L09 期权:交易策略

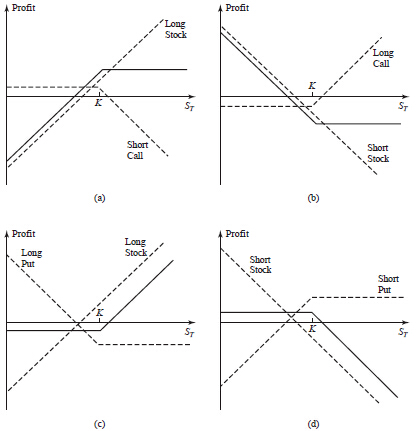

同时交易期权与标的资产

同时交易期权与标的资产

Put-call parity: $c+Ke^{-rT}+D=p+S_0$

Put-call parity: $c+Ke^{-rT}+D=p+S_0$

差价

差价

-

差价(spread) 策略涉及到两个或者更多的同一种类的期权的头寸

-

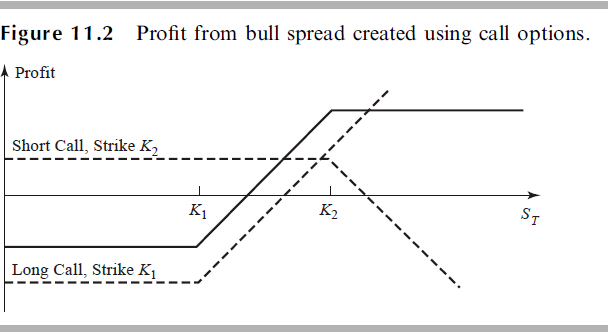

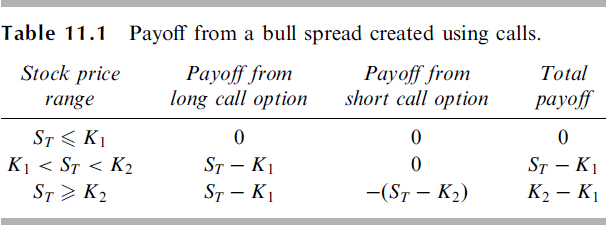

牛市差价(Bull Spread)

- 可以用欧式看涨期权或者欧式看跌期权构造

- 当标的资产价格上涨时获利

-

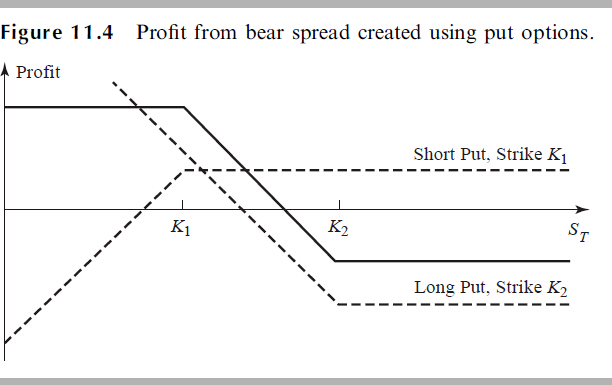

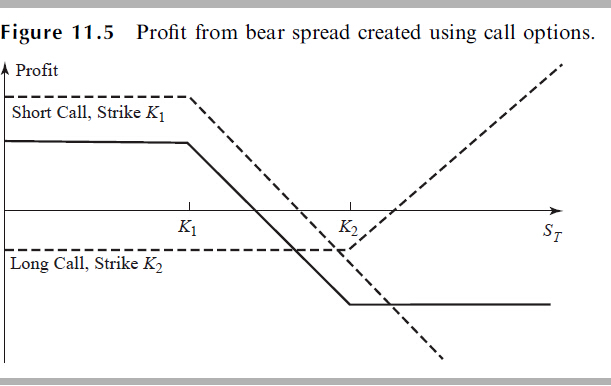

熊市差价(Bear Spread)

- 可以用欧式看涨期权或者欧式看跌期权构造

- 当标的资产价格下跌时获利

用看涨期权构造牛市差价

用看跌期权构造牛市差价

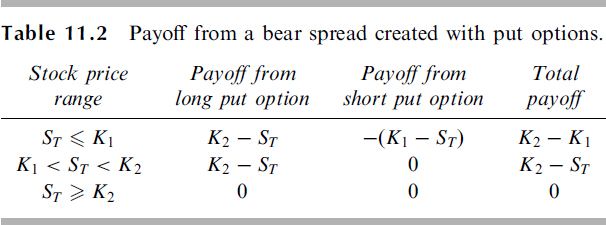

用看跌期权构造熊市差价

用看涨期权构造熊市差价

盒式差价(Box Spread)

-

由牛市差价和熊市差价组合而成

-

如果所有的期权都是欧式的,盒式差价的价值为协议价格之差的现值

-

如果是由美式期权组成,则不一定

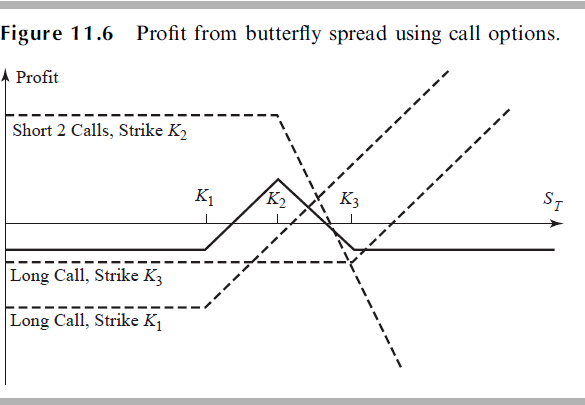

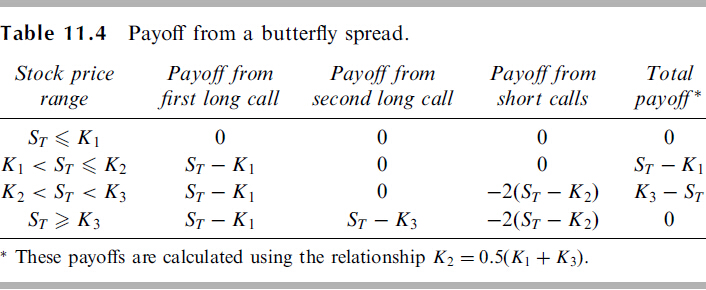

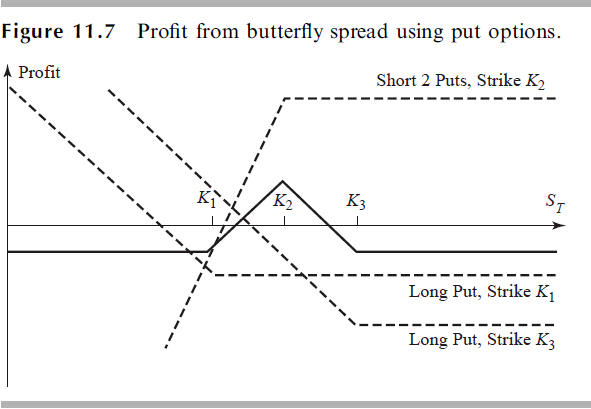

蝶式差价(Butterfly Spread)

-

蝶式差价涉及到三个拥有不同协议价格的期权的头寸

-

假设,蝶式差价可通过下面的方式构造: 买入一份协议价格为的欧式看涨期权,买入一份协议价格为的欧式看涨期权,同时卖出两份协议价格为的欧式看涨期权。此时,为和的中点。

-

与当前股票价格接近

-

蝶式差价可由看涨期权或者看跌期权构成

用看涨期权构造蝶式差价

用看跌期权构造蝶式差价

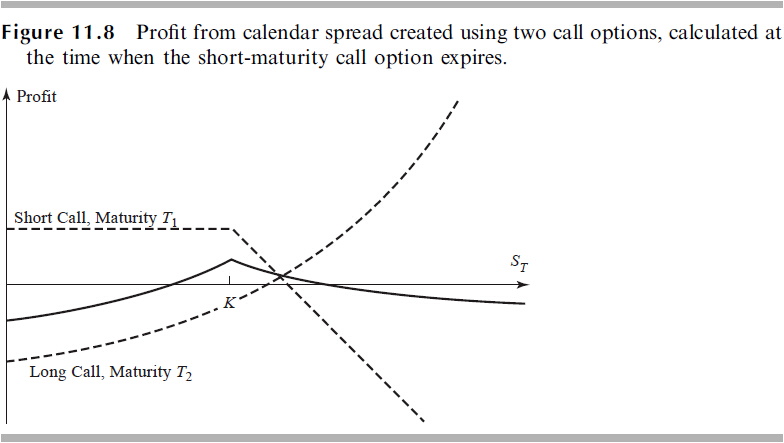

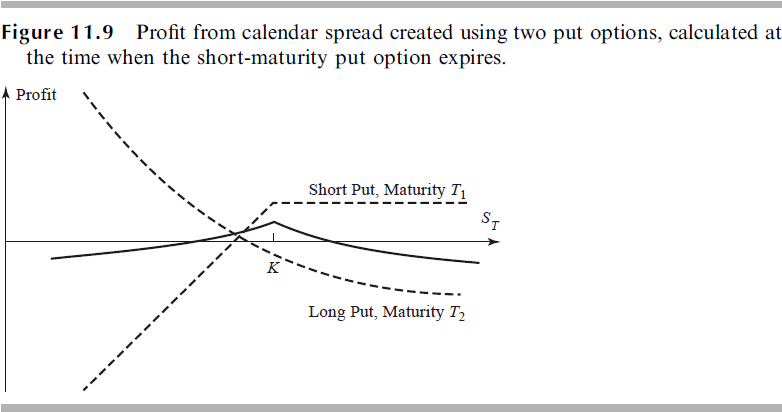

日历差价(Calendar Spread)

-

日历差价由协议价格相同但到期时间不同的期权构成

-

卖出到期时间短的欧式看涨期权同时买入协议价格相同到期时间更长的另一个欧式看涨期权

-

分类:

- 中性日历差价(neutral calendar spread): 协议价格接近当前股票价格

- 牛市日历差价(bullish calendar spread): 协议价格高于当前股票价格

- 熊市日历差价(bearish calendar): 协议价格低于当前股票价格

-

反向 日历差价(Reverse calendar spread): 买入到期时间短的期权,卖出到期时间场的期权

用看涨期权构造日历差价

用看跌期权构造日历差价

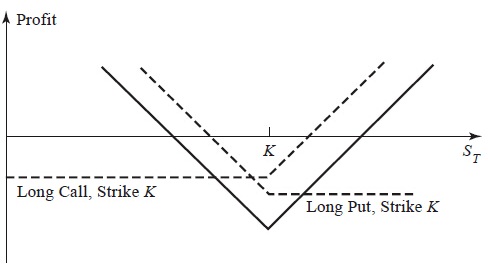

组合(Combinations)

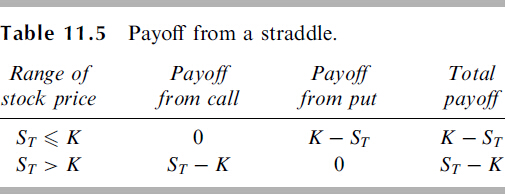

跨式期权组合(Straddle Combination)

跨式期权组合(Straddle Combination)涉及到同时买入协议价格和到期时间相同的欧式看涨期权和欧式看跌期权

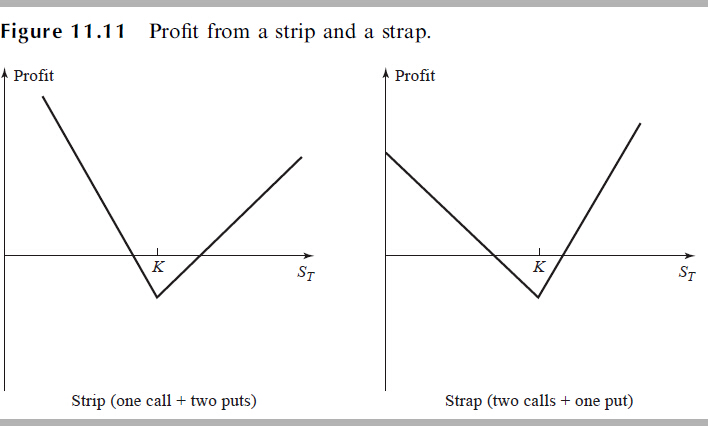

条式组合(Strips)与带式组合(Straps)

-

条式组合(Strips)由协议价格和到期时间相同的一份欧式看涨期权的多头和两份欧式看跌期权的多头构成

-

带式组合(Straps)由协议价格和到期时间相同的两份欧式看涨期权的多头和一份欧式看跌期权的多头构成

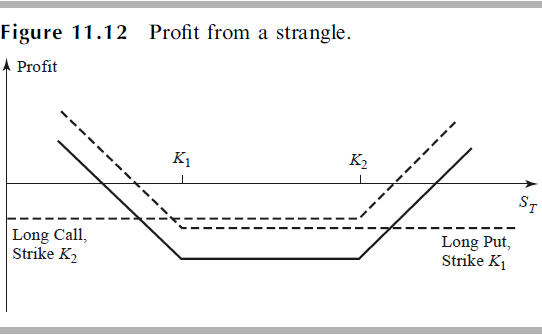

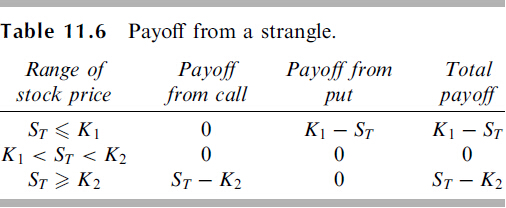

异价跨式期权(Strangle)

异价跨式期权 (亦被称作bottom vertical combination)涉及到同时买入协议价格相同但到期时间不同的欧式看涨期权和欧式看跌期权

课后练习

扫码做题

课堂练习

-

Draw a diagram showing the variation of an investor's profit and loss with the terminal stock price for a portfolio consisting of :

- (a) One share and a short position in one call option

- (b) Two shares and a short position in one call option

- (c) One share and a short position in two call options

- (d) One share and a short position in four call options.

In each case, assume that the call option has an exercise price equal to the current stock price.

-

Suppose that put options on a stock with strike prices $30 and $35 cost $4 and $7, respectively. How can the options be used to create

- (a) a bull spread

- (b) a bear spread

Construct a table that shows the profit and payoff for both spreads.

-

Three put options on a stock have the same expiration date and strike prices of $55, $60, and $65. The market prices are $3, $5, and $8, respectively. Explain how a butterfly spread can be created. Construct a table showing the profit from the strategy. For what range of stock prices would the butterfly spread lead to a loss?

-

A call option with a strike price of $50 costs $2. A put option with a strike price of $45 costs $3. Explain how a strangle can be created from these two options. What is the pattern of profits from the strangle?