L11 期权定价:B-S-M模型

- L11 期权定价:B-S-M模型

Wiener Processes and Itô's Lemma

Model the Dynamics of Stock Prices / Returns

ABC of Stochastic Processes

-

Stochastic Processes

- Describes the way in which a variable such as a stock price, exchange rate or interest rate changes through time

- Incorporates uncertainties

-

Example of Stochastic Processes

- Each day a stock price: increases by $1 with probability 30, stays the same with probability 50%, reduces by $1 with probability 20%

- Each day a stock price change is drawn from a normal distribution with mean $0.2 and standard deviation $1

-

Markov Processes

- In a Markov process future movements in a variable depend only on where we are, not the history of how we got to where we are

- Is the process followed by the temperature at a certain place Markov?

- We assume that stock prices follow Markov processes

-

Weak-Form Market Efficiency

- This asserts that it is impossible to produce consistently superior returns with a trading rule based on the past history of stock prices. In other words technical analysis does not work.

- A Markov process for stock prices is consistent with weak-form market efficiency

Variances & Standard Deviations

-

In Markov processes changes in successive periods of time are independent

-

This means that variances are additive

-

Standard deviations are not additive

-

In our example it is correct to say that the variance is 100 per year.

-

It is strictly speaking not correct to say that the standard deviation is 10 per year.

A Wiener Process

-

Define as a normal distribution with mean and variance

-

A variable follows a Wiener process if

- The change in in a small interval of time is

- where

- The values of for any different (non-overlapping) periods of time are independent

-

Properties of a Wiener Process

- Mean of is

- Variance of is

- Standard deviation of is

Norbert Wiener (诺伯特维纳)

Brownian Motion

Louis Bachelier (路易斯巴舍利耶)

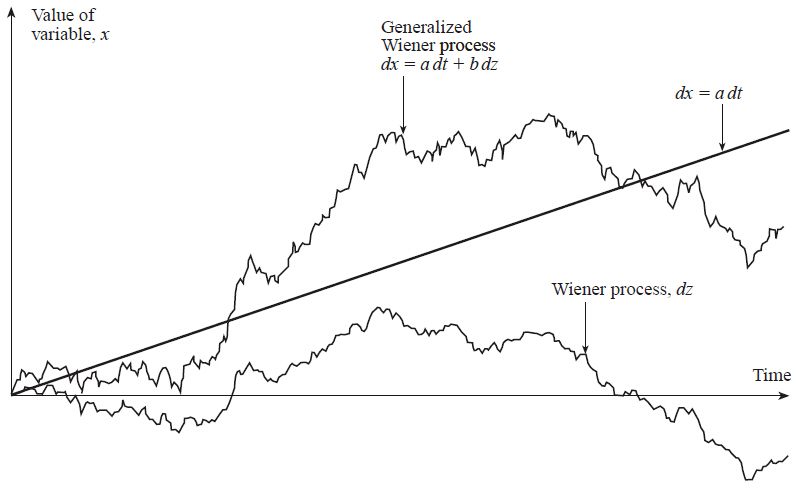

Generalized Wiener Processes

-

A Wiener process has a drift rate (i.e. average change per unit time) of and a variance rate of

-

In a generalized Wiener process the drift rate and the variance rate can be set equal to any chosen constants

- Mean change in per unit time is

- Variance of change in per unit time is

-

Taking Limits

- What does an expression involving and mean?

- It should be interpreted as meaning that the corresponding expression involving and is true in the limit as tends to zero

- In this respect, stochastic calculus is analogous to ordinary calculus

Generalized Wiener Process

A Model for Stock Prices

-

It Process

- In an It process the drift rate and the variance rate are functions of time

- The discrete time equivalent is true in the limit as tends to zero

- In an It process the drift rate and the variance rate are functions of time

-

A generalized Wiener process is not appropriate for stocks

- For a stock price we can conjecture that its expected percentage change in a short period of time remains constant (not its expected actual change)

- We can also conjecture that our uncertainty as to the size of future stock price movements is proportional to the level of the stock price

-

Geometric Brownian Motion

It's lemma

Kiyosi It (伊藤清)

It's lemma

-

If we know the stochastic process followed by , It's lemma tells us the stochastic process followed by some function . When then

-

Since a derivative is a function of the price of the underlying asset and time, It's lemma plays an important part in the analysis of derivatives

-

Applications of It's Lemma to A Stock Price Process

- Suppose the stock price process is

- For a function of and we have

The Black-Scholes-Merton Model

The Stock Price Assumption

The Stock Price Assumption

-

Consider a stock whose price is

-

In a short period of time of length , the return on the stock is normally distributed:

-

So the price is lognormal distributed

or

Continuously Compounded Return

-

If is the realized continuously compounded return we have

-

The Expected Return

- The expected value of the stock price is

- The expected return on the stock is not

- The reason is that, and are not the same

-

vs.

- is the expected return in a very short time, , expressed with a compounding frequency of

- is the expected return in a long period of time expressed with continuous compounding (or, to a good approximation, with a compounding frequency of )

Volatility

-

The Volatility

- The volatility is the standard deviation of the continuously compounded rate of return in year

- The standard deviation of the return in a short time period time is approximately

- If a stock price is $50 and its volatility is 25% per year what is the standard deviation of the price change in one day?

-

Estimating Volatility

- Take observations at intervals of years (e.g. for weekly data )

- Calculate the continuously compounded return in each interval as:

- Calculate the standard deviation, , of the 's

- The historical volatility estimate is:

-

Nature of Volatility

- Volatility is usually much greater when the market is open (i.e. the asset is trading) than when it is closed

- For this reason time is usually measured in ``trading days'' not calendar days when options are valued

- It is assumed that there are trading days in one year for most assets

The Black-Scholes-Merton Model

Black-Scholes-Merton: The Big Idea

-

The option price and the stock price depend on the same underlying source of uncertainty

-

We can form a portfolio consisting of the stock and the option which eliminates this source of uncertainty

-

The portfolio is instantaneously riskless and must instantaneously earn the risk-free rate

-

This leads to the Black-Scholes-Merton differential equation

The Derivation of the Black-Scholes-Merton Differential Equation

-

Stock price & derivative price

-

Set up a portfolio

- derivative:

- shares:

-

The value of the portfolio

Since the portfolio is risk-free, we have

So, the Black-Scholes-Merton Differential Equation is

- Any security whose price is dependent on the stock price satisfies the differential equation

- The particular security being valued is determined by the boundary conditions of the differential equation

- In a forward contract the boundary condition is when

- The solution to the equation is

Black-Scholes-Merton Pricing for Options

where

- Properties of Black-Scholes Formula

- As becomes very large tends to and p tends to zero

- As becomes very small tends to zero and tends to

- What happens as becomes very large?

- What happens as becomes very large?

Understanding Black-Scholes

The formula

- : Discount rate

- : Probability of exercise

- : Expected percentage increase in stock price if option is exercised

- : Strike price paid if option is exercised

Risk-Neutral Valuation

Risk-Neutral Valuation

-

Risk-Neutral Valuation

- The variable does not appear in the Black-Scholes-Merton differential equation

- The equation is independent of all variables affected by risk preference

- The solution to the differential equation is therefore the same in a risk-free world as it is in the real world

- This leads to the principle of risk-neutral valuation

-

Applying Risk-Neutral Valuation

- [1] Assume that the expected return from the stock price is the risk-free rate

- [2] Calculate the expected payoff from the option

- [3] Discount at the risk-free rate

Option Sensitivities: Greeks

Greeks

The Taylor Expansion

- Delta:

- Gamma:

- Vega:

- Rho:

- Theta:

课后阅读与练习

课后阅读与练习

-

课后阅读:教材第十一章第三节、十二章第一节、第六章、第七章相关内容

-

练习

- 教材pp186:7,10

- 扫码做题