L10 期权定价:二叉树

二叉树模型

无套利理论

二叉树模型

-

期权及其他衍生证券定价的二叉树模型的出发点是假设标的资产的价格波动服从二项分布(Binomial Distribution)

- 在每一次随机试验中,随机变量只有两种可能的结果,而且是互相对立的

- 在一系列随机试验中,随机变量的结果发生的概率保持不变

- 每次试验是独立的,与其它各次试验结果无关

-

为什么用二叉树model标的资产价格的波动?

-

利用二叉树模型为风险资产估值包括以下三个步骤:

- 构造一个关于目标资产价格波动的二叉树

- 确定二叉树中每种可能结果的概率

- 利用每个可能的结果和对应的概率,计算目标资产在期末的期望价值

无套利理论

-

一个简单的例子

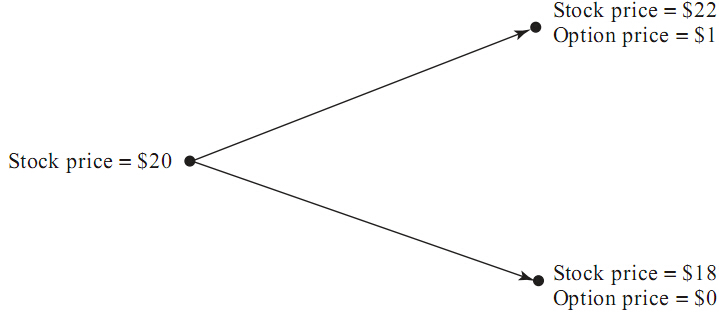

- 股票当前和未来价格如下图

- 协议价格为,三个月的无风险利率为(连续复利)

- 股票当前和未来价格如下图

-

思路:

- 用衍生工具和标的资产构造(复制)无风险证券(什么是无风险证券?为什么复制无风险证券?)

- 由无套利理论:无风险组合得到无风险收益

-

构造(复制)无风险组合:

- 多头:份股票

- 空头:份看涨期权

-

到期时无风险组合的价值:

| 价值 | ||

|---|---|---|

| 股票的头寸 | ||

| 期权的头寸 | ||

| 组合 |

-

确定(组合无风险):

-

无风险组合的价值

- :

- :

-

确定(组合获得无风险收益):

一般化

-

构造(复制)无风险组合:

- 多头: 份股票

- 空头: 份看涨期权

-

确定(组合无风险):

-

确定(组合获得无风险收益):

-

令,可表示为: 。

问题:是概率吗?

风险中性定价

风险中性定价(Risk-neutral valuation)

-

假设我们生活在风险中性世界:

- [1] 存在风险中性概率分布,使得股票(或其他资产)的期望收益等于无风险利率

- [2] 计算期权(或其他衍生工具)收益现值的折现率为无风险利率

-

用风险中性笔概率为股票和期权估值

| 价值 | 期望 | ||

|---|---|---|---|

| 风险中性概率 | 不适用 | ||

| 股票 | |||

| 期权 |

-

在风险中性世界:

-

因此,期权费为:

-

风险中性定价理论有两个最基本的假设:

- 在一个投资者都是风险中性的世界里,所有证券的预期收益率均为无风险收益率

- 投资者的投资成果体现为用无风险利率贴现收益现金流得到的现值

-

无风险的套利机会出现时

- 市场参与者的套利活动与其对风险的态度无关(套利分析时未用到风险偏好信息)

- 无套利均衡分析的过程和结果与市场参与者的风险偏好无关

- 因此,假设风险中性世界(风险中性定价)简化分析

-

从风险中性世界进入到风险厌恶或者风险喜好的世界时:

- (概率分布发生变化)资产的预期收益率发生变化

- 资产任何损益(或现金流)所适用的贴现率发生改变

- 以上两个变化效果互相抵消

多期(步)二叉树

欧式期权

欧式看涨期权

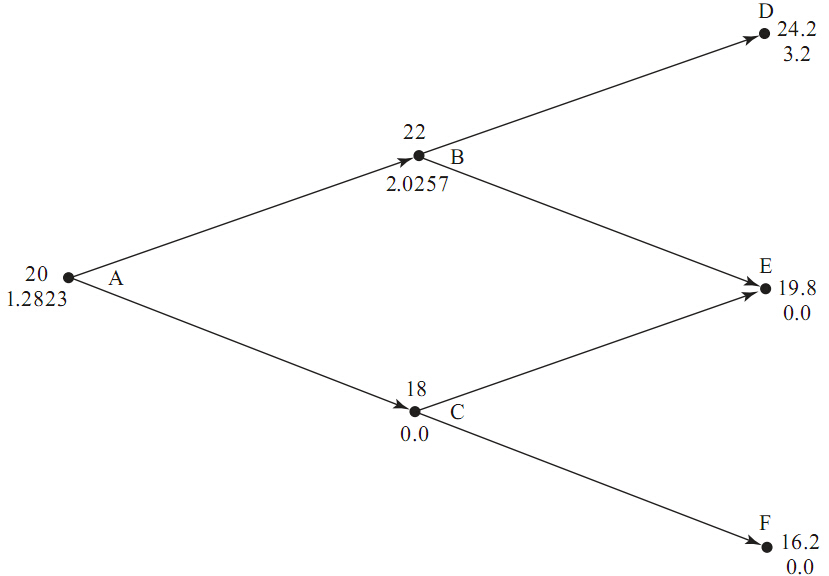

- ,

- 每一步长度为3个月

- 思路:逆向求解,依次计算期权在每个节点的价值

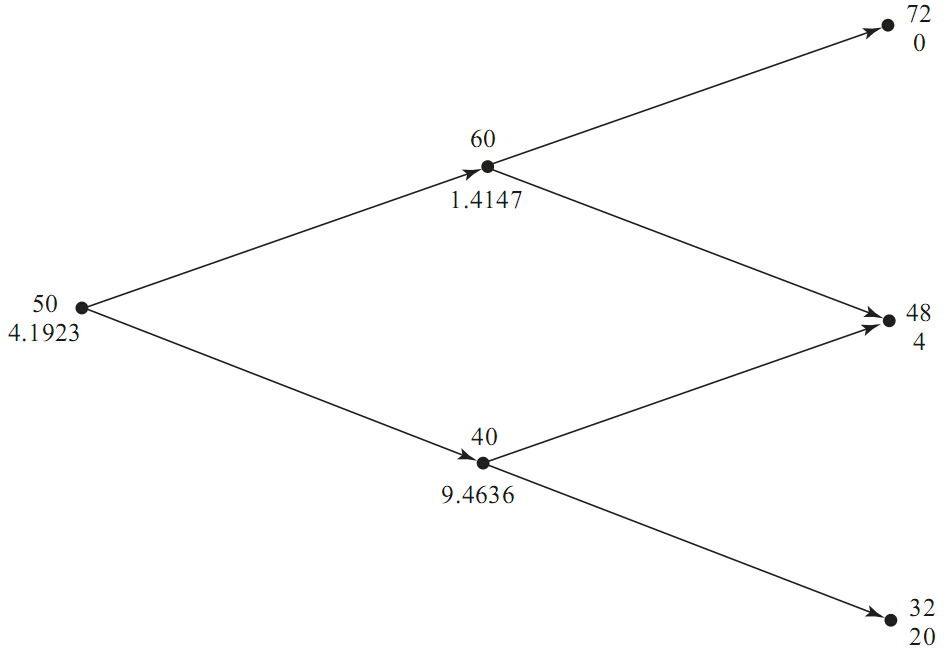

欧式看跌期权

- ,

- 每一步长度为12个月

美式期权

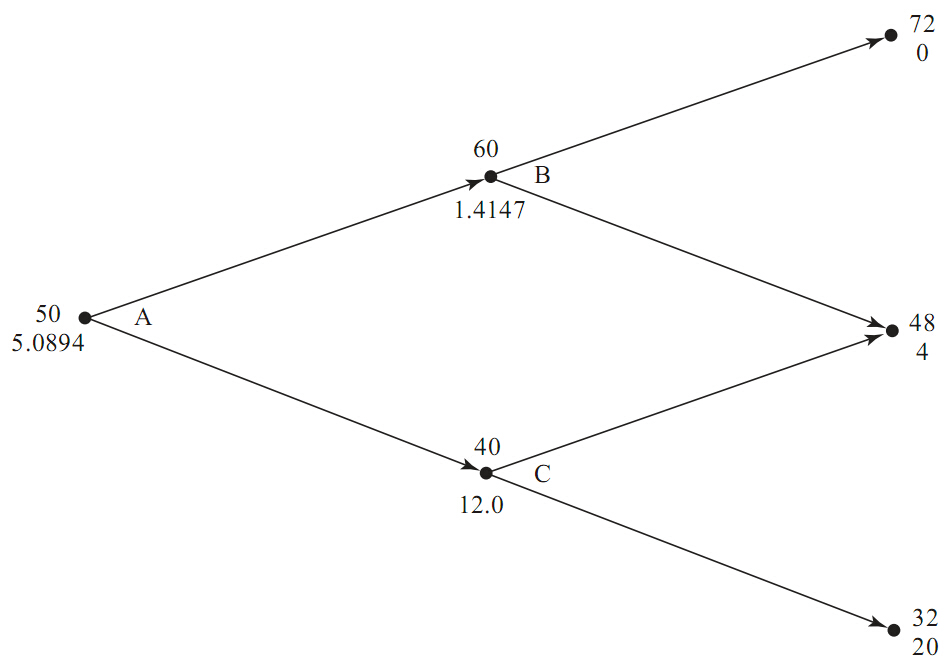

美式看跌期权

- ,

- 每一步长度为12个月

- 需要考虑提前执行的可能性

二叉树模型的实现与应用

二叉树模型的实现

Delta

-

Delta ()表示期权价格变化量与标的资产价格变化量之比

-

每个节点对应的不同

确定和

-

,

- 是标的资产收益率的波动率

- 是步长(即相邻两节点间的时间间隔)

- 该方法由Cox, Ross, and Rubinstein (1979)提出

-

Girsanov定理

- 真实世界中与风险中性世界中资产收益率的波动率相等

- 因此我们可以用真实世界的数据度量波动率,然后用波动率估计和以构造风险中性世界中的二叉树

其他的标的资产

-

对其他资产,用同样的方法构造二叉树,不同之处仅仅在于的计算:一般地,令

-

一些已知的结论:

- 标的资产不产生收益:

- 标的资产为收益率等于的股票指数:

- 标的资产是外币(以外币计算的无风险利率为):

- 标的资产为期货合约:

DerivaGem

DerivaGem

-

百度网盘亦可下载(提取码:t7me)

课后阅读与练习

课后阅读与练习

-

课后阅读:教材第十一章第三节、十二章第一节、第六章、第七章相关内容

-

练习

- 教材pp186:7,10

- 扫码做题

课堂练习

-

Explain the no-arhitrage and risk-neutral valuation approaches to valuing a European option using a one-step binomial tree.

-

What is meant by the delta of a stock option?

-

A stock price is currently $40. It is known that at the end of one month it will he either $42 or $38. The risk-free interest rate is 8% per annum with continuous compounding. What is the value of a 1-month European call option with a strike price of $39?

-

A stock price is currently $100. Over each of the next two 6-month periods it is expected to go up by 10% or down by 10%. The risk-free interest rate is 8% per annum with continuous compounding. What is the value of a 1-year European call option with a strike price of $100?

-

For the situation considered in the above problem, what is the value of a 1-year European put option with a strike price of $100? Verify that the European call and European put prices satisfy put-call parity.

-

A stock price is currently $50. It is known that at the end of 6 months it will be either $60 or $42. The risk-free rate of interest with continuous compounding is 12% per annum. Calculate the value of a 6-month European call option on the stock with an exercise price of $48. Verify that no-arhitrage arguments and risk-neutral valuation arguments give the same answers.

-

A stock price is currently $40. Over each of the next two 3-month periods it is expected to go up by 10% or down by 10%. The risk-free interest rate is 12% per annum with continuous compounding.

- (a) What is the value of a 6-month European put option with a strike price of $42?

- (b) What is the value of a 6-month American put option with a strike price of $42?