L01 金融工程概论

关于金融与金融工程

“金融”的意义

-

黄洪:

- 金融一词并非古已有之 。‘金’与‘融’这两个字,是极古老的中国字,可是这两个字连在一起组成一个既不能单独用‘金’字解释也不能单独用‘融’字解释的词—金融—则不见于任何古籍。《康熙字典》及其以前的所有辞书均无金与融连用的记栽。作为一个词条,最早见于1915年初版的《辞源》和1937年初版的《辞海》。这说明,至迟在19世纪下半叶,金与融这两个字组成的词已经定型并在经济领域中相当广泛地使用;两部辞书的释义均指通过信用中介机构的货币资金融通。”

- 连起来的‘金融’始于何时,无确切考证,最大可能是来自明治维新的日本。那一阶段,有许多西方经济学的概念就是从日本引进的—直接把日语翻译西文的汉字搬到中国来

-

艾俊川:古籍中“金融”义指“黄金融制而成” 。

-

张辑颜:金融者,金币之融通状况之谓也。故金融学科,为研究金币之融通状况,及其与国家财政,民生经济,所生各种关系之学科也。金融之名词译自日本:盖日本以金币为本位,故称金融。”

-

艾俊川:

- (日本)“金融”二字连用之词,显然是“金钱融通”的缩略 (1875)

- 将“金融”译为英文 The Circulation of Money (1897,1911)

- 在此后十年间,日本书籍报刊中“金融”一词爆发性使用,词义也开始转变,被用来指称与货币和信用有关的交易与经济活动,日译本“金融”对应英语名词“money market"(1883)

-

孙大权:

- 1902年4月22日,梁启超独自编辑的《新民丛报》登载了关于“金融”一词的“问答”。东京爱读生问: “日本书中金融二字其意云何? 中国当以何译之?”梁启超答道: “金融者指金银行情之变动涨落。……日本言金融,取金钱融通之意,如吾古者以泉名币也。沿用之似亦可乎。

- Finance最初在中国和日本均为与“财政”有关的含义。1929年3月,萧纯锦在编译自美国的《经济学》里指出: “‘金融’(在英文为Finance)”

- 1941 年,由何廉、陈岱孙、陈启修等32位著名经济学家审查通过,由国民政府教育部公布的《经济学名词》中,Finance对译为“财政,金融”; Money Market对译为“金融市场”; Money对译为“货币”; Currency对译为“通货”。“金融”唯一的对应译词为Finance,这样,金融与Finance对译就成为民国主流经济学家认可的用法。

- 1902年4月22日,梁启超独自编辑的《新民丛报》登载了关于“金融“一词的“问答”。东京爱读生问: “日本书中金融二字其意云何? 中国当以何译之?”梁启超答道: “金融者指金银行情之变动涨落。……日本言金融,取金钱融通之意,如吾古者以泉名币也。沿用之似亦可乎。

- Finance最初在中国和日本均为与“财政”有关的含义。1929年3月,萧纯锦在编译自美国的《经济学》里指出: “‘金融’(在英文为Finance) ”

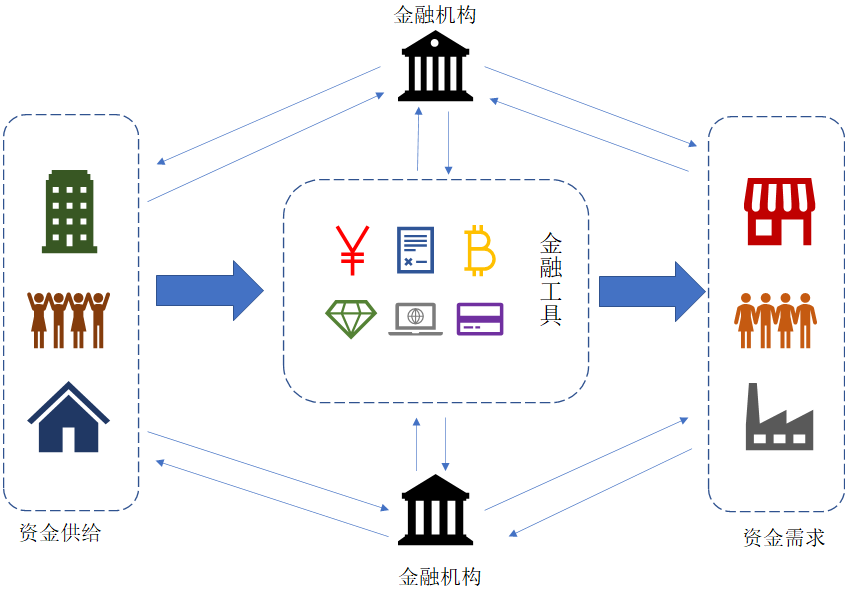

金融活动

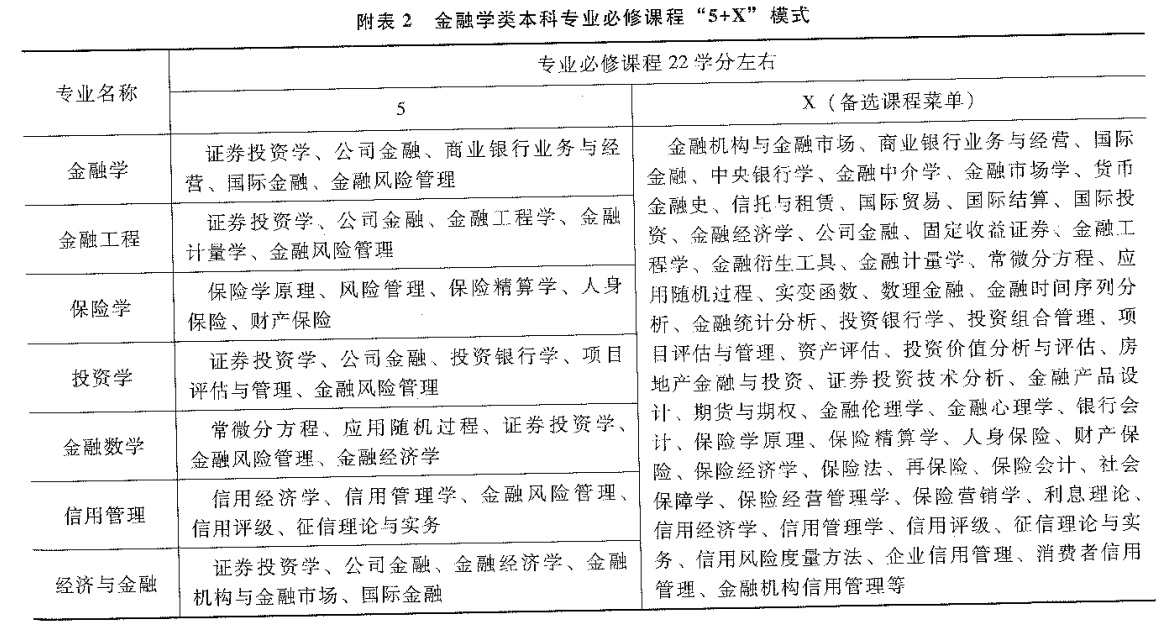

金融课程

金融研究

- 期刊

| 期刊 | 创刊年份 |

|---|---|

| The Journal of Finance | 1946 |

| Journal of Financial and Quantitative Analysis | 1966 |

| Journal of Financial Economics | 1974 |

| 金融研究 | 1980 |

| The Review of Financial Studies | 1988 |

- 学会/协会

| 协会 | 创办年份 |

|---|---|

| The American Finance Association | 1939 |

| 中国金融学会 | 1950 |

| Western Finance Association | 1965 |

| European Finance Association | 1974 |

| Society for Financial Studies | 1987 |

什么是金融?

-

金融学研究资源如何有效地在不确定的条件下跨期分配

-

金融学研究的几个重要问题:

- 资产定价

- 风险管理

- 资产配置

与金融相关的诺贝尔经济学奖

-

1981: James Tobin “for his analysis of financial markets and their relations to expenditure decisions, employment, production and prices”.

-

1985: Franco Modigliani “for his pioneering analyses of saving and of financial markets”.

-

1990: Harry M. Markowitz, Merton H. Miller and William F. Sharpe “for their pioneering work in the theory of financial economics”.

-

1997: Robert C. Merton and Myron S. Scholes “for a new method to determine the value of derivatives”.

-

2003: Robert F. Engle III “for methods of analyzing economic time series with time-varying volatility (ARCH)”. Clive W.J. Granger “for methods of analyzing economic time series with common trends (cointegration)”

-

2013: Eugene F. Fama, Lars Peter Hansen and Robert J. Shiller “for their empirical analysis of asset prices”.

-

2017: Richard H. Thaler “for his contributions to behavioural economics”.

什么是金融工程?

什么是工程?

-

工程是...

- 利用基本的材料、工具、部件、器材、结构

- 在相关基础理论的指导下、按照某(些)种工艺、技术进行组合、装配

- 实现一定的功能、满足特定需求、解决具体问题

兹维博迪的定义

Financial engineering is the application of science-based mathematical models to decisions about saving, investing, borrowing, lending, and managing risk. -- by Zvi Bodie

- 金融工程是金融理论与工程方法的结合

- 金融工程不是一个工程学科

- 金融工程的发展基于现代金融理论

- 金融工程是一个应用学科

国际数量金融协会(iaqf)对金融工程的介绍

-

Financial engineering is the application of mathematical methods to the solution of problems in finance. It is also known as financial mathematics, mathematical finance, and computational finance.

-

Financial engineering draws on tools from applied mathematics, computer science, statistics, and economic theory.

-

Investment banks, commercial banks, hedge funds, insurance companies, corporate treasuries, and regulatory agencies employ financial engineers.

-

These businesses apply the methods of financial engineering to such problems as new product development, derivative securities valuation, portfolio structuring, risk management, and scenario simulation.

-

Quantitative analysis has brought innovation, efficiency and rigor to financial markets and to the investment process.

-

As the pace of financial innovation accelerates, the need for highly qualified people with specific training in financial engineering continues to grow in all market environments.

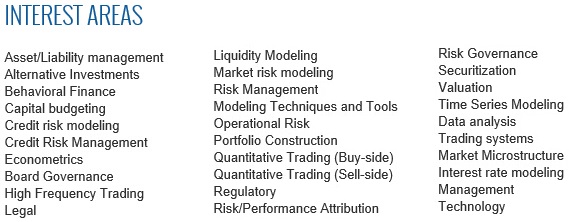

金融工程的研究领域

金融工程的核心问题

-

核心问题

- 资产定价(基础资产、衍生工具、复杂的结构化产品)

- 组合管理/优化

- 风险管理

-

原理与方法

- 合成与复制

- 无套利动态过程

- 风险中性

合成与复制

-

BofA Finds Way to Gain From Alibaba IPO Even After Advisory Snub

- 思路:做多阿里巴巴的主要股东(Softbank、Yahoo),同时做空非阿里巴巴收入的成分

- BAML的做法:买Soft bank,卖Sprint,卖Yahoo Japan,卖KDDI

-

期权定价:用含有期权的组合复制无风险证券

- 做空一份期权合约

- 做多若干股股票

无套利动态过程

-

套利机会存在的条件

- 存在两个不同的资产组合,它们的未来现金流相同,但它们的成本却不同

- 存在两个成本相同的组合,第一个组合在所有可能状态下的现金流都不低于第二个组合,而且至少存在一种状态,在此状态下第一个组合的现金流大于第二个组合

- 一个组合的成本为零,但在所有可能状态下,这个组合的损益都不小于零,而且至少存在一种状态,在此状态下这个组合的损益要大于零

-

套利的实现

- 买入被低估的资产(组合),卖出被高估的资产(组合)

- 通过融资/融券使初始投资为零

- 在期末获得正的利润

-

无套利动态过程

风险中性

-

风险中性定价理论有两个最基本的假设:

- 在一个投资者都是风险中性的世界里,所有证券的预期收益率均为无风险收益率

- 投资者的投资成果体现为用无风险利率贴现收益现金流得到的现值

-

无风险的套利机会出现时

- 市场参与者的套利活动与其对风险的态度无关(套利分析时未用到风险偏好信息)

- 无套利均衡分析的过程和结果与市场参与者的风险偏好无关

- 因此,假设风险中性世界(风险中性定价)简化分析

-

从风险中性世界进入到风险厌恶或者风险喜好的世界时:

- (概率分布发生变化)资产的预期收益率发生变化

- 资产任何损益(或现金流)所适用的贴现率发生改变

- 以上两个变化效果互相抵消

金融工程发展的历史逻辑

-

历史背景

- 经济全球化与金融自由化

-

理论基础

- 现代投资组合理论:Markowitz (1952)

- 资本资产定价模型:Sharpe (1964),Lintner (1964),Treynor (1964)

- 期权定价理论:Black and Scholes (1973)

-

技术条件

- 信息技术与计算能力的发展(计算机、互联网、并行计算、云计算)

- 最优化理论与算法的进展

- 大数据、人工智能

-

数理基础

- 概率论与随机过程的严格化

- 宇航科学与随机控制

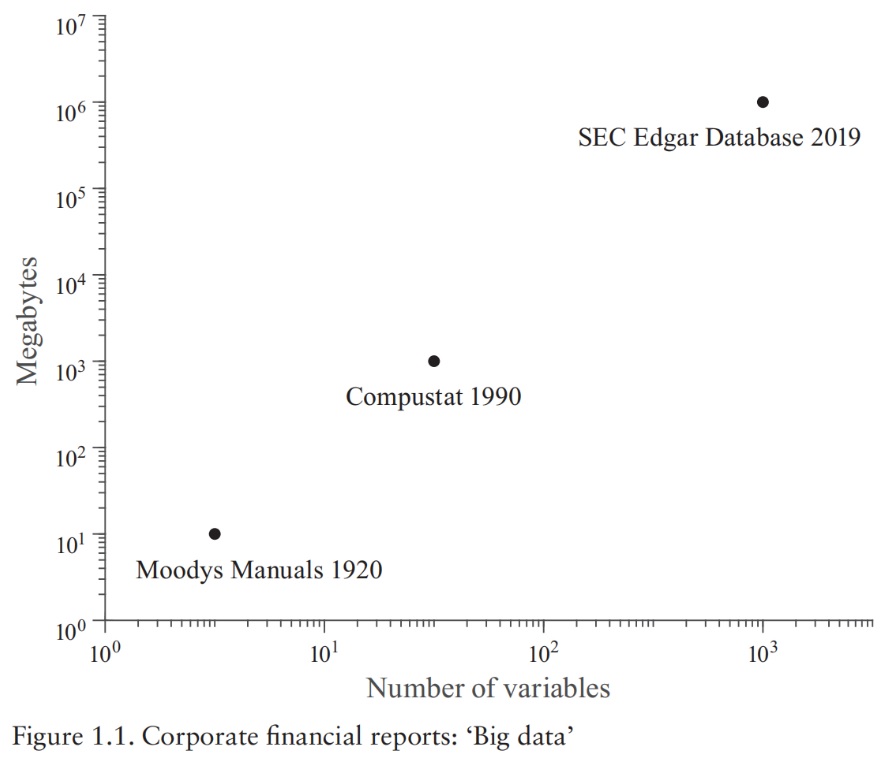

金融工程与大数据

- 金融数据

- 大数据(4v)

- Volume: The amount of data collected in files, records, and tables is very large, representing many millions, or even billions, of data points (GB->TB->PB->EB->ZB).

- Velocity: The speed with which the data are communicated is extremely great. Real- time or near- real- time data have become the norm in many areas.

- Variety: The data are collected from many different sources and in a variety of formats, including structured data (e.g., SQL tables or CSV files), semi-structured data (e.g., HTML code), and unstructured data (e.g., video messages).

- Value: Low value density.

关于金融工程教育

-

金融工程的学历教育项目

- 几乎没有金融工程的本科项目

- 有许多(授课式/专业型)硕士研究生项目 (Financial Engineering, Quantitative Finance, Mathematical Finance, Financial Mathematics)

- 有一些博士项目专注该领域

- 学位由工程学院、数学系、统计系、运筹与管理科学系等院系授予

- Ranking & Placement: Quantnet Ranking, Program Websites, LinkedIn

-

课程与技能

- 经济学与金融学

- 数学、理论物理

- 运筹学与统计学

- 信息理论、编程

-

金融工程师的专业背景

- 火箭科学家、应用数学家、运筹学、计算机科学家

- 金融工程项目的毕业生

金融市场与金融衍生工具

Derivatives(衍生工具)

-

A derivative can be defined as a financial instrument whose value depends on (or derives from) the values of other, more basic, underlying variables(标的变量).

- It is a kind of security(证券)

- It is a contracts(合约、契约), physically

-

Then, what are the underlying variables?

- It can be interest rate, exchange rate, stock price, etc.

- It can be a derivative

- It can even be something like weather

金融衍生工具的类别

-

按基础金融工具分类

- 利率衍生工具

- 汇率衍生工具

- 权益衍生工具

- 信用衍生工具

- 其他新型衍生工具.

-

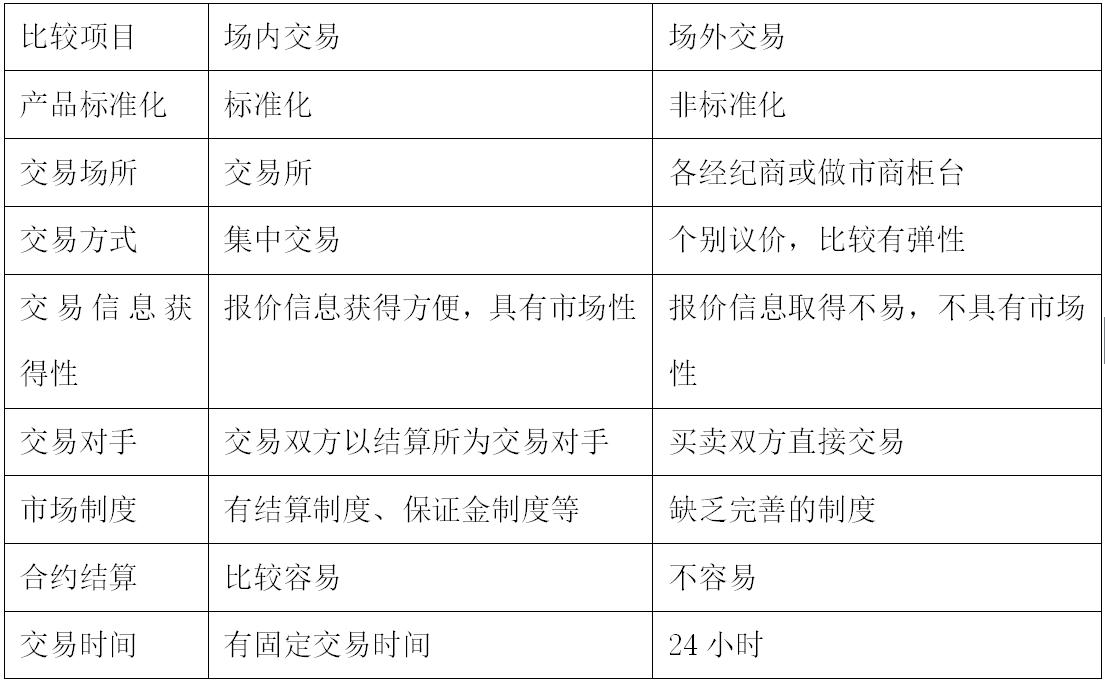

按照交易市场的类型分类

- 场内交易的衍生工具

- 场外交易的衍生工具

-

按照衍生工具的合约类型分类

- 远期

- 期货

- 期权

- 互换

远期合约(Forward Contracts)

- Agreement to buy or sell an asset for a certain price at a certain time

- Elements of a forward: underlying variable, the nominal amount(名义金额、面额), maturity(到期日), forward price(远期价格), etc.

- Forward price: The forward price for a contract is the delivery price(交割价格) that would be applicable to the contract if were negotiated today (i.e., it is the delivery price that would make the contract worth exactly zero)

- The forward price may be different for contracts of different maturities

- Terms of a forward contract rely on the bilateral agreements

远期的例子

- On July 20, 2007 the treasurer of a corporation enters into a long forward contract to buy million in six months at an exchange rate of 2.0489

- This obligates the corporation to pay $2,048,900 for million on January 20, 2008

- What are the possible outcomes?

Future Contracts(期货合约)

- Similar to forward contract

- Whereas a forward contract is traded OTC, a futures contract is traded on an exchange

- Exchanges Trading Futures

- Chicago Board of Trade

- Chicago Mercantile Exchange

- LIFFE (London)

- Eurex (Europe)

- BM&F (Sao Paulo, Brazil)

- TIFFE (Tokyo)

- and many more (see list at end of book)

期货的例子

Agreement to:

- Buy 100 oz. of gold @ US$900/oz. in December (NYMEX)

- Sell @ 2.0500 US$/\pounds\ in March (CME)

- Sell 1,000 bbl. of oil @ US$120/bbl. in April (NYMEX)

期权(Options)

-

Call(看涨期权) vs. Put(看跌期权)

- A call option is an option to buy a certain asset by a certain date for a certain price, i.e. the strike price(敲定价格)

- A put option is an option to sell a certain asset by a certain date for a certain price, i.e. the strike price

-

European(欧式) vs. American(美式)

- A European option can be exercised(执行) only at maturity

- An American option can be exercised at any time during its life

-

Options vs. Futures / Forwards

- A futures/forward contract gives the holder the obligation to buy or sell at a certain price

- An option gives the holder the right to buy or sell at a certain price

衍生工具交易

- Exchange-traded markets (场内交易市场)

- Over-the-Counter (OTC) Markets (场外交易市场)

我国的衍生工具市场

-

郑州商品交易所

- 交易品种包括:强麦、普麦、棉花、白糖、 PTA 、菜籽油、早籼稻、甲醇、玻璃、油菜籽、动力煤、粳稻、晚籼稻、铁合金

-

大连商品交易所

- 交易品种包括:农产品(玉米、玉米淀粉、黄大豆 1 号、黄大豆 2 号、豆粕、豆油、棕榈油、纤维板、胶合板、鸡蛋),工业品(聚乙烯、聚氯乙烯、聚丙烯、焦炭、焦煤、铁矿石),期权(豆粕期权),期货指数(农产品、铁矿石、豆粕、油脂、油料、饲料类、更多),现货指数(温度指数、环渤海动力煤价格指数、中国塑料价格指数)

-

上海商品交易所

- 交易品种包括:铜、铝、锌、铅、镍、锡、黄金、白银、螺纹钢、线材、热轧卷板、燃料油、石油沥青、天然橡胶

-

中国金融期货交易所

- 交易品种包括:沪深 300 股指期货、中证 500 股指期货、上证 50 股指期货、 5 年期国债期货、 10 年期国债期货

衍生工具的用途

- To hedge (对冲) risks

- To speculate(投机): take a view on the future direction of the market)

- To lock in an arbitrage(套利) profit

- To change the nature of a liability

- To change the nature of an investment without incurring the costs of selling one portfolio and buying another

金融工具的头寸

-

头寸(Position)

- 投资人根据其对某一项资产未来价值走势的判断而持有的买入或者卖出该资产的立场

-

多方头寸(Long Position)

- 如果投资人看涨某项资产,那么投资人会买入该项资产,以期在未来获利

-

空方头寸(Short Position)

- 投资人认为某项资产的价格未来可能下跌,因而卖出了该项资产,以期在未来获利

-

卖空(Short Sell)

- (通过融券)卖出自己不拥有的资产

衍生工具市场的参与者

-

按机构类别分

- 银行、证券公司、基金公司、保险公司、工商企业、个人

-

按参与者的作用划分

- 交易所

- 交易结算机构

- 经纪公司、经纪人

- 交易商

- 客户

-

按交易动机划分

- 套期保值者 (Hedgers)

- 投机者 (Speculators)

- 套利者 (Arbitrageurs)

例子:套期保值

- A US company will pay \pounds10 million for imports from Britain in 3 months and decides to hedge using a long position in a forward contract

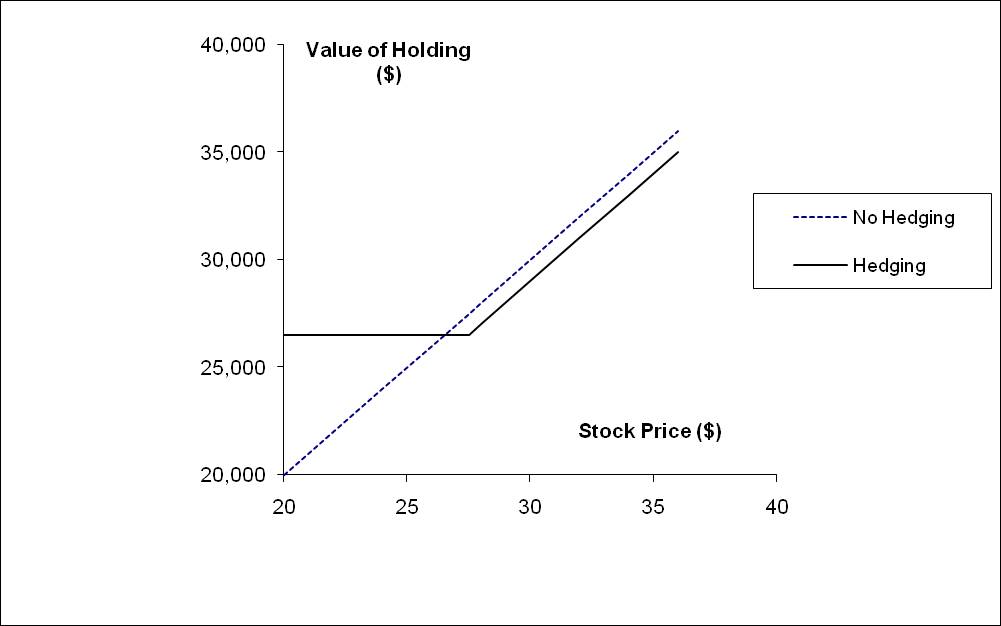

- An investor owns 1,000 Microsoft shares currently worth $28 per share. A two-month put with a strike price of $27.50 costs $1. The investor decides to hedge by buying 10 contracts

例子:投机

- An investor with $2,000 to invest feels that a stock price will increase over the next 2 months. The current stock price is $20 and the price of a 2-month call option with a strike of 22.50 is $1

- What are the alternative strategies?

例子:套利

Gold Price

Suppose that:

- The spot price of gold is US$900

- The 1-year forward price of gold is US$1,020

- The 1-year US$ interest rate is 5% per annum(每年)

Is there an arbitrage opportunity?

Suppose that:

- The spot price of gold is US$900

- The 1-year forward price of gold is US$900

- The 1-year US$ interest rate is 5% per annum

Is there an arbitrage opportunity?

The Forward Price of Gold

If the spot price of gold is and the forward price for a contract deliverable in years is , then

where is the 1-year (domestic currency) risk-free rate of interest. In our examples, , , and so that

Oil Price

Suppose that:

- The spot price of oil is US$95

- The quoted 1-year futures price of oil is US$125

- The 1-year US$ interest rate is 5% per annum

- The storage costs of oil are 2% per annum

Is there an arbitrage opportunity?

Suppose that:

- The spot price of oil is US$95

- The quoted 1-year futures price of oil is US$80

- The 1-year US$ interest rate is 5% per annum

- The storage costs of oil are 2% per annum

Is there an arbitrage opportunity?

Stock Price

- A stock price is quoted as \pounds100 in London and $200 in New York

- The current exchange rate is 2.0300

- What is the arbitrage opportunity?

课后阅读与练习

-

课后阅读:教材第一章相关内容

-

练习

- 教材pp18:2,3,4,6

- 线上练习(自愿练习)

参考文献

[1] 孙大权. "金融"一词在中国近代的起源,演变及当代启示[J]. 复旦学报:社会科学版, 2019(4):11.

[2] 艾俊川. "金融"与"银行"丛考. 中国钱币论文集(第六辑), 2016-09

[3] 黄达. 金融学学科建设若干问题[J]. 中央财经大学学报, 2000 (9): 1-7.

[4] Miller M H. The history of finance[J]. The Journal of Portfolio Management, 1999, 25(4): 95-101.

[5] Ross S. Finance[M]//Durlauf S, Blume L E. The new Palgrave dictionary of economics. Springer, 2016.

[6] Lo A W. Robert C. Merton: The First Financial Engineer[J]. Annual Review of Financial Economics, 2020, 12: 1-18.

[7] Beder T S, Marshall C M. Financial engineering: the evolution of a profession[M]. John Wiley & Sons, 2011.