利率互换的典型用途:改变投资的属性

|

fixed

|

floating

|

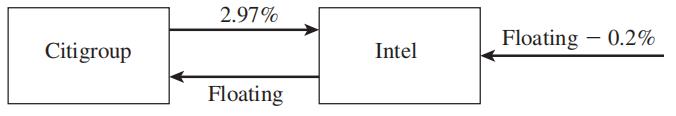

利率互换的报价

| Maturity (years) | Bid (买入价) | Ask (卖出价) | Swap rate |

|---|---|---|---|

| 2 | 2.97 | 3.00 | 2.985 |

| 3 | 3.05 | 3.08 | 3.065 |

| 4 | 3.15 | 3.19 | 3.170 |

| 5 | 3.26 | 3.30 | 3.280 |

| 7 | 3.40 | 3.44 | 3.420 |

| 10 | 3.48 | 3.52 | 3.500 |

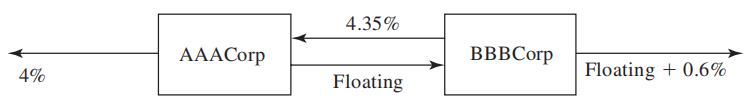

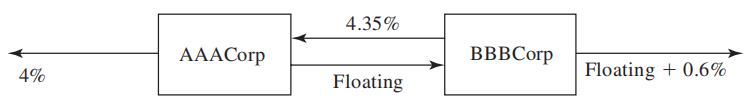

比较优势的观点(Comparative Advantage Argument)

- AAA Corp和BBB Corp在不同市场获得融资的成本如下表:

| Fixed | Floating | |

|---|---|---|

| AAA Corp | 4.0% | 6-month LIBOR -0.1% |

| BBB Corp | 5.2% | 6-month LIBOR +0.6% |

- AAA Corp和BBB Corp分别要求获得浮动利率合固定利率的融资

- 通过下面的互换可以同时改善两家公司的融资成本

- 请分析两家公司获得的好处

互换设计

|

|

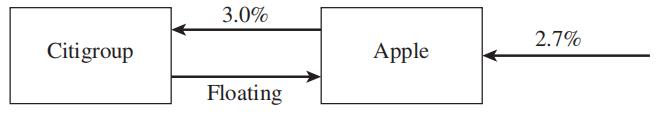

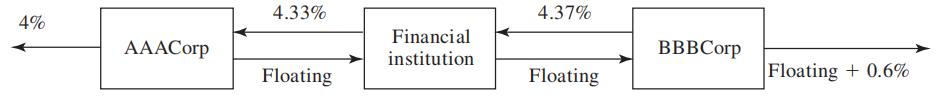

通过金融中介完成互换交易

- 请分析两家公司和金融机构获得的好处

- 如何设计互换?

课堂练习

Companies A and B have been offered the following rates per annum on a $20 million 5-year loan:

| Fixed | Floating | |

|---|---|---|

| A Company | 5.0% | Floating +0.1% |

| B Company | 6.4% | Floating +0.6% |

Company A requires a floating-rate loan; company B requires a fixed-rate loan. Design a swap that will net a bank, acting as intermediary, 0.1% per annum and that will appear equally attractive to both companies.

- 分析比较优势与融资需求

| 公司 | 固定市场优势 | 浮动市场优势 | 比较优势 | 融资需求 |

|---|---|---|---|---|

| A | 1.4% | 0.5% | 固定 | 浮动 |

| B | -1.4% | -0.5% | 浮动 | 固定 |

-

“做蛋糕”

- A借固定、B借浮动、用利率互换改变债务属性

- 一共节省的融资成本:1.4%+(-0.5/%)=0.9%

-

"分蛋糕"

- 银行=0.1%;A或B=(0.9/%-0.1/%)/2=0.4/%

- 实际融资成本:A=Floating +0.1%-0.4/%=Floating -0.3%;B=6.4%-0.4%=6.0%

比较优势理论的缺陷

- 核心问题:无法合理解释不同公司在固定利率与浮动利率市场中的利差差异。

- 利差差异的本质原因

|

|

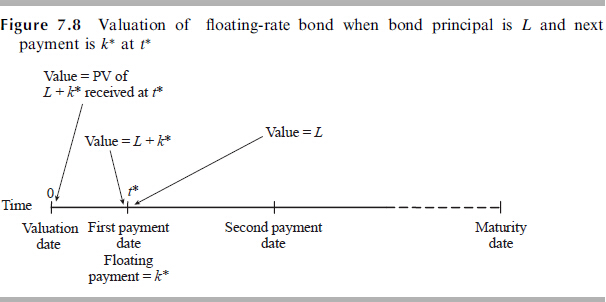

以债券组合的形式估值

- 利率互换的现金流可以分解为两个债券的现金流,因此:

- 固定利率债券价值为其现金流现值

- 浮动利率债券的价值在下一个支付日为其面值

例子

- 本金为$100 million,付出6个月的LIBOR,收入8% (每半年复利一次)

- 剩余期限为1.25年

- 3个月、9个月和15个月的即期LIBOR分别为 10%,10.5%和11% (连续复利)

- 最近一次支付日观察到的6个月LIBOR为10.2% (每半年复利一次)

| Time | cash flow |

cash flow |

Discount factor |

Present value |

Present value |

|---|---|---|---|---|---|

| 0.25 | 4.0 | 105.100 | 0.9753 | 3.901 | 102.505 |

| 0.75 | 4.0 | 0.9243 | 3.697 | ||

| 1.25 | 104.0 | 0.8715 | 90.640 | ||

| Total | 98.238 | 102.505 |

以FRAs组合的形式估值

-

思路

- 利率互换现金流可以分解为(在每个支付日)远期利率协议的组合

- 通过假设“今天的远期利率会实现”,可以为远期利率协议定价

-

具体过程

- [1] 用即期利率计算远期利率,从而得到互换的现金流

- [2] 假设未来的LIBOR会等于远期利率,计算互换(在每个支付日)的(净)现金流

- [3] 通过折现这些(净)现金流为互换定价

例子

- 本金为$100 million,付出6个月的LIBOR,收入8% (每半年复利一次)

- 剩余期限为1.25年

- 3个月、9个月和15个月的即期LIBOR分别为 10%,10.5%和11% (连续复利)

- 最近一次支付日观察到的6个月LIBOR为10.2% (每半年复利一次)

| Time | Fixed cash flow |

Floating cash flow |

Net cash flow |

Discount factor |

Present value of net cash flow |

|---|---|---|---|---|---|

| 0.25 | ? | ? | ? | ? | ? |

| 0.75 | ? | ? | ? | ? | ? |

| 1.25 | ? | ? | ? | ? | ? |

| Total | ? |

解答

|

|

正确的解答

|

|

互换交易的信用风险

- 在初期互换的价值为零(互换定价原理)

- 未来互换的价值可正可负

- 仅当互换价值为正时公司暴露在信用风险下(why?)

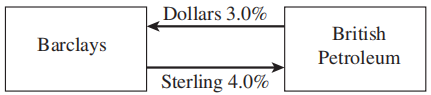

货币互换

- 定期交换以两种不同货币计算的本金和利息

|

|

- 固定利率对浮动利率货币互换(fixed-for-fixed currency swap)= 固定利率对固定利率货币互换 + 1*利率互换

- 浮动利率对浮动利率货币互换(fixed-for-fixed currency swap)= 固定利率对固定利率货币互换 + 2*利率互换

其他互换

-

标准利率互换的变形

- 固定利率对浮动利率:不同支付频率

- 浮动利率对浮动利率:e.g. 商业票据利率对隔夜参考利率

- 互换本金可变:摊还互换(amortizing swap)、递升互换(step-up swap)、远期互换(forward swap)/延期互换(deferred swap)

- 复合互换(compounding swap):利率复合,到期日付款

-

跨货币互换(diff swap, Quantos):将一种货币上观察到的利率用于另一种货币的本金

-

股权互换(Equity Swaps): 将某一股指的整体收益与(固定利率或浮动利率)利息交换

-

内嵌期权的互换(Options): 内嵌(延期、赎回)期权

-

商品互换(Commodity Swaps): 具有不同期限和相同协议价格的商品远期合约组合

-

波动率互换(Volatility Swaps): 交换历史波动率和协议波动率决定的现金流

课后阅读与练习

课后阅读与练习

|

拓展学习

|

习题

- [10.1] 为什么说当利率期限结构向上倾斜时(

- 解答:

- 假设

- 假设

习题

- [10.5] 一家金融机构与 A 公司签订了一份 5 年期的利率互换协议,收取 10% 的固定年利率,支付 6 个月期的 LIBOR ,本金为$10,000,000 ,每 6 个月支付一次。假设 A 公司未能进行第六次支付(即在第 3 年末违约),当时的利率期限结构是平坦的,都为 8% (按半年计一次复利计),而第 3 年年中的 6个月期的 LIBOR 为年利率 9% 。请计算该金融机构的损失是多少?

- 分析:

- 金融机构损失的是违约时互换的价值(如果非负)

- 这是一个利率互换估值问题

- 用 “债券价格之差” 估值比较合适

- 解答: 以第3年末为0时刻,货币单位为百万美元。

| Time | cash flow |

cash flow |

Discount factor |

Present value |

Present value |

|---|---|---|---|---|---|

| 0 | 0.50 | 10.45 | 1 | 0.500 | 10.450 |

| 0.5 | 0.50 | 0.9615 | 0.481 | ||

| 1 | 0.50 | 0.9246 | 0.462 | ||

| 1.5 | 0.50 | 0.8890 | 0.445 | ||

| 2 | 10.50 | 0.8548 | 8.975 | ||

| Total | 10.863 | 10.450 |

该金融机构的损失(约)为0.413(百万元)。

- 如果交换互换交易中金融机构和公司地位,金融机构的损失为多少?

- 如果将利率互换看作远期利率协议的组合,本问题该如何解答?

习题

- [10.6] 设甲公司与乙公司达成一项有效期为 2 年的互换协议:甲公司以固定利率支付利息给乙公司,本金为 1000 万美元,乙公司以 LIBOR 的浮动利率向甲公司支付利息,名义本金仍为 1000 万美元,每半年支付一次利息。 6 个月、 12 个月、18 个月和 24 个月的 LIBOR 零息票利率(连续复利率)分别为 8.8%、 9.5%、 9.9%和 10.2%。请问甲公司应向乙公司支付何种水平的固定利率?

- 分析:

- 这是一个利率互换定价的问题

- 利率互换的协议价格是使互换协议本身价值为0的互换利率

- 本质上这是一个利率互换估值的问题

- 用 “债券价格之差” 估值比较合适

- 解答: 将互换利率设为

| Time | cash flow |

cash flow |

Discount factor |

Present value |

Present value |

|---|---|---|---|---|---|

| 0 | |||||

| 0.5 | |||||

| 1 | |||||

| 1.5 | |||||

| 2 | |||||

| Total |

- 如果将利率互换看作远期利率协议的组合,本问题该如何解答?