L08 期权:市场与性质

期权基础

期权

期权(Option)

期权(option) 给其拥有者在事先确定的时间(或之前)以事先确定的价格买入或者卖出标的资产的权利(而非义务)

-

期权的标的资产

- 股票

- 外汇

- 股票指数

- 期货

-

期权的其他要素

- Call(看涨期权) or Put(看跌期权)

- American(美式期权) vs. European(欧式期权)

- Excercise Price(执行价格) or Strike Price (敲定价格)

- Expiration Date(到期日) or Maturity Date(满期日)

-

期权与期货有何异同?

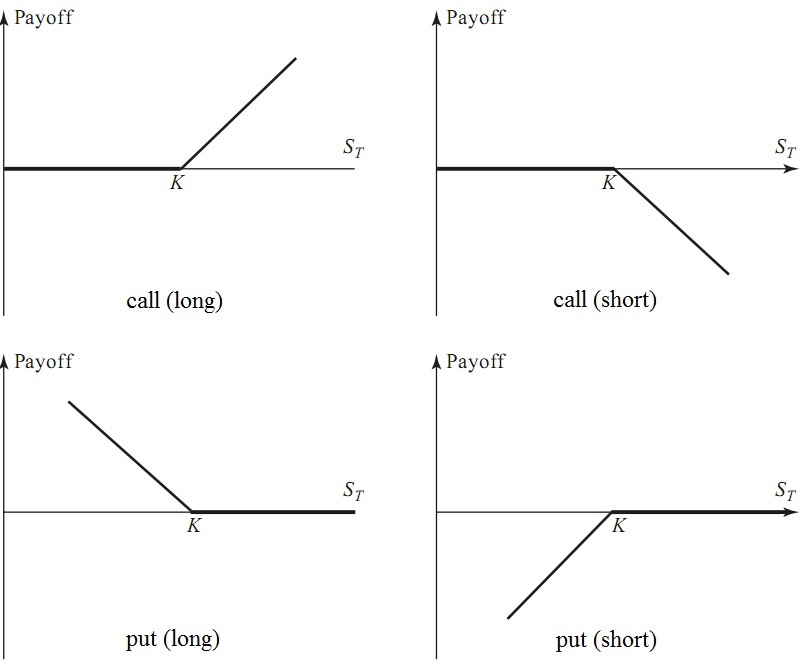

收益 (图)

| 多头 | 空头 | |

|---|---|---|

| 看涨期权 | ||

| 看跌期权 |

术语

-

期权种类(Option class)

- 所有相同类型的(看涨期权或者看跌期权)期权被称作期权种类

- e.g. IBM calls are one class, whereas IBM puts are another class

-

期权系列(Option series)

- 一个期权系列由一类期权中所有到期时间和敲定价格都相同的期权组成

- e.g. IBM 70 October calls

-

期权的价值

- 内涵价值(Intrinsic value): 如果现在立刻执行期权所具有的价值与0之间的大者

- 时间价值(Time value)

-

Moneyness

- 平值期权(At-the-money option)

- 实值期权(In-the-money option)

- 虚值期权(Out-of-the-money option)

股利 & 股票分割

-

假设你拥有份期权,协议价格为

-

期权无需对现金股利做调整

-

股票按的比率分割(每股分割为股)

- 敲定价格将减少为

- 期权的数量将增加到

-

股票股利参照股票分割处理

-

-

例子

- 一个看涨期权允许持有者购买100股股票,协议价格为 $20/股

- 期权条款该如何调整?

- 股票按的比率分割

- 5%的股票股利

认股权证与可转换债券

认股权证与可转换债券

-

认股权证(Warrants) 是公司以自己的股票作为标的发行的长期看涨期权

- 认股权证通常在发行债券的时候被创造出来

- 认股权证通常与债券分开交易

- 当认股权证被执行时,发行人对持有人结清

- 当认股权证被执行时,公司获得现金同时发行新的股票

-

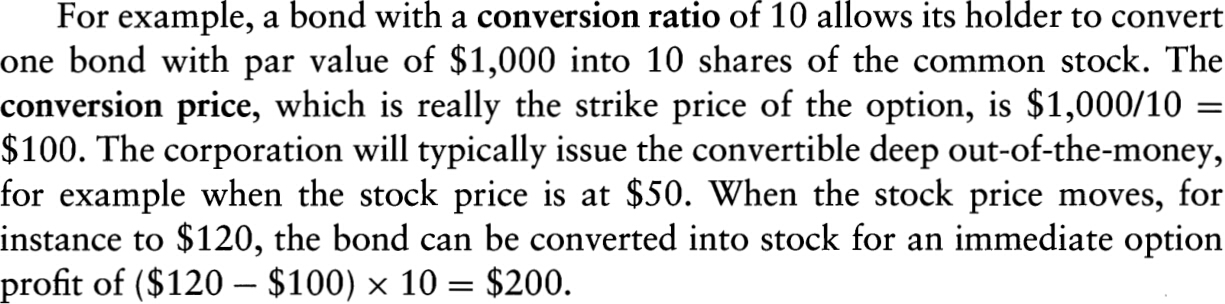

可转换债券(Convertible bonds) 是公司发行的,在特定时间可以按照事先确定的转换比率转换为股票的债券

- 可转换债券等价于普通债券加认股权证

- 可转换债券使公司可以以较低的票息率发行债务

-

可转换债券的转换价值(Conversion value) 等于当前的股票价格与转换比率的乘积

-

多数可转换债券可由公司赎回(callable)

- 当股票价格足够高时,可转换债券可以被强制转换成股票(forced conversion)

- 当转换权不再具有价值时,可转换债券可被赎回,公司可以以更低的息票率再融资

定价

认股权证和可转债可以用标准的期权定价模型定价,我们只需将摊薄效应(dilution effect)考虑在内。假设公司现有股股票和份认股权证,每份权证允许持有人以协议价格购买股股票。在期初包括股票和认股权证的公司价值为:

在新股摊薄之后:

简化后,我们得到:

这等于份股票期权的价值:

股票期权

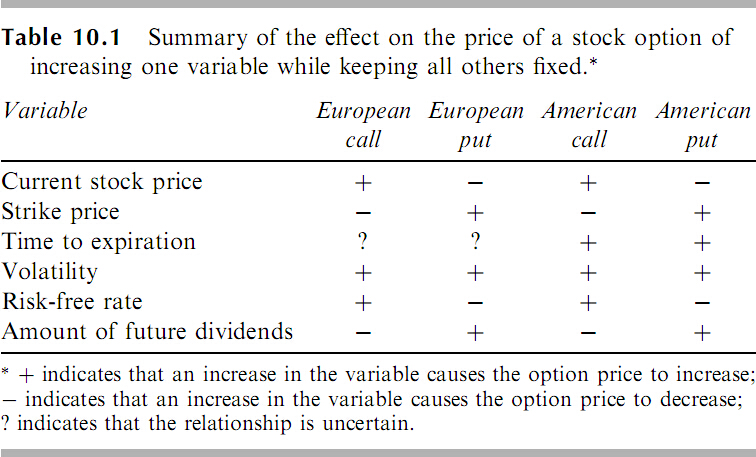

影响期权价格的因素

影响期权价格的因素

- vs. ?

- vs. ?

期权价格的上下限

记号与假设

记号:

| 欧式 | 美式 | |

|---|---|---|

| 看涨期权价格 | ||

| 看跌期权价格 | ||

| 当日股票价格 | ||

| 到期时股票价格 | ||

| 协议价格 | ||

| 期权的到期时间 | ||

| 股利现值 | ||

| 无风险利率 | ||

| 股票价格的波动率 |

假设:

- [1.] 无交易费用

- [2.] 所有的交易获利适用于相同税率

- [3.] 能以相同的无风险利率投、融资

期权价格的上限

-

看涨期权

- and

- 若 或者 ,是否存在套利机会?

- 提示:卖出看涨期权同时买入股票

-

看跌期权

- and

- 若 或者 ,是否存在套利机会?

- 提示:卖出看跌期权同时投资到无风险资产

看涨期权价格的下限

-

比较下面两个组合的价值:

- 组合 A: 一份欧式看涨期权+一份时刻支付的零息债券

- 组合 B: 一股股票

- 组合 B': 一份时刻支付的零息债券

- 下限:

-

(套利的)例子

- 假设:. 。

- 是否存在套利机会?

- 如何套利?

看跌期权价格的下限

-

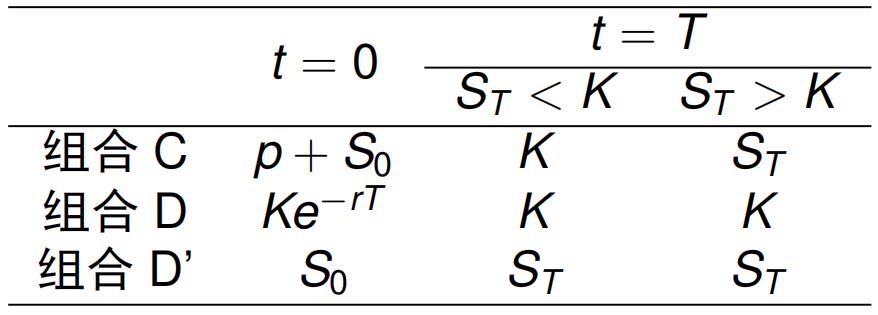

比较下面两个组合的价值:

- 组合 C: 一份欧式看跌期权+一股股票

- 组合 D: 一份时刻支付的零息债券

- 组合 D': 一股股票

- 下限:

-

(套利的)例子

- 假设:. .

- 是否存在套利机会?

- 如何套利?

看跌期权-看涨期权平价关系

看跌期权-看涨期权平价关系(Put-Call Parity)

-

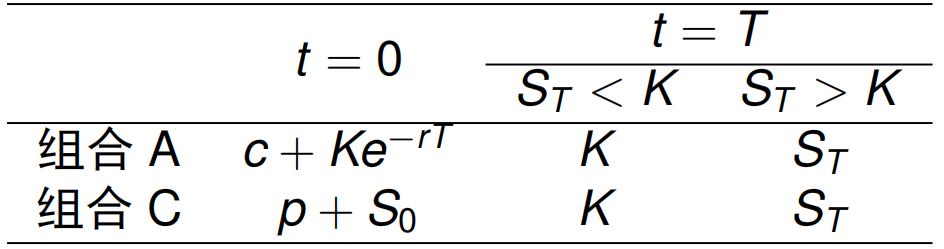

比较组合 A & 组合 C的价值

- 组合 A: 一份欧式看涨期权+一份时刻支付的零息债券

- 组合 C: 一份欧式看跌期权+一股股票

- 期末:组合 A & C 的价值均为

- 看跌期权-看涨期权平价关系:

-

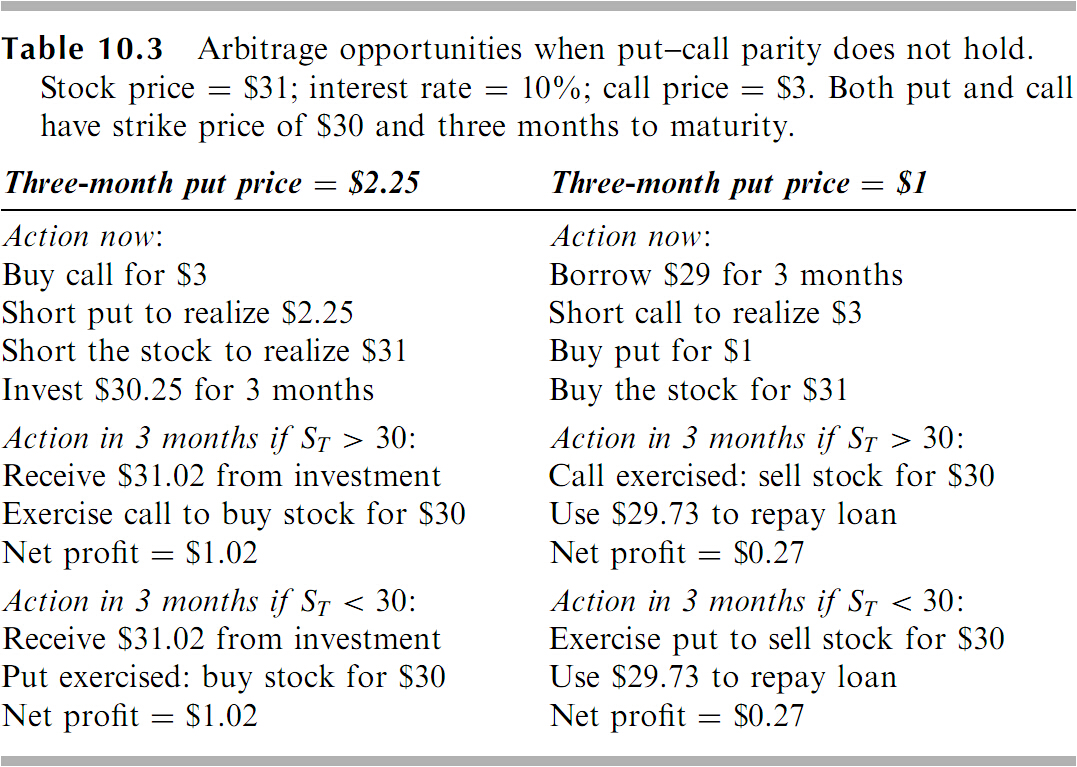

(套利的)例子

- 假设:. .

- 若或者是否存在套利机会?

- 如何套利?

对美式期权:

美式期权的性质

美式看涨期权(标的资产无股息)

提前执行的决策

-

如果投资者希望获得标的资产

- 在时刻执行可以推迟现金支付

- 等待更好地机会()

-

如果标的资产被高估(时)

- 与其提前执行(然后卖掉股票)不如直接卖掉期权

- 与其提前执行(然后卖掉股票)不如直接卖掉期权

-

结论:若标的资产不产生股息,提前执行美式看涨期权都不是最优的

美式看跌期权

提前执行的决策

-

提前执行标的资产不支付股息的美式看跌期权可能是最优的

-

深度实值的美式看跌期权总是应该提前执行的

-

一般地,当增加、增加或波动率减少时,提前执行美式看跌期权都会变得有吸引力

股息的影响

股息的影响

-

看涨期权价格的下限

- 组合 A: 一份欧式看涨期权+一份当前价值为的零息债券

- 组合 B: 一股股票

-

看跌期权价格的下限

- 组合 C: 一份欧式看跌期权+一股股票

- 组合 D: 一份当前价值为的零息债券

-

提前执行:(因为直接卖出期权不一定更划算)可能提前执行

-

看跌期权-看涨期权平价关系

课后阅读与练习

课后阅读与练习

-

课后阅读:教材第十一章第一、二节相关内容

-

练习

- 教材pp185-186:1,3,4,5,8

- 扫码做题

课堂练习

-

What is a lower bound for the price of a 4-month call option on a non-dividend-paying stock when the stock price is $28, the strike price is $25, and the risk-free interest rate is 8% per annum?

-

Give two reasons why the early exercise of an American call option on a non-dividendpaying stock is not optimal. The first reason should involve the time value of money. The second should apply even if interest rates are zero.

-

A European call option and put option on a stock both have a strike price of $20 and an expiration date in 3 months. Both sell for $3. The risk-free interest rate is 10% per annum, the current stock price is $19, and a $1 dividend is expected in 1 month. Identify the arbitrage opportunity open to a trader.

-

Suppose that , , and are the prices of European call options with strike prices, , and , respectively, where and . All options have the same maturity. Show that

(Hint: Consider a portfolio that is long one option with strike price , long one option with strike price , and short two options with strike price .)

-

一份6个月到期的协议价格为$30的欧式看涨期权的当前市场价格为$2。已知标的股票的当前市场价格为$29,标的股票将于第2个月和第5个月末分别支付$0.5的股利。假设无风险利率为2%(连续复利),试计算6个月到期的协议价格为$30的欧式看跌期权的价格(列出表达式即可)。