L05 (利率)互换

利率互换

利率互换(Interest Rate Swap)

互换(swap) 协议允许交易双方根据一定的规则在未来特定的时间交换现金流

- 互换可以被视为一种打包远期协议的方便办法

- 虽然最初互换的价值为零,组成其的远期协议的价值并不为零

普通利率互换( “Plain Vanilla” Interest Rate Swap)的例子:

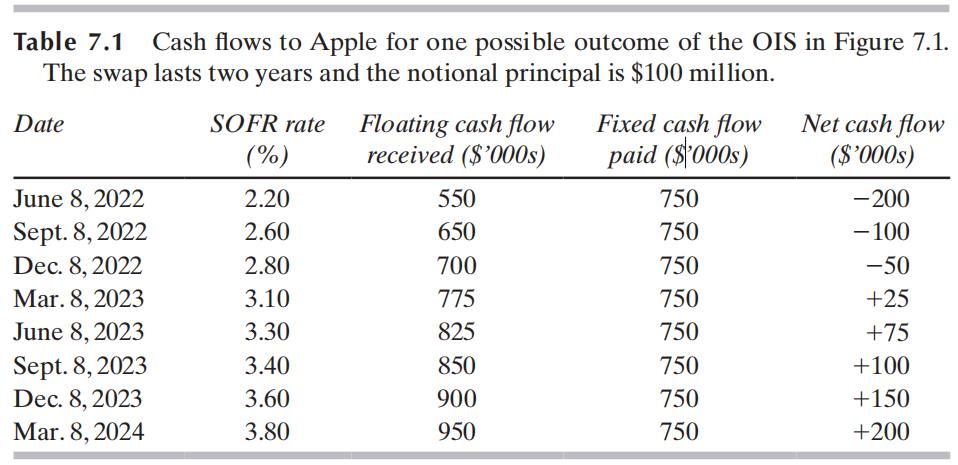

- 根据协议在接下来的两年内,每三个月Apple同意收到3个月的SOFR (Secured Overnight Financing Rate,担保隔夜融资利率),同时付出年利率为3%的固定利率。名义本金约定为 $100 million。

例子:利率互换的现金流

利率互换的典型用途

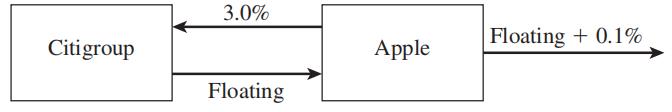

用互换改变债务的属性 (floating fixed)

-

进入互换协议后,Apple将发生以下三个现金流:

- [1] 付出Floating0.1% 给外部债权人

- [2] 根据互换条款收到Floating

- [3] 根据互换条款付出3%

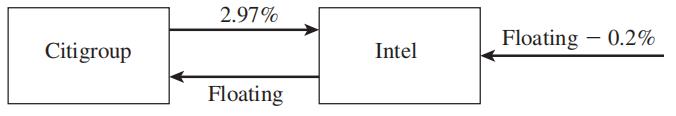

用互换改变债务的属性 (fixed floating)

-

进入互换协议后,Intel将发生以下三个现金流:

- [1] 付出3.2% 给外部债权人

- [2] 根据互换条款收到2.97%

- [3] 根据互换条款付出Floating

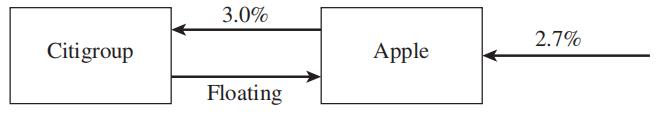

用互换改变投资的属性 (fixed floating)

-

进入互换协议后,Microsoft将发生以下三个现金流:

- [1] 从债券收到2.7%

- [2] 根据互换条款收到Floating

- [3] 根据互换条款付出3%

用互换改变投资的属性 (floating fixed)

-

进入互换协议后,Microsoft将发生以下三个现金流:

- [1] 从债券收到Floating-0.2%

- [2] 根据互换条款收到2.97%

- [3] 根据互换条款付出Floating

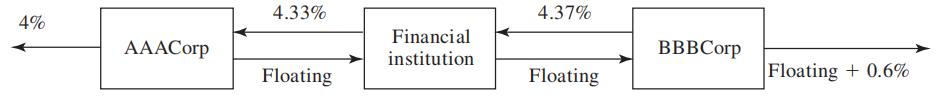

利率互换的报价

比较优势的观点

比较优势的观点(Comparative Advantage Argument)

- AAA Corp和BBB Corp在不同市场获得融资的成本如下表:

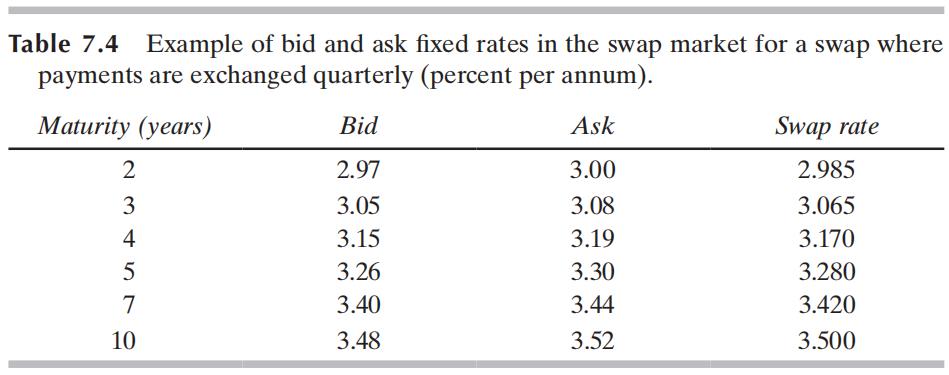

| Fixed | Floating | |

|---|---|---|

| AAA Corp | 4.0% | 6-month LIBOR -0.1% |

| BBB Corp | 5.2% | 6-month LIBOR +0.6% |

-

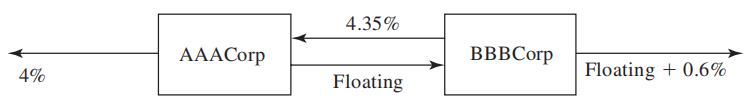

通过下面的互换可以同时改善两家公司的融资成本

- 请分析两家公司获得的好处

-

如果通过金融中介完成互换交易

- 请分析两家公司和金融机构获得的好处

课堂练习

Companies A and B have been offered the following rates per annum on a $20 million 5-year loan:

| Fixed | Floating | |

|---|---|---|

| A Company | 5.0% | Floating +0.1% |

| B Company | 6.4% | Floating +0.6% |

Company A requires a floating-rate loan; company B requires a fixed-rate loan. Design a swap that will net a bank, acting as intermediary, 0.1% per annum and that will appear equally attractive to both companies.

估值(valuation)

以债券组合的形式估值

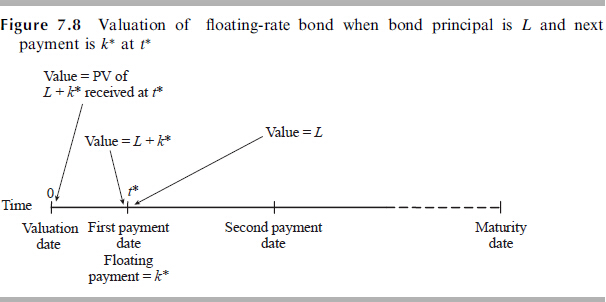

- 利率互换的现金流可以分解为两个债券的现金流,因此:

- 固定利率债券价值为其现金流现值

- 浮动利率债券的价值在下一个支付日为其面值

例子

- 本金为$100 million,付出6个月的LIBOR,收入8% (每半年复利一次)

- 剩余期限为1.25年

- 3个月、9个月和15个月的即期LIBOR分别为 10%,10.5%和11% (连续复利)

- 最近一次支付日观察到的6个月LIBOR为10.2% (每半年复利一次)

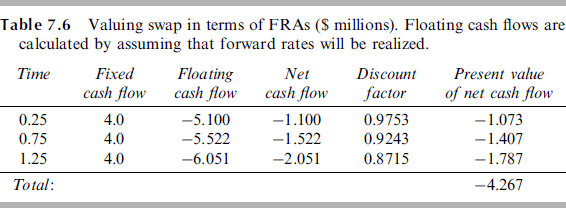

以FRAs组合的形式估值

-

思路

- 利率互换现金流可以分解为(在每个支付日)远期利率协议的组合

- 通过假设“今天的远期利率会实现”,可以为远期利率协议定价

-

具体过程

- [1.] 用即期利率计算远期利率,从而得到互换的现金流

- [2.] 假设未来的LIBOR会等于远期利率,计算互换(在每个支付日)的(净)现金流

- [3.] 通过折现这些(净)现金流为互换定价

例子

- 本金为$100 million,付出6个月的LIBOR,收入8% (每半年复利一次)

- 剩余期限为1.25年

- 3个月、9个月和15个月的即期LIBOR分别为 10%,10.5%和11% (连续复利)

- 最近一次支付日观察到的6个月LIBOR为10.2% (每半年复利一次)

信用风险

- 在初期互换的价值为零

- 未来互换的价值可正可负

- 仅当互换价值为正时公司暴露在信用风险下(why?)

课后阅读与练习

课后阅读与练习}

-

课后阅读:教材第十章第一节相关内容

-

练习

- 教材pp162-163:1,4,5

- 扫码练习

习题

-

[10.1] 为什么说当利率期限结构向上倾斜时,利率互换中,收到浮动利率的一方初期现金流为负,后期现金流为正,后期面临的信用风险较大?

-

[10.5] 一家金融机构与 A 公司签订了一份 5 年期的利率互换协议,收取 10% 的固定年利率,支付 6 个月期的 LIBOR ,本金为$10,000,000 ,每 6 个月支付一次。假设 A 公司未能进行第六次支付(即在第 3 年末违约),当时的利率期限结构是平坦的,都为 8% (按半年计一次复利计),而第 3 年年中的 6个月期的 LIBOR 为年利率 9% 。请计算该金融机构的损失是多少?

-

[10.6] 设甲公司与乙公司达成一项有效期为 2 年的互换协议:甲公司以固定利率支付利息给乙公司,本金为 1000 万美元,乙公司以 LIBOR 的浮动利率向甲公司支付利息,名义本金仍为 1000 万美元,每半年支付一次利息。 6 个月、 12 个月、18 个月和 24 个月的 LIBOR 零息票利率(连续复利率)分别为 8.8%、 9.5%、 9.9%和 10.2%。请问甲公司应向乙公司支付何种水平的固定利率?