含有衍生工具的组合复制标的资产

- 考虑下面两个组合

- 组合A:一份标的资产

- 组合B:一份远期协议+

|

|

- 由无套利原理知:

已知现金收益资产远期合约定价

例子:

- 一个附息债券,当前价格为$900

- 债券将在4个月后支付利息$40

- 4个月和9个月的无风险利率分别为3%和4%(以连续复利计算)

- 以该附息债券为标的资产的9个月后到期的远期价格为$910(太高) 或$870(太低)时如何套利?

|

远期价格 = $910

|

远期价格 = $870

|

|

现在:

借入$900: $39.60借4个月,$860.40借9个月 买入1单位资产 签订9个月以后以$910卖出资产的远期协议 |

现在:

卖空1单位资产,获得$900 将$39.60投资4个月,将$860.40投资9个月 签订9个月后以$870买入资产的远期协议 |

|

4个月时:

收到资产收益$40 用$40偿还第一笔贷款及利息 |

4个月时:

收到4个月投资收益$40 支付资产收益$40 |

|

9个月时:

卖出资产获得$910 用$886.60偿还第二笔贷款及利息 |

9个月时:

收到9个月的投资收益$886.60 用$870买入资产 平仓空头头寸 |

|

实现利润 = $23.40

|

实现利润 = $16.60

|

定价公式

- 均衡时无套利机会:所有套利方式得到的利润都非正

- 套利策略

- 若远期被低估:买远期卖现货,套利利润为

- 若远期被高估:卖远期买现货,套利利润为

- 无套利机会:

- 若远期被低估:买远期卖现货,套利利润为

定价公式:另一种理解(复制)

- 考虑下面两个组合

- 组合A:一份标的资产

- 组合B:一份远期协议+与标的资产收益现金流匹配的一组无风险证券+一份

- 标的资产产生现金收益时:无风险证券组合产生相同金额的现金流

- 组合在期末的价值

- 组合A:一份标的资产,价值为

- 组合B:无风险证券期末价值为

- 组合A:一份标的资产,价值为

- 由无套利原理知:

已知红利收益率资产远期合约定价

- 均衡时无套利机会:所有套利方式得到的利润都非正

- 若远期被低估:买远期卖现货,套利利润为:

- 若远期被高估:卖远期买现货,套利利润为:

- 无套利机会:

- 若远期被低估:买远期卖现货,套利利润为:

另一种方法

- 考虑下面两个组合

- 组合A:

- 组合B:一份远期协议+一份

- 组合A:

- 组合在期末的价值

- 组合A:一份标的资产,价值为

- 组合B:无风险证券期末价值为

- 组合A:一份标的资产,价值为

- 由无套利原理知:

远期合约的估值

- 在远期合约被创造出来时(除了买卖差价,bid-offer spread)其价值为零

- 在被创造出来之后,远期合约的价值可正可负

- 假设

- 考虑交割价格为

- 远期协议多头的价值为:

- 远期协议空头的价值为:

- 远期协议多头的价值为:

- (另一种方法)考虑两个投资组合

- 组合A:一份协议价格为

- 组合B:一份协议价格为

- 组合A:一份协议价格为

股票指数期货合约及其定价

- 股票指数期货合约

- 股票指数反映的是某个假想的、按照一定方式组成的股票组合的价值变化

- 股票指数期货是指买入或卖出相应股票指数面值的期货合约

- 股票指数面值则定义为股票指数乘以某一特定货币金额所得的值

- 所有的股票指数期货合约均是现金交割,而不是实物交割

- 股票指数期货合约的定价

- 大部分股票指数可以视为支付红利(

- 指数的变动必须对应某一可交易的组合价值的变动

- 法日德等国家所有的股票都在相同的日期支付红利,也可以估计指数中股票组合将要收到的红利金额及其时间分布,计算其现值(

- 大部分股票指数可以视为支付红利(

股指套利

- 当

- 当

- 股指套利涉及到同时交易股指期货以及许多不同的股票

- 股指套利常常由计算机(算法)生成交易

- 有时无法同时进行交易,此时现货与期货价格间的关系不成立

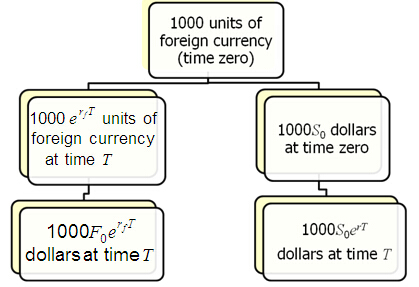

外汇期货合约(货币远期)及其定价

|

|

储存成本

储存成本可以被看做是负的收入(收益率):

-

若单位时间内的储存成本

- 对投资性资产:

- 对消费性资产:

- 对投资性资产:

-

若储存成本

- 对投资性资产:

- 对消费性资产:

- 对投资性资产:

持有成本

- 持有成本(the cost of carry),

- 对投资性资产:

- 对消费性资产:

- 对投资性资产:

- 一项消费性资产的便利收益率(the convenience yield)

- 代表持有资产本身的好处

- 定义:便利收益率(

远期价格与期货价格

- 通常假设标的资产、到期时间都相同的远期和期货其价格相同

- 理论上,当利息率不确定时,两者有少许差别(为什么会有差别?):

- 当利率与资产价格强烈正相关时,期货价格大于远期价格

- 当利率与资产价格强烈负相关时,期货价格小于远期价格

期货价格与未来现货价格的期望

- 假设投资者对一个资产要求的期望收益率为

- 可以通过以无风险利率投资

- 这说明:

- 无系统性风险:

- 系统性风险为正:

- 系统性风险为负:

- 无系统性风险:

案例:WTI原油期货 负 价格(2020)

关键信息

|

|

WTI 2020年5月 & 6月合约结算价(2020-04-15 ~ 2020-04-24)

|

单位:美元/桶,NYMEX 结算价 说明:

如何从远期/期货定价角度理解这一负期货价格事件? |

|

|

影响与后续变化

|

交易与风险管理启示

|

课后阅读与练习

课堂练习

1. 某股票当前价格为65美元,该股票在未来1年不支付股利,市场无风险利率为5\%(连续复利),该股票1年期的远期价格为多少?

-

分析:这是典型的无收益资产远期定价问题

-

解答:

- 某股票预计在2个月和5个月后每股分别派发1元股息,该股票目前市价等于30,所有期限的无风险连续复利年利率均为6%,某投资者刚取得该股票6个月期的远期合约空头,请问:

- (a) 该远期价格等于多少?若交割价格等于远期价格,则远期合约的初始价值等于多少?

- (b) 3个月后,该股票价格涨到35元,无风险利率仍为6%,此时远期价格和该合约空头价值等于多少?

- 分析:

- (a) 是典型的已知现金收益资产远期合约定价问题

- (b) 涉及已知现金收益资产远期合约定价和远期合约估值问题

- 解答:

- (a)

- (b)

- (a)

- 某投资者能以每盎司$560的价格买进和$559的价格卖出黄金,以6%的年利率借入和5.5%的年利率贷出资金(均为连续复利),当黄金期货价格在什么范围内波动时,该投资者不能进行套利?(提示:

-

分析:

- 这是一个期货定价问题

- 应用无套利原定定价

- 买卖价格和借贷利率的不同可能使无套利价格不唯一

-

解答:

- 若期货被低估,买期货卖现货,套利利润为:

- 若期货被高估,卖期货买现货,套利利润为:

- 无套利价格应满足:

- 若期货被低估,买期货卖现货,套利利润为:

- A company enters into a forward contract with a bank to sell a foreign currency for

- 分析:

- 这是一个远期设计(定价)问题,实际是一个远期估值问题

- 在签订新的远期时交易双方不发生支付

- 新远期协议签订时的价值应等于旧远期协议的价值

- 解答:

课后阅读与练习

|

拓展学习

|