资讯

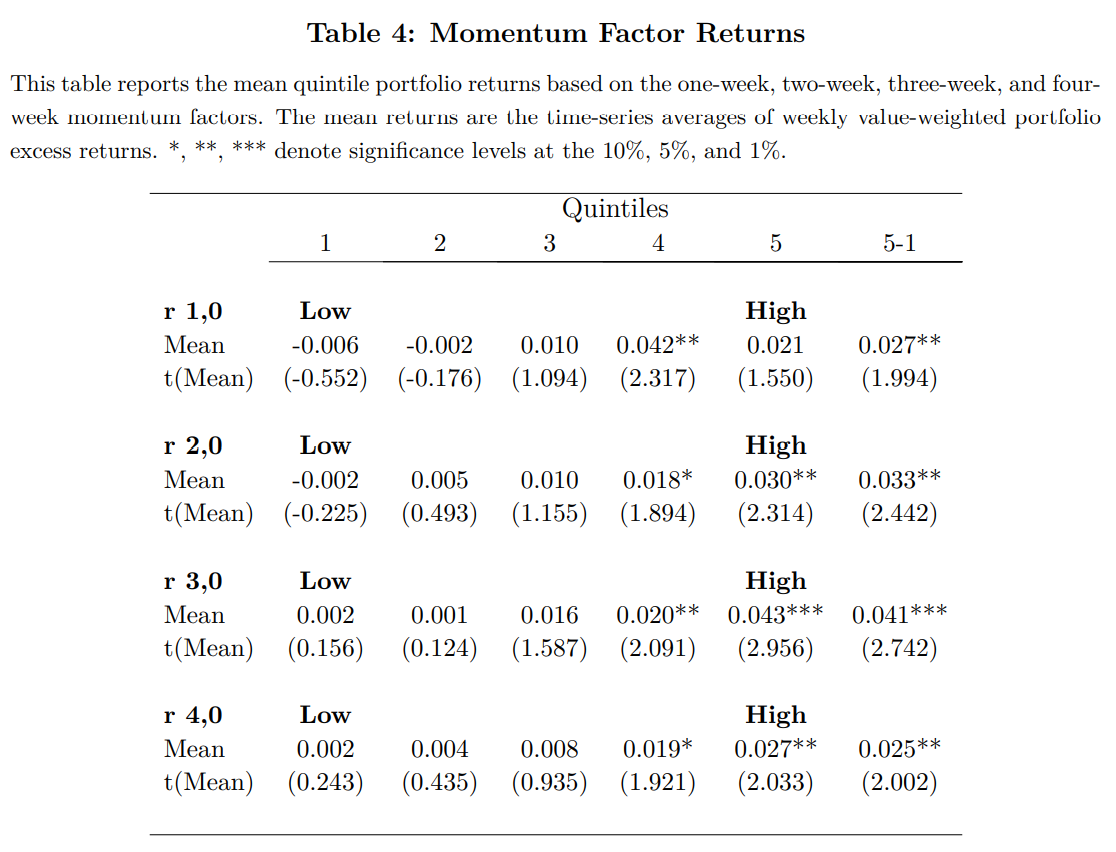

软件

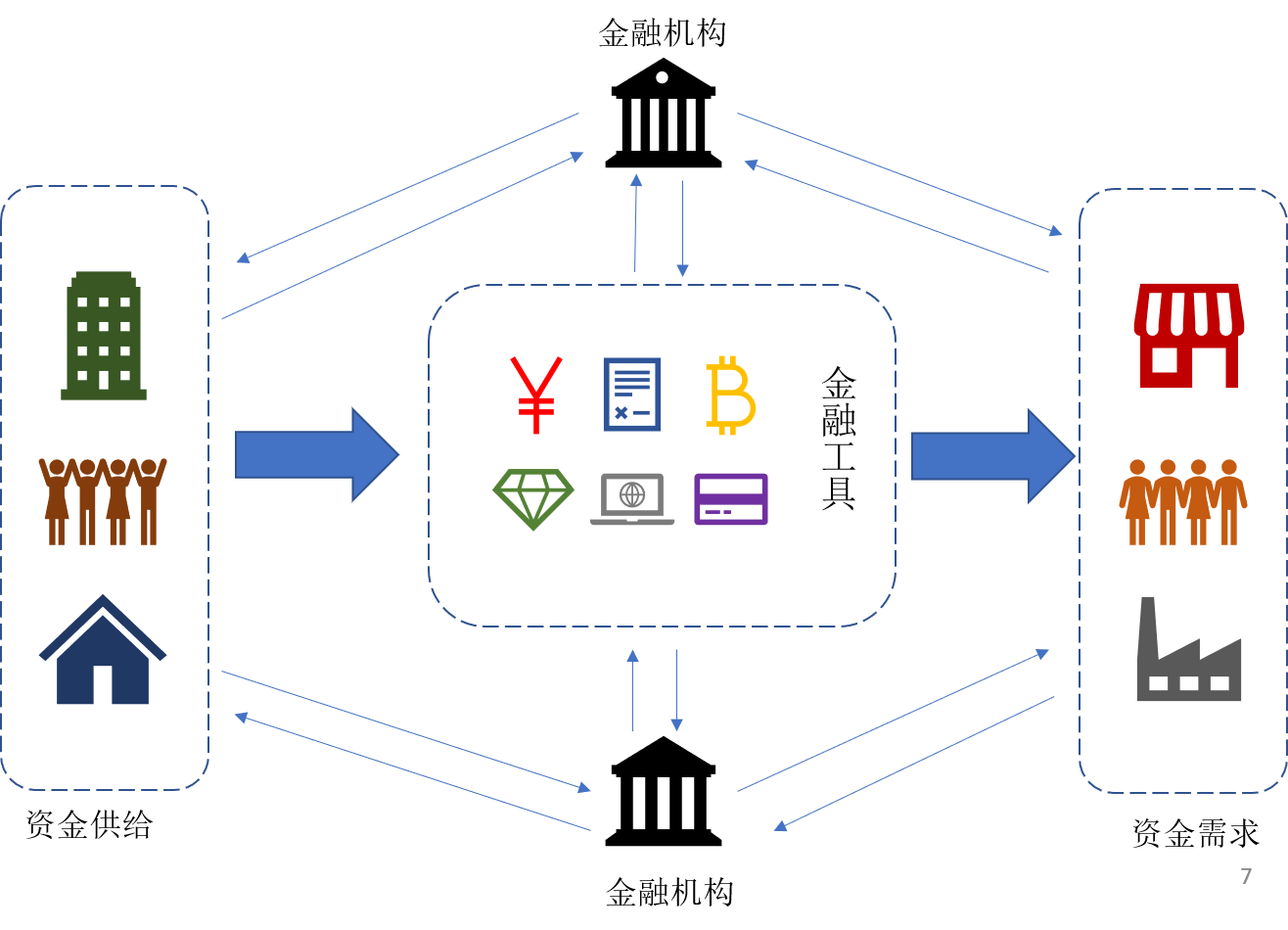

The FSB understands FinTech as technologically enabled innovation in financial services that could result in new business models, applications, processes or products with an associated material effect on financial markets and institutions and the provision of financial services.

金融科技是技术驱动的金融创新(该定义由金融稳定理事会(FSB)于2016年提出,目前已成为全球共识),旨在运用现代科技成果改造或创新金融产品、经营模式、业务流程等,推动金融发展提质增效。

After reviewing more than 200 scientific papers citing the term "fintech," a study on the definition of fintech concluded that "fintech is a new financial industry that applies technology to improve financial activities."

Financial technology (Fintech) is used to describe new tech that seeks to improve and automate the delivery and use of financial services.

In its broadest sense, the term “fintech” generally refers to technology-driven innovation occurring in the financial services industry. For the purposes of this reading, fintech refers to technological innovation in the design and delivery of financial services and products.

Fintech=A(rtificial Intelligence)+B(igData)+C(loud Computing)+D(LT)+M(obile Internet)+I(oT)+X

| Science | Technology | Engineering |

|---|---|---|

| Science (from the Latin word scientia, meaning "knowledge") is a systematic enterprise that builds and organizes knowledge in the form of testable explanations and predictions about the universe. Modern science is typically divided into the natural sciences, the social sciences and the formal sciences. Disciplines that use existing scientific knowledge for practical purposes, such as engineering and medicine, are described as applied sciences. | Technology ("science of craft", from Greek τέχνη, techne, "art, skill, cunning of hand"; and -λογία, -logia) is the sum of techniques, skills, methods, and processes used in the production of goods or services or in the accomplishment of objectives, such as scientific investigation. | The creative application of scientific principles to design or develop structures, machines, apparatus, or manufacturing processes, or works utilizing them singly or in combination; or to construct or operate the same with full cognizance of their design; or to forecast their behavior under specific operating conditions; all as respects an intended function, economics of operation and safety to life and property. |

#### 第二部分:案例介绍。

#### 第三部分:案例存在的问题和原因分析。

案例资料是案例分析的基石。案例资料的获取可以通过文件、档案记录、访谈、直接观察、参与性观察和实物证据等。资料收集过程中,要尽量使用多种数据来源,并注意及时记录和整理相关资料,原则上要求原创性资料(一手资料)比例不少于60%。

在已获得充实的资料的基础上选用适合的方法进行分析,如图表分析、因果分析和对比分析等,运用相关金融理论和知识找出案例的启示及存在的问题。

#### 第四部分:解决问题和改进建议。

#### 第一部分:产品方案基本概念和设计理念

#### 第二部分:设计方案

#### 第三部分:产品优势

#### 第四部分:产品推广策略

#### 第一部分:问题描述

#### 第二部分:分析问题

#### 第三部分:问题解决方案设计

#### 第四部分:方案的合理性论证(检验)以及实施途径

#### 报告正文的内容要求:

#### 报告正文的逻辑结构形式:

“现状–问题–解决方案–建议”式结构——多用于反映、解决问题的报告;

“成果–具体做法–经验”式结构——多用于总结经验的报告;

“事件过程–事件性质结论–处理意见”式结构——多用于揭示是非的报告。

| 2010 | ... | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 今天 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| BTC/USD | 0.0025 | ... | 123.89 | 524.58 | 240.35 | 439.32 | 2,173.40 | 8,041.78 | 7,680.07 | 6,452.69 | 37,536.63 | 39,073.16 |

| Pizza in $ | 25 | ... | 1.2mi | 5.2mi | 2.4mi | 4.4mi | 21.7mi | 80.4mi | 76.8mi | 64.5mi | 375.37mi | 390.73mi |

| USD/CNY | 6.8298 | ... | 6.1312 | 6.2352 | 6.1974 | 6.549 | 6.8863 | 6.3661 | 6.9061 | 7.09 | 6.43 | 6.49 |

| Pizza in ¥ | 170.75 | ... | 760万 | 3271万 | 1490万 | 2877万 | 1亿4967万 | 5亿1195万 | 5亿3039万 | 4亿5750万 | 24亿1363万 | 25亿3585万 |

"In terms of cryptocurrencies generally, I can say almost with certainty that they will come to a bad ending," Buffett said in an interview with CNBC in January 2018. "Now, when it happens or how or anything else, I don't know."

He added: "If I could buy a five-year put on every one of the cryptocurrencies, I'd be glad to do it, but I would never short a dime's worth."

Mineable cryptocurrencies are rewards to solving a cryptographic algorithm via a process known as mining

The distribution and creation of non-mineable cryptocurrencies (NMCs) is decided ex-ante and is generally based on the protocol of their founders.

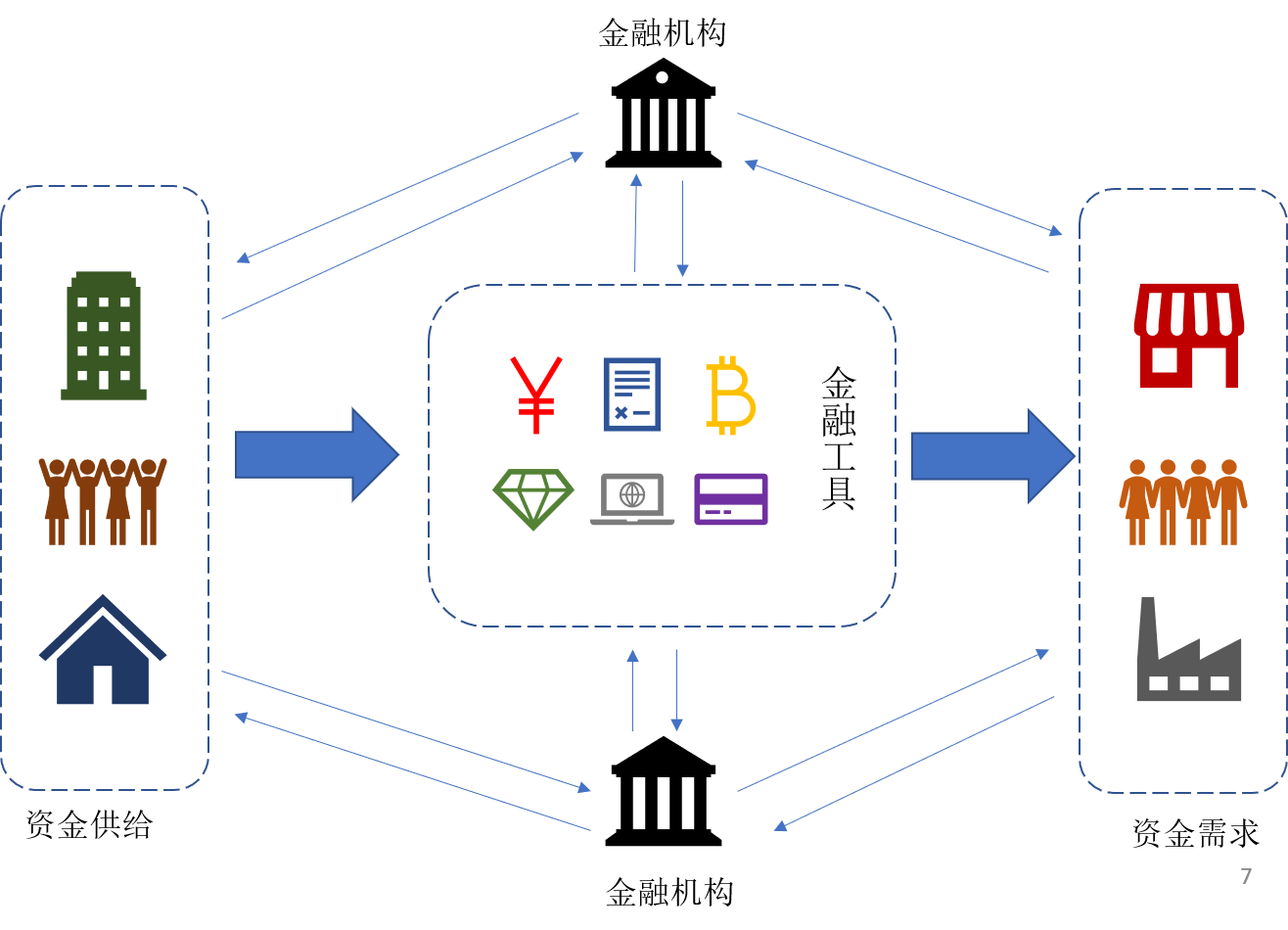

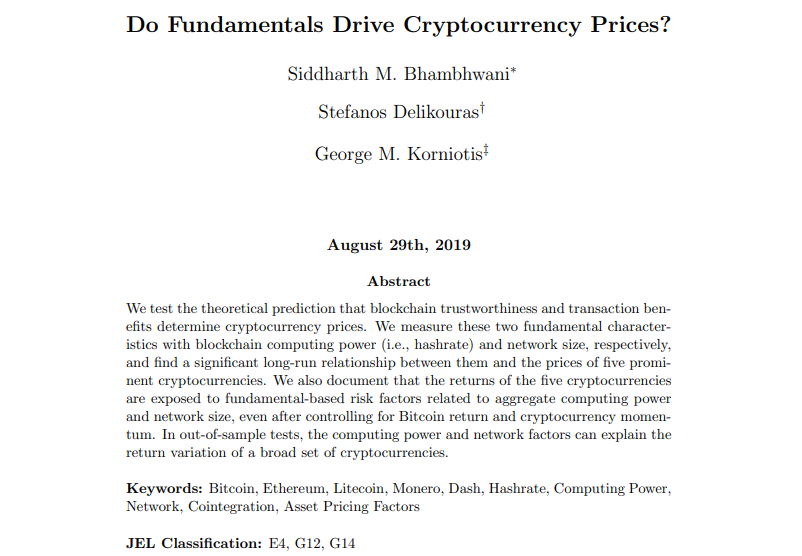

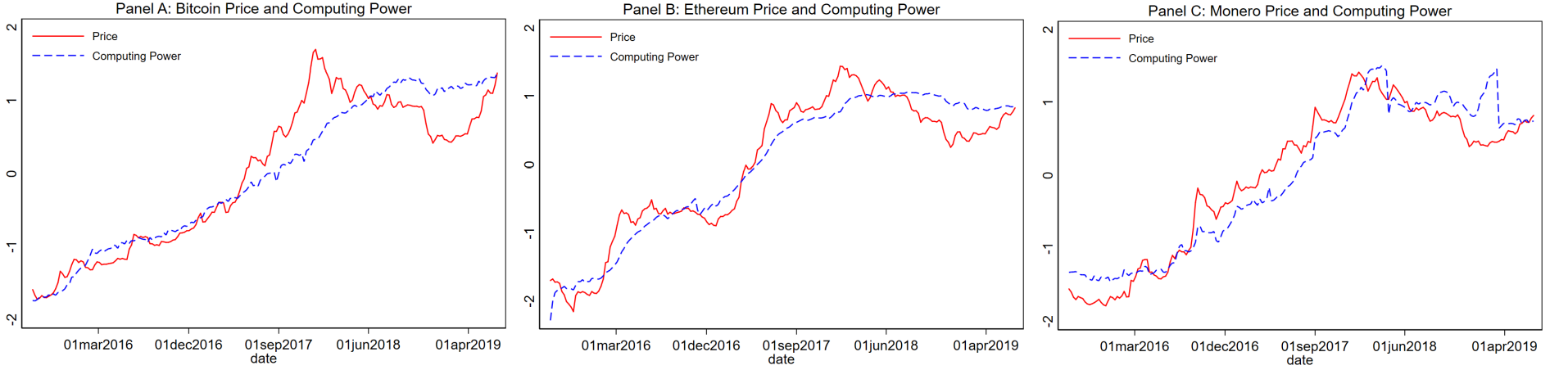

This paper focus on mineable cryptocurrencies

Computing Power

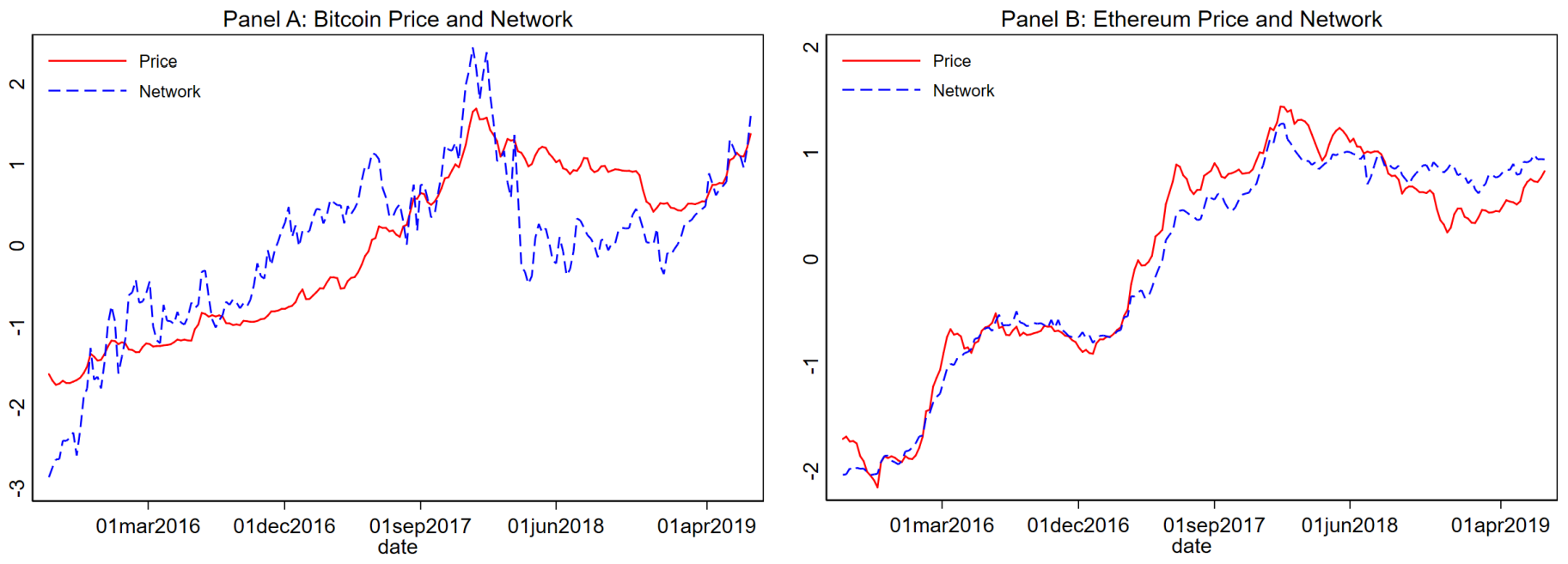

Network

| price | Average of daily log prices over the 7-day period ending on Friday. The daily price is the fixed closing price at midnight UTC of the current day denominated in U.S. dollars. The daily prices are from Coinmetrics.io’s fixing/reference rate service. |

|---|---|

| CP | Average of daily log hashrate over the 7-day period ending on Friday. The daily hasharate is the mean difficulty of finding a new block multiplied by the number of blocks mined on that day. For example, if 100 blocks of Bitcoin were mined on a particular day and each block required an average of 5 TH to mine, the computing power value would be 500 × 1012 hashes. |

| NET | Average of daily log unique active addresses over the 7-day period ending on Friday. The daily addresses are the sum of unique addresses that were active in the network (either as a recipient or originator of a ledger change) that day. Unique active addresses are the number of addresses from (or to) which transactions are conducted on the cryptocurrency’s respective blockchain. Network data for Monero are not available. |

Cross-Sectional Factors

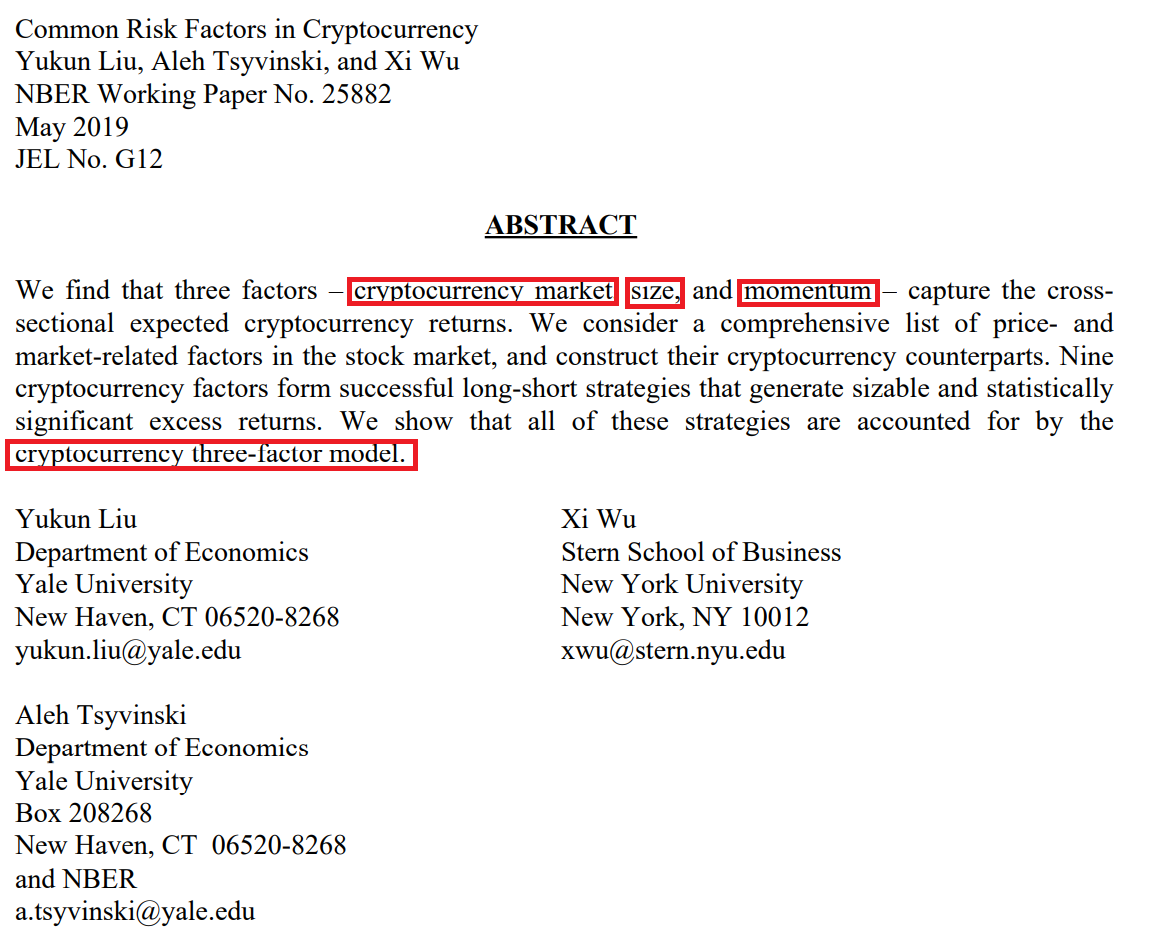

Size Factor Returns

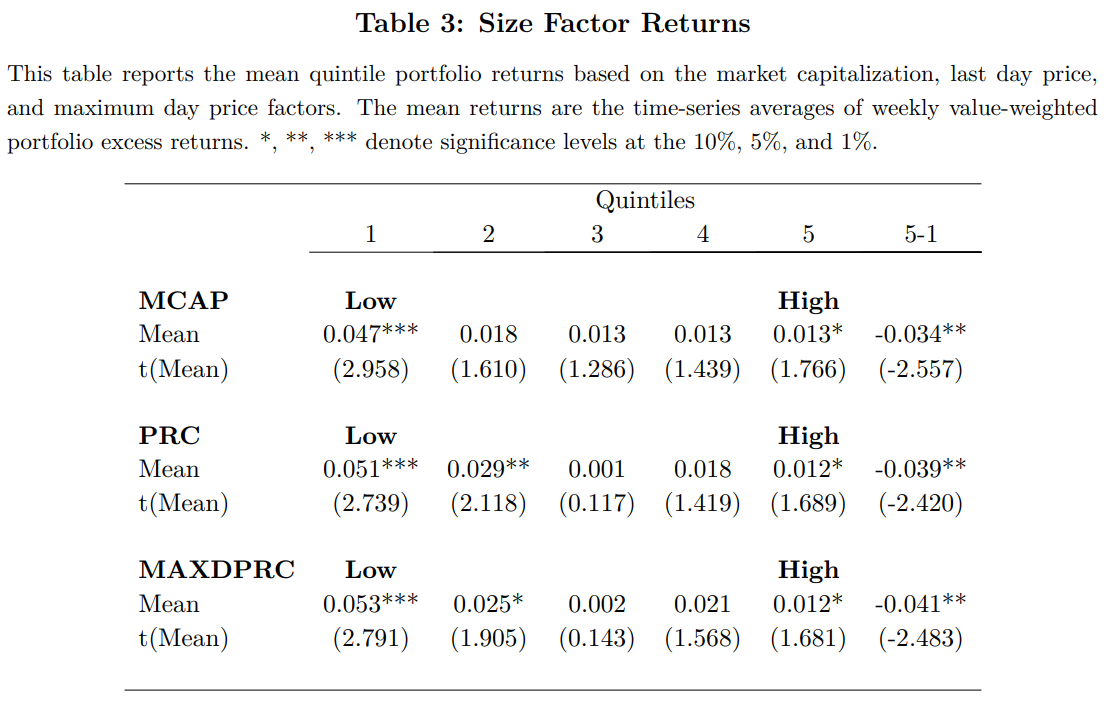

Momentum Factor Returns

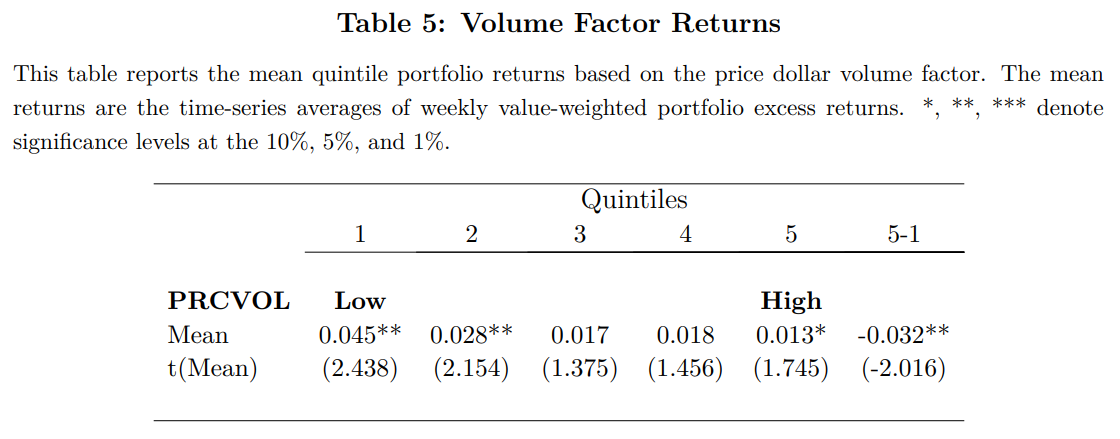

Volume Factor Returns

Volatility Factor Returns

Cryptocurrency Factors

Cryptocurrency One-Factor Model

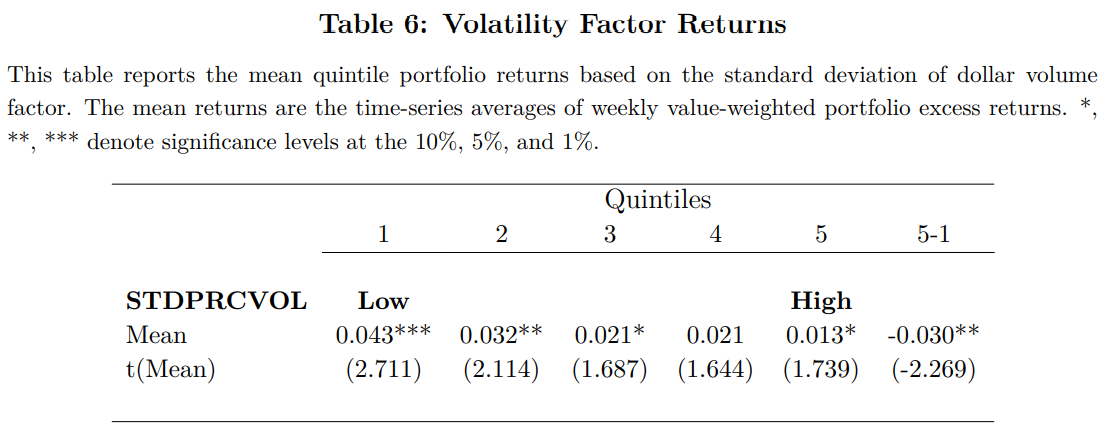

Cryptocurrency Market and Size Factor Model

Cryptocurrency Market and Momentum Factor Model

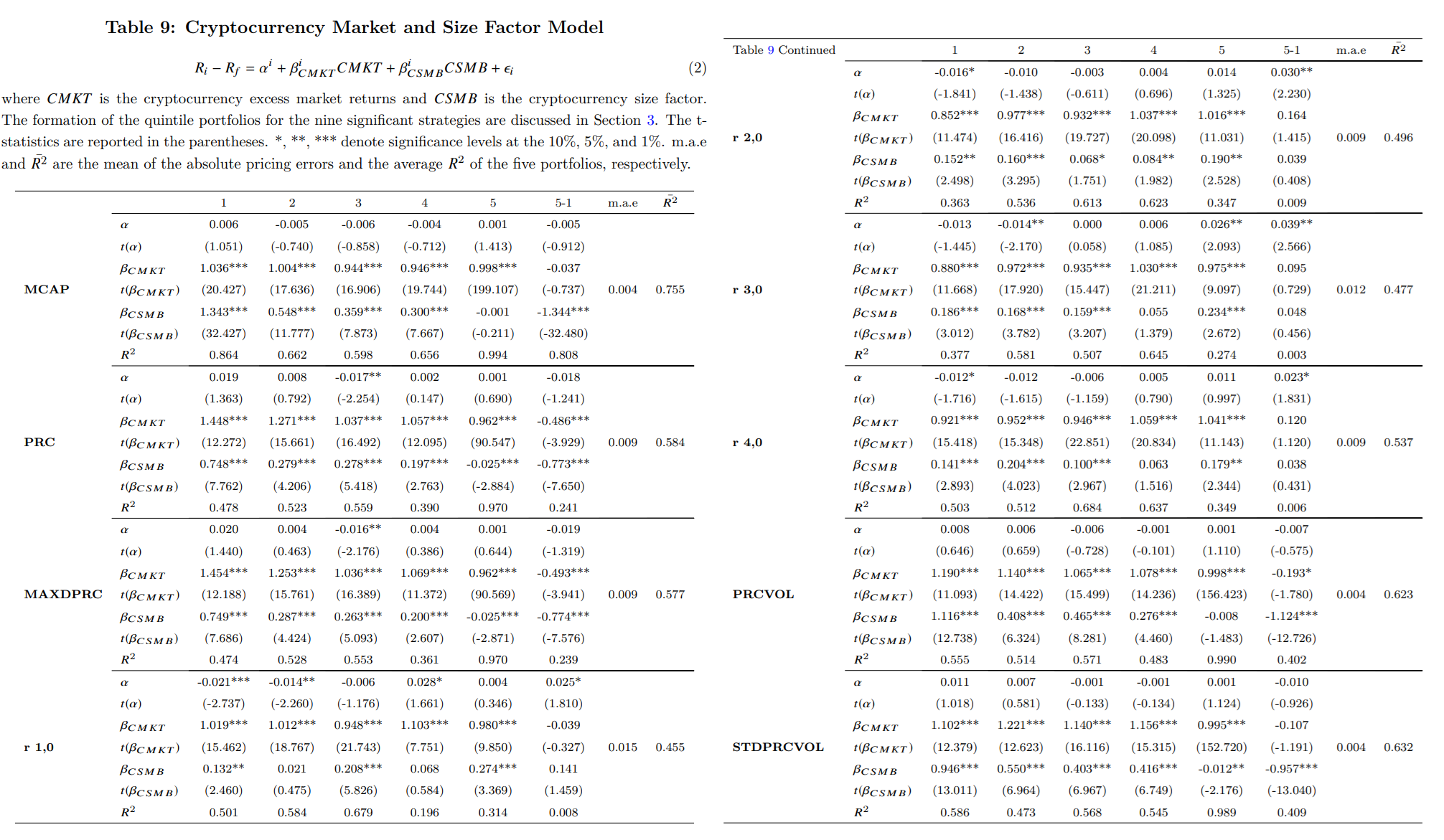

Cryptocurrency Three-Factor Model

Do investor sentiments drive cryptocurrency prices? (Economics Letters 2021)

Is Bitcoin Really Untetherd?

Figure 1 Aggregate flow of Tether between major addresses.

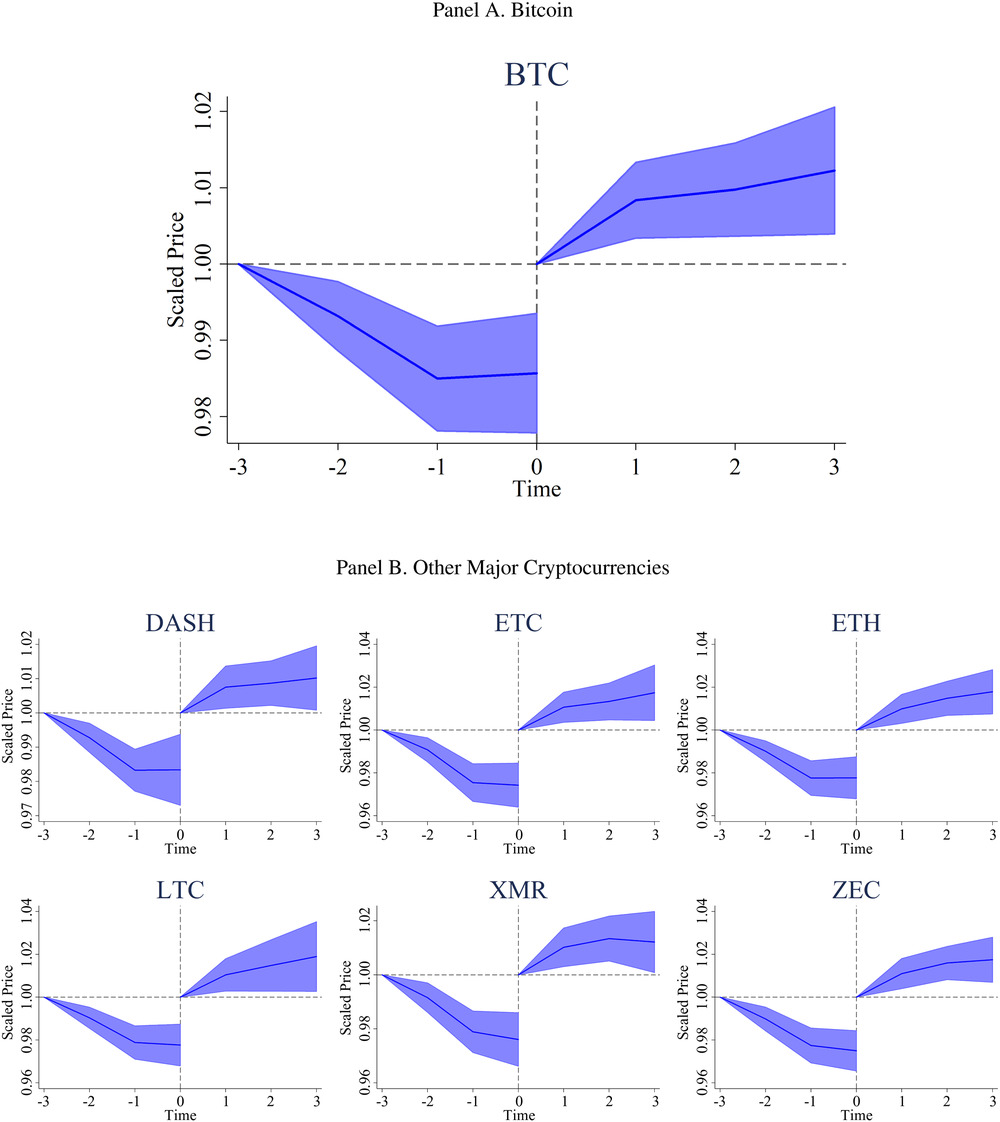

Figure 5 Prices of Bitcoin and other cryptocurrencies around high-flow events.

Panel A shows Bitcoin prices three hours before and after the top 1% of high-flow hours to Poloniex and Bittrex. Prices are scaled to one at time −3 before the event and at time 0 at the end of the event window. Scaled prices are averaged across events. High-flow events are defined as the top 1% of hours with high net average flows of Tether from Bitfinex to Poloniex and Bittrex and Bitcoin back from Poloniex and Bittrex to Bitfinex in the prior hour, which means that high flows occur between time −1 and time 0. Panel B depicts similar results for other major cryptocurrencies.

hash pointer is:

if we have a hash pointer, we can

生成公钥、私钥

签名

验证

通过验证

This algorithm is simplified in that it assumes the ability to select a random node in a manner that is not vulnerable to Sybil attacks.

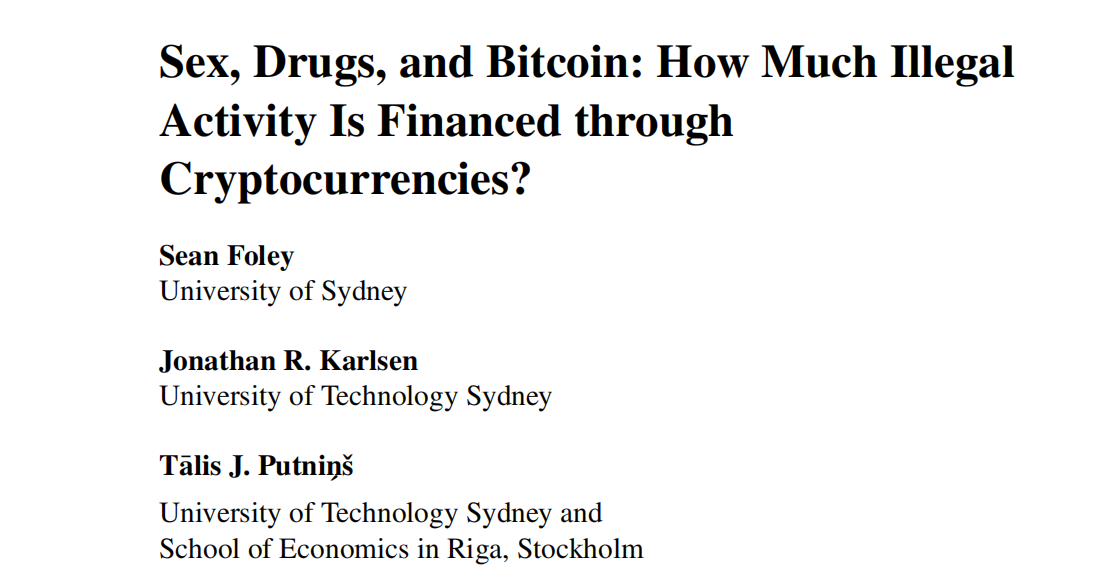

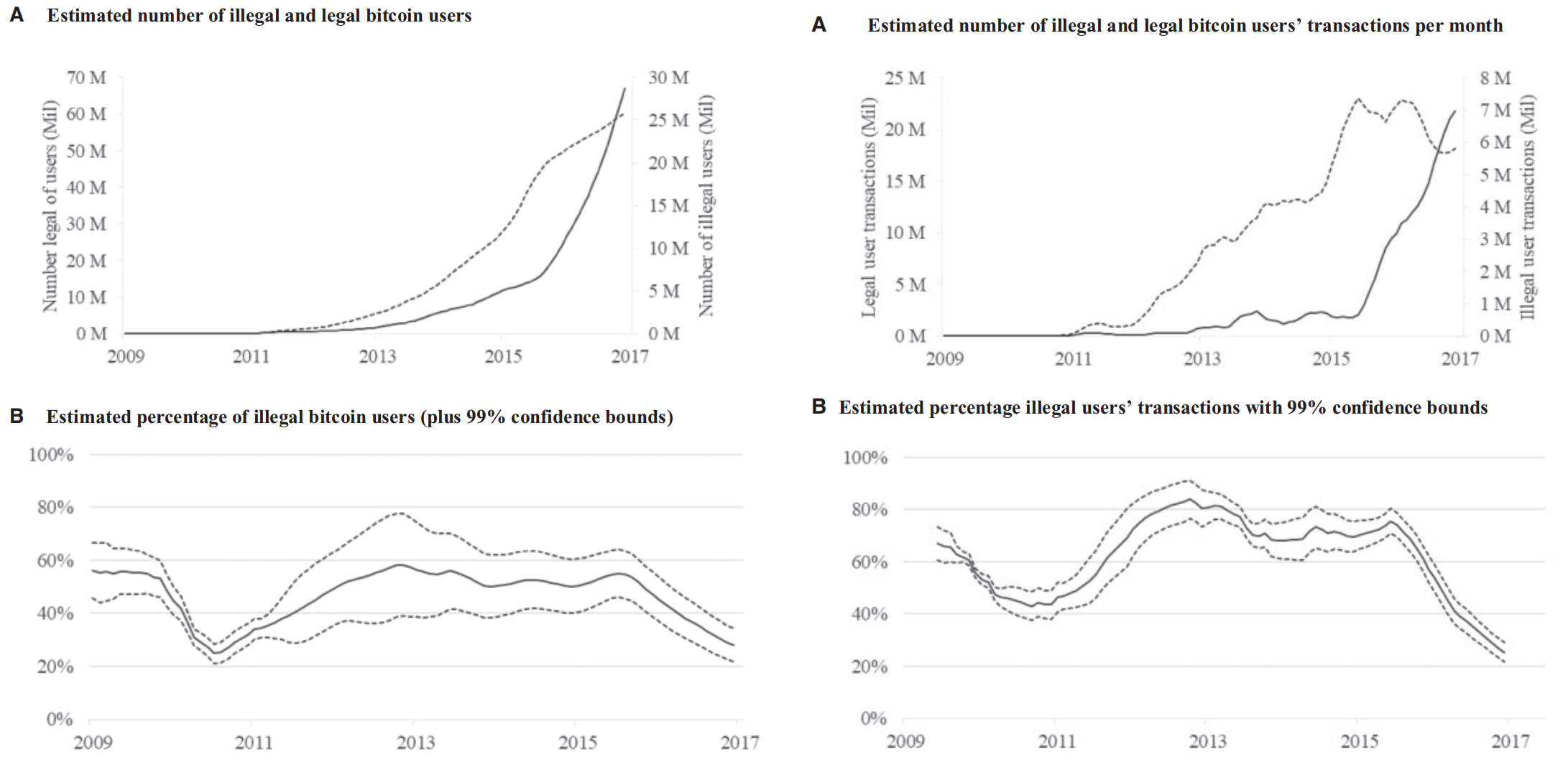

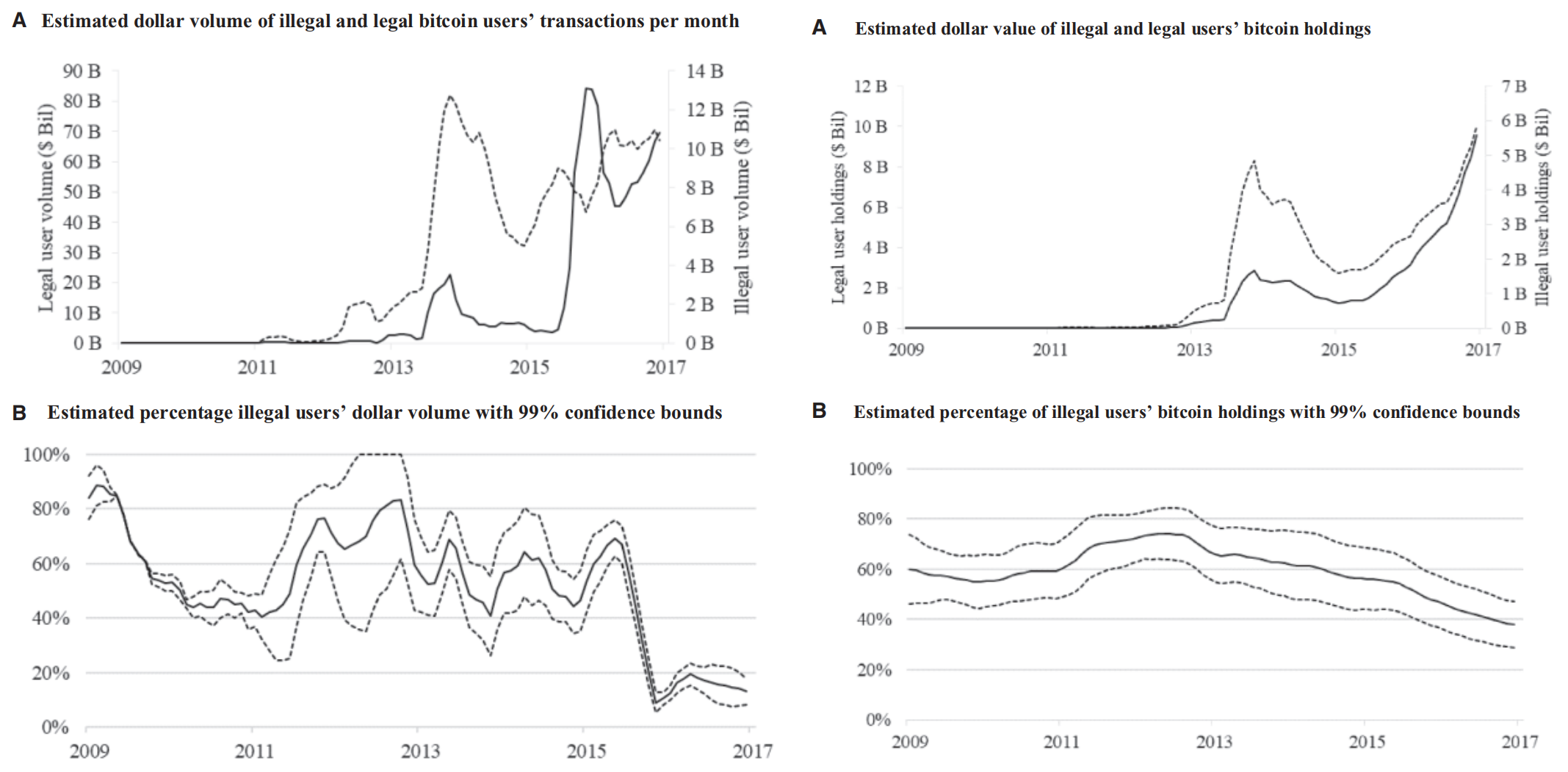

[11] Foley, Sean, Jonathan R. Karlsen, and Tālis J. Putniņš. "Sex, drugs, and bitcoin: How much illegal activity is financed through cryptocurrencies?." The Review of Financial Studies 32.5 (2019): 1798-1853.

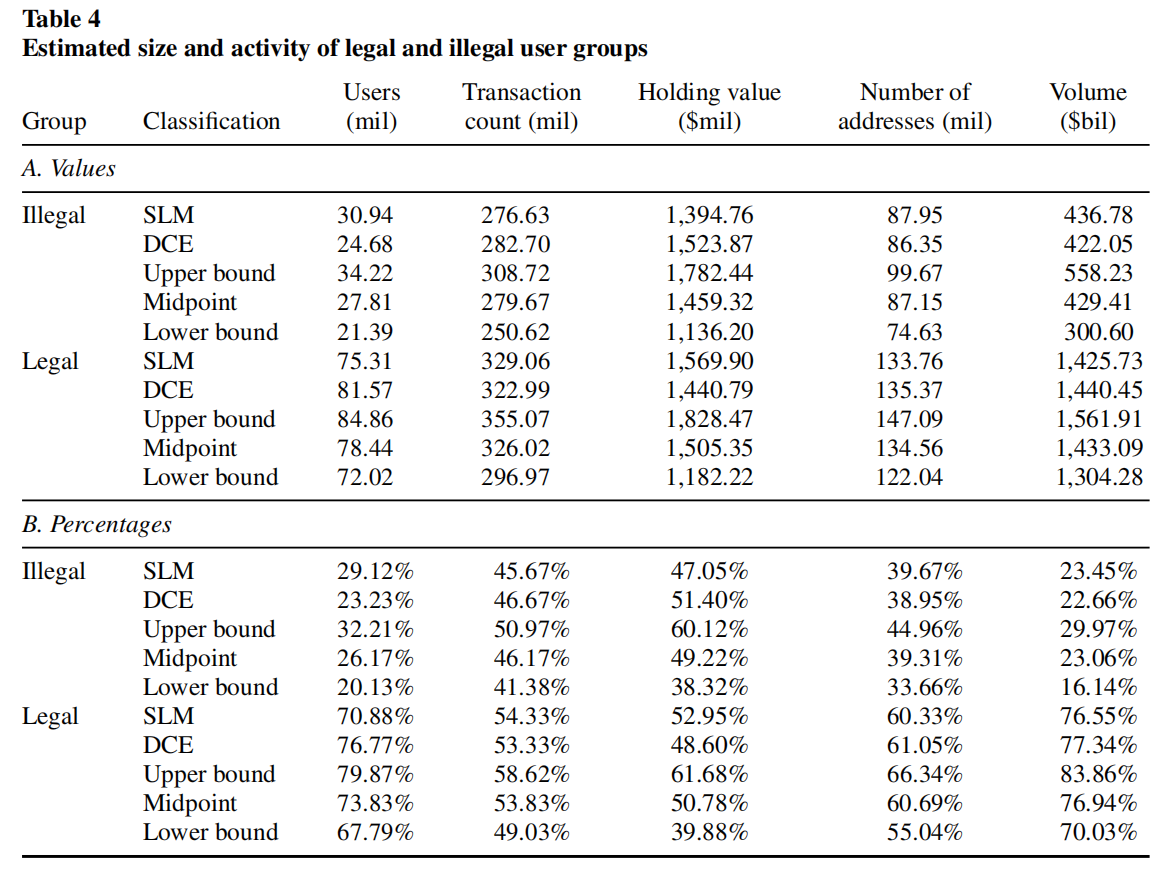

This table reports the size and activity of legal and illegal user groups. The measures of group size and activity are: the number of users (Users), the number of transactions (Transaction count), the average dollar value of bitcoin holdings (Holding value), the number of bitcoin addresses (Number of addresses), and the dollar volume of transactions (Volume). Panel A reports the values of these measures for the two user groups, and panel B expresses the measures for each group as a percentage of the total. Different rows report different approaches to classifying the legal and illegal user groups. SLM provides estimates from the network cluster analysis approach to classification (a variant of the “smart local moving” algorithm). DCE provides estimates from the detection controlled estimation (DCE) approach to classification, which exploits the characteristics of legal and illegal users. Midpoint is the average of the estimates from the SLM and DCE models. Upper bound and Lower bound provide a 99% confidence interval around the Midpoint, using a form of bootstrapped standard errors.

[3] Hinzen, Franz J., Kose John, and Fahad Saleh. "Bitcoin’s limited adoption problem." Journal of Financial Economics 144.2 (2022): 347-369.

[27] Malik, Nikhil, et al. "Why Bitcoin will Fail to Scale?." Management Science (2022).

[29] Csóka, Péter, and P. Jean-Jacques Herings. "Decentralized clearing in financial networks." Management Science 64.10 (2018): 4681-4699.

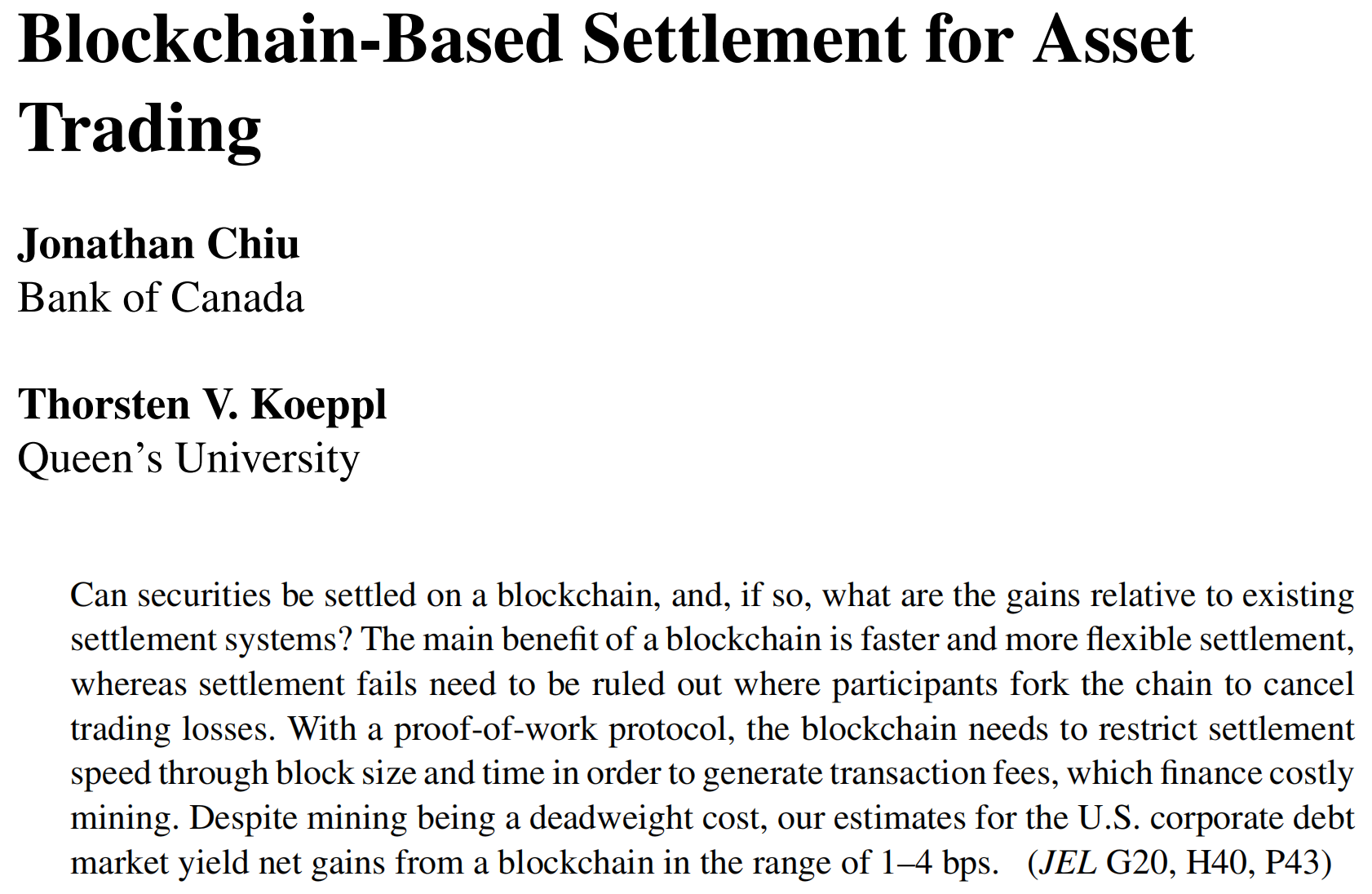

[18] Chiu, Jonathan, and Thorsten V. Koeppl. "Blockchain-based settlement for asset trading." The Review of Financial Studies 32.5 (2019): 1716-1753.

larger trading volume, higher time criticality, and lower default exposure make settlement on a blockchain more attractive.

[22] Cheng, Stephanie F., et al. "Riding the blockchain mania: Public firms’ speculative 8-K disclosures." Management Science 65.12 (2019): 5901-5913.

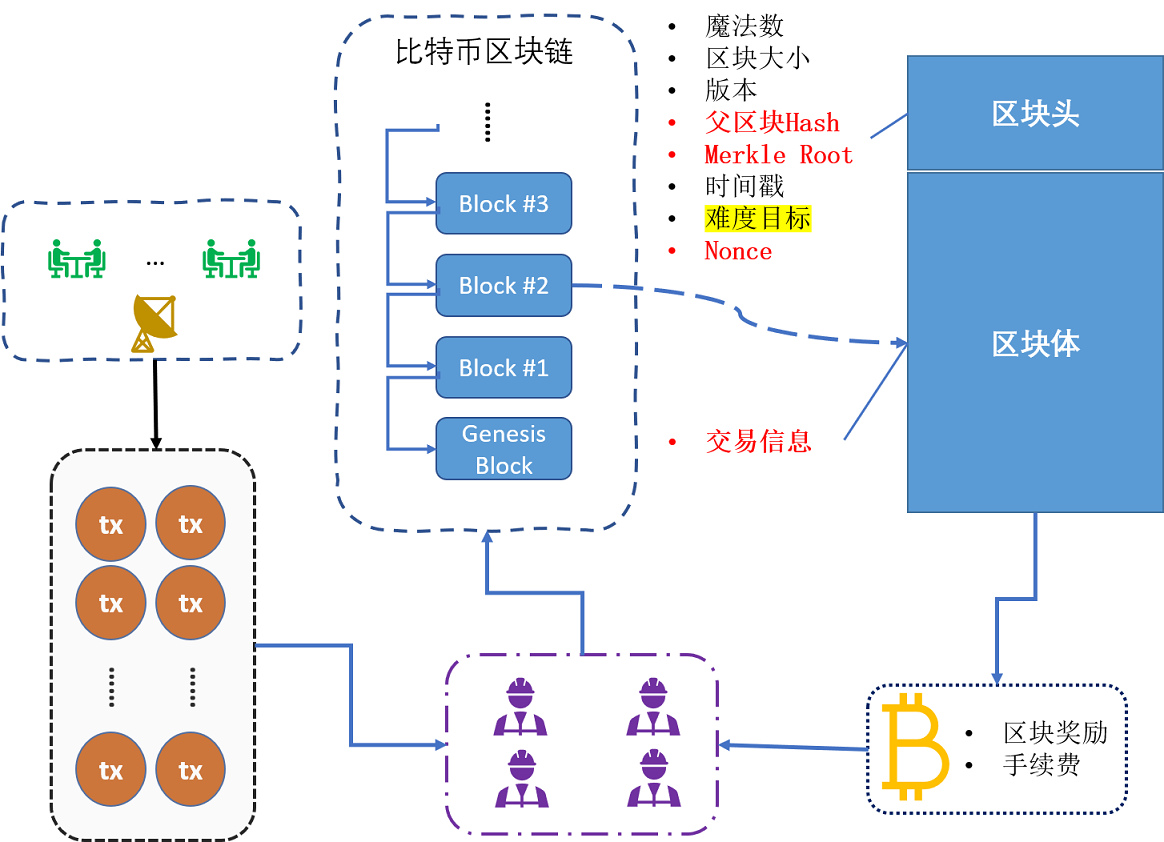

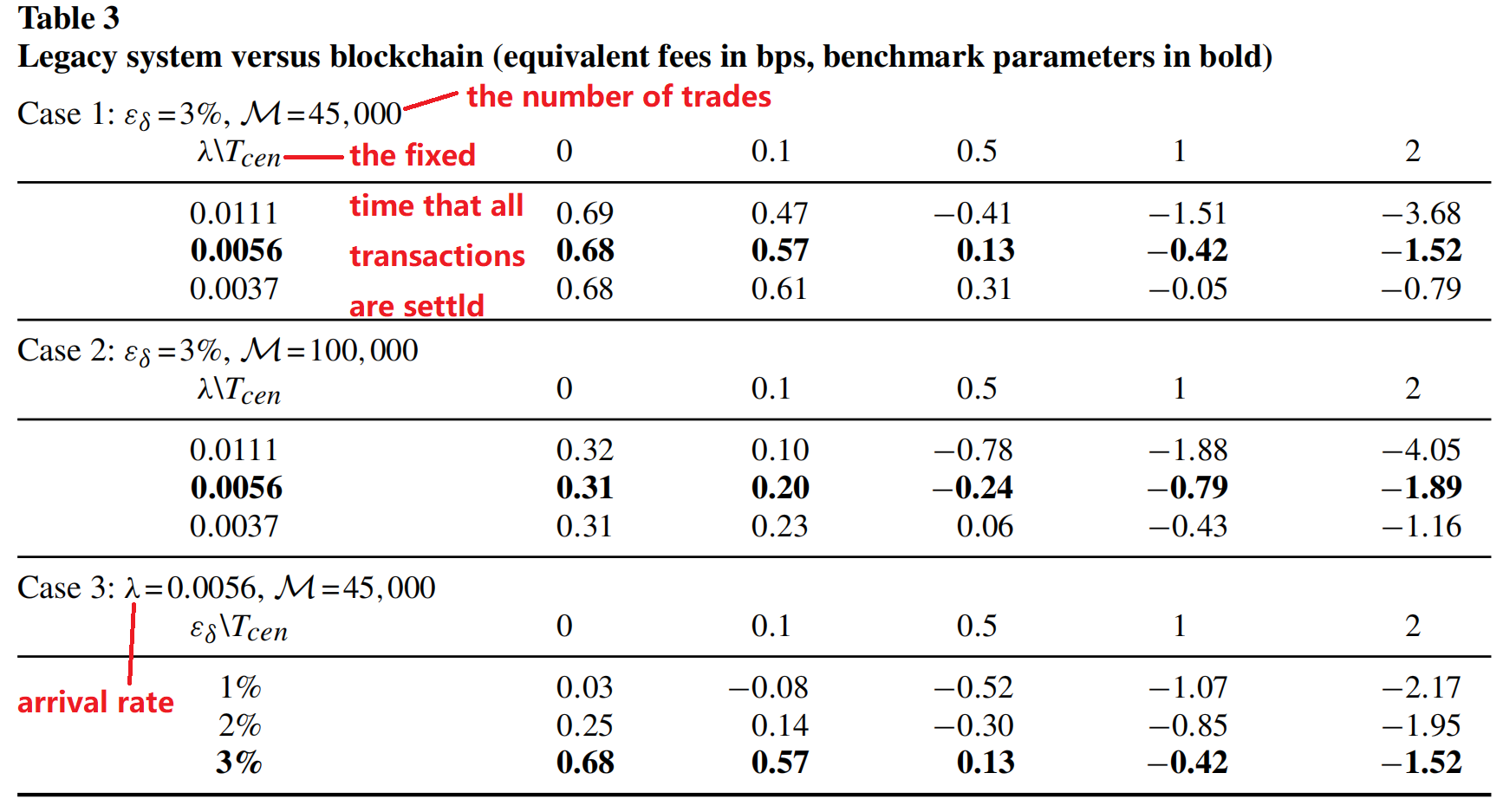

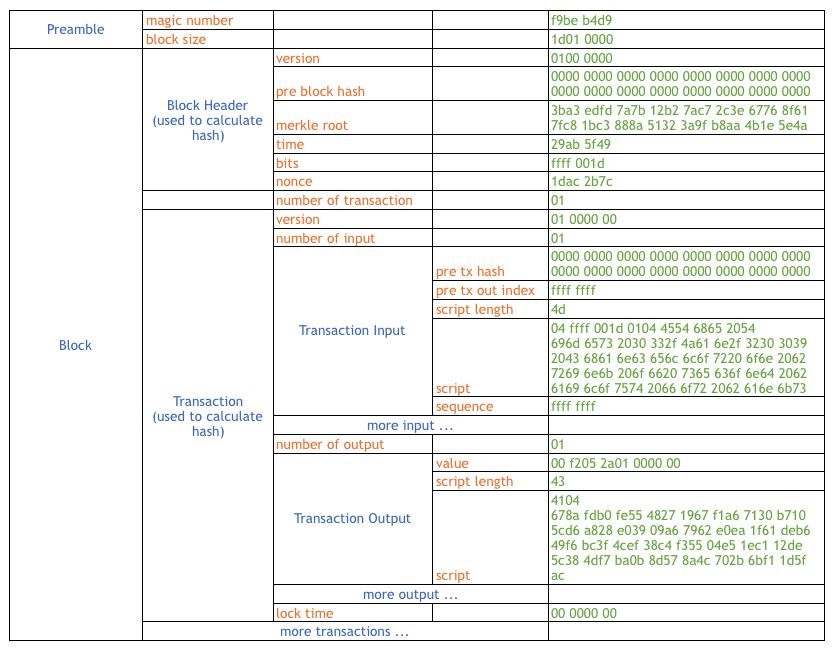

BTC区块结构(source: arcblock.io)

| 序号 | 方法 | 描述 |

|---|---|---|

| 1 | GET | 请求指定的页面信息,并返回实体主体。 |

| 2 | HEAD | 类似于get请求,只不过返回的响应中没有具体的内容,用于获取报头 |

| 3 | POST | 向指定资源提交数据进行处理请求(例如提交表单或者上传文件)。数据被包含在请求体中。POST请求可能会导致新的资源的建立和/或已有资源的修改。 |

| 4 | PUT | 从客户端向服务器传送的数据取代指定的文档的内容。 |

| 5 | DELETE | 请求服务器删除指定的页面。 |

| 6 | CONNECT | HTTP/1.1协议中预留给能够将连接改为管道方式的代理服务器。 |

| 7 | OPTIONS | 允许客户端查看服务器的性能。 |

| 8 | TRACE | 回显服务器收到的请求,主要用于测试或诊断。 |

HTTP状态码由三个十进制数字组成,第一个十进制数字定义了状态码的类型,后两个数字没有分类的作用。HTTP状态码共分为5种类型:

| 分类 | 分类描述 |

|---|---|

| 1** | 信息,服务器收到请求,需要请求者继续执行操作 |

| 2** | 成功,操作被成功接收并处理 |

| 3** | 重定向,需要进一步的操作以完成请求 |

| 4** | 客户端错误,请求包含语法错误或无法完成请求 |

| 5** | 服务器错误,服务器在处理请求的过程中发生了错误 |

HTTP状态码的详细描述请参考:HTTP状态码列表

| 步骤 | 工具 | |

|---|---|---|

| 1 | 获取目标网页 | requests |

| 2 | 解析html文件提取有用信息 | BeautifulSoup, re |

| 3 | 保存数据 | csv, txt, json |

本页内容取自Jake Vander Plas的 Whirlwind Tour of Python;相关资料可从GitHub获取。Python正则表达式的完整介绍请参考技术文档。

| Character | Description | Example |

|---|---|---|

\d (\D) |

Match any digit (non-digit) | |

\s (\S) |

Match any whitespace (non-whitespace) | |

\w (\W) |

Match any alphanumeric char (non-alphanumeric char) | |

? |

Match zero or one repetitions of preceding | "ab?" matches "a" or "ab" |

* |

Match zero or more repetitions of preceding | "ab*" matches "a", "ab", "abb", "abbb"... |

+ |

Match one or more repetitions of preceding | "ab+" matches "ab", "abb", "abbb"... but not "a" |

{n} |

Match n repetitions of preeeding |

"ab{2}" matches "abb" |

{m,n} |

Match between m and n repetitions of preceding |

"ab{2,3}" matches "abb" or "abbb" |

import requests

import warnings

warnings.filterwarnings('ignore')

url='https://blockchain.info/block-height/00000?format=json'

r=requests.get(url)

#print(r.text)

j=r.json()

j

{'blocks': [{'hash': '000000000019d6689c085ae165831e934ff763ae46a2a6c172b3f1b60a8ce26f',

'ver': 1,

'prev_block': '0000000000000000000000000000000000000000000000000000000000000000',

'mrkl_root': '4a5e1e4baab89f3a32518a88c31bc87f618f76673e2cc77ab2127b7afdeda33b',

'time': 1231006505,

'bits': 486604799,

'next_block': ['00000000839a8e6886ab5951d76f411475428afc90947ee320161bbf18eb6048'],

'fee': 0,

'nonce': 2083236893,

'n_tx': 1,

'size': 285,

'block_index': 0,

'main_chain': True,

'height': 0,

'weight': 1140,

'tx': [{'hash': '4a5e1e4baab89f3a32518a88c31bc87f618f76673e2cc77ab2127b7afdeda33b',

'ver': 1,

'vin_sz': 1,

'vout_sz': 1,

'size': 204,

'weight': 816,

'fee': 0,

'relayed_by': '0.0.0.0',

'lock_time': 0,

'tx_index': 2098408272645986,

'double_spend': False,

'time': 1231006505,

'block_index': 0,

'block_height': 0,

'inputs': [{'sequence': 4294967295,

'witness': '',

'script': '04ffff001d0104455468652054696d65732030332f4a616e2f32303039204368616e63656c6c6f72206f6e206272696e6b206f66207365636f6e64206261696c6f757420666f722062616e6b73',

'index': 0,

'prev_out': {'n': 4294967295,

'script': '',

'spending_outpoints': [{'n': 0, 'tx_index': 2098408272645986}],

'spent': True,

'tx_index': 0,

'type': 0,

'value': 0}}],

'out': [{'type': 0,

'spent': False,

'value': 5000000000,

'spending_outpoints': [],

'n': 0,

'tx_index': 2098408272645986,

'script': '4104678afdb0fe5548271967f1a67130b7105cd6a828e03909a67962e0ea1f61deb649f6bc3f4cef38c4f35504e51ec112de5c384df7ba0b8d578a4c702b6bf11d5fac',

'addr': '1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa'}]}]}]}

print("dtype: %s, length: %d" %(type(j),len(j)))

dtype: <class 'dict'>, length: 1

blocks=j['blocks'][0]

print(type(blocks))

blocks.keys()

<class 'dict'>

dict_keys(['hash', 'ver', 'prev_block', 'mrkl_root', 'time', 'bits', 'next_block', 'fee', 'nonce', 'n_tx', 'size', 'block_index', 'main_chain', 'height', 'weight', 'tx'])

tx=blocks['tx']

print(len(tx))

tx

1

[{'hash': '4a5e1e4baab89f3a32518a88c31bc87f618f76673e2cc77ab2127b7afdeda33b',

'ver': 1,

'vin_sz': 1,

'vout_sz': 1,

'size': 204,

'weight': 816,

'fee': 0,

'relayed_by': '0.0.0.0',

'lock_time': 0,

'tx_index': 2098408272645986,

'double_spend': False,

'time': 1231006505,

'block_index': 0,

'block_height': 0,

'inputs': [{'sequence': 4294967295,

'witness': '',

'script': '04ffff001d0104455468652054696d65732030332f4a616e2f32303039204368616e63656c6c6f72206f6e206272696e6b206f66207365636f6e64206261696c6f757420666f722062616e6b73',

'index': 0,

'prev_out': {'n': 4294967295,

'script': '',

'spending_outpoints': [{'n': 0, 'tx_index': 2098408272645986}],

'spent': True,

'tx_index': 0,

'type': 0,

'value': 0}}],

'out': [{'type': 0,

'spent': False,

'value': 5000000000,

'spending_outpoints': [],

'n': 0,

'tx_index': 2098408272645986,

'script': '4104678afdb0fe5548271967f1a67130b7105cd6a828e03909a67962e0ea1f61deb649f6bc3f4cef38c4f35504e51ec112de5c384df7ba0b8d578a4c702b6bf11d5fac',

'addr': '1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa'}]}]

https://blockchain.info/block-height/$block_height?format=json

import requests

import csv

with open('./btc_block_info.csv','w',newline='') as csvfile:

writer = csv.writer(csvfile)

writer.writerow(['height','hash','n_tx','time'])

for i in range(10):

r=requests.get('https://blockchain.info/block-height/0000'+str(i)+'?format=json')

blocks=r.json()['blocks'][0]

writer.writerow([i,blocks['hash'],blocks['n_tx'],blocks['time']])

print('i=',i,' completed')

i= 0 completed i= 1 completed i= 2 completed i= 3 completed i= 4 completed i= 5 completed i= 6 completed i= 7 completed i= 8 completed i= 9 completed

[i,blocks['hash'],blocks['n_tx'],blocks['time']]

[9, '000000008d9dc510f23c2657fc4f67bea30078cc05a90eb89e84cc475c080805', 1, 1231473279]

get_block

Get a single block based on a block hash. Returns a Block object.Params:

block_id : str - block hashUsage:

from blockchain import blockexplorer

block = blockexplorer.get_block('000000000000000016f9a2c3e0f4c1245ff24856a79c34806969f5084f410680')

from blockchain import blockexplorer

block = blockexplorer.get_block('000000000000000016f9a2c3e0f4c1245ff24856a79c34806969f5084f410680')

block.n_tx

345

get_block_height

Get an array of blocks at the specified height. Returns an array of Block objects.Params:

height : int - block heightUsage:

blocks = blockexplorer.get_block_height(2570)

blocks = blockexplorer.get_block_height(2570)

print(blocks[0].merkle_root)

blocks[0].n_tx

115f940a1363ca9ab303fdd3fdddb8d6d0d98fbfc013419fc66917b2bded5208

1

get_blocks

Get a list of blocks for a specific day or mining pool. Returns an array of SimpleBlock objects.Params:

time : int - unix time in ms (optional)

pool_name : str - pool name (optional)At least one parameter is required.

Usage:

blocks = blockexplorer.get_blocks(pool_name = 'Discus Fish')

Block¶hash : str

version : int

previous_block : str

merkle_root : str

time : int

bits : int

fee : int

nonce int

n_tx : int

size : int

block_index : int

main_chain : bool

height : int

received_time : int

relayed_by : string

transactions : array of Transaction objectsTransaction¶double_spend : bool

block_height : int (if -1, the tx is unconfirmed)

time : int

relayed_by : str

hash : str

tx_index : int

version : int

size : int

inputs : array of Input objects

outputs: array of Output objectsAddress¶hash160 : str

address : str

n_tx : int

total_received : int

total_sent : int

final_balance : int

transactions : array of Transaction objectsMultiAddress¶n_tx : int

n_tx_filtered : int

total_received : int

total_sent : int

final_balance : int

addresses : array of SimpleAddress objects

transactions : array of Transaction objects新华社北京10月25日电 中共中央政治局10月24日下午就区块链技术发展现状和趋势进行第十八次集体学习。中共中央总书记习近平在主持学习时强调,区块链技术的集成应用在新的技术革新和产业变革中起着重要作用。我们要把区块链作为核心技术自主创新的重要突破口,明确主攻方向,加大投入力度,着力攻克一批关键核心技术,加快推动区块链技术和产业创新发展。

浙江大学教授、中国工程院院士陈纯就这个问题作了讲解,并谈了意见和建议。

中共中央政治局各位同志认真听取了讲解,并进行了讨论。

习近平在主持学习时发表了讲话。他指出,区块链技术应用已延伸到**数字金融、物联网、智能制造、供应链管理、数字资产交易**等多个领域。目前,全球主要国家都在加快布局区块链技术发展。我国在区块链领域拥有良好基础,要加快推动区块链技术和产业创新发展,积极推进区块链和经济社会融合发展。

习近平强调,要强化基础研究,提升原始创新能力,努力让我国在区块链这个新兴领域走在理论最前沿、占据创新制高点、取得产业新优势。要推动协同攻关,加快推进核心技术突破,为区块链应用发展提供安全可控的技术支撑。要加强区块链标准化研究,提升国际话语权和规则制定权。要加快产业发展,发挥好市场优势,进一步打通创新链、应用链、价值链。要构建区块链产业生态,**加快区块链和人工智能、大数据、物联网等前沿信息技术的深度融合**,推动集成创新和融合应用。要加强人才队伍建设,建立完善人才培养体系,打造多种形式的高层次人才培养平台,培育一批领军人物和高水平创新团队。

习近平指出,要抓住区块链技术融合、功能拓展、产业细分的契机,发挥区块链在**促进数据共享、优化业务流程、降低运营成本、提升协同效率、建设可信体系等方面的作用**。要推动区块链和实体经济深度融合,**解决中小企业贷款融资难、银行风控难、部门监管难**等问题。要利用区块链技术探索数字经济模式创新,为打造便捷高效、公平竞争、稳定透明的营商环境提供动力,为推进供给侧结构性改革、实现各行业供需有效对接提供服务,为加快新旧动能接续转换、推动经济高质量发展提供支撑。要探索“区块链+”在民生领域的运用,积极推动区块链技术在**教育、就业、养老、精准脱贫、医疗健康、商品防伪、食品安全、公益、社会救助等领域的应用**,为人民群众提供更加智能、更加便捷、更加优质的公共服务。要推动区块链底层技术服务和新型智慧城市建设相结合,**探索在信息基础设施、智慧交通、能源电力等领域**的推广应用,提升城市管理的智能化、精准化水平。要利用区块链技术**促进城市间在信息、资金、人才、征信等方面更大规模的互联互通**,保障生产要素在区域内有序高效流动。要探索利用区块链数据共享模式,*实现政务数据跨部门、跨区域共同维护和利用**,促进业务协同办理,深化“最多跑一次”改革,为人民群众带来更好的政务服务体验。

习近平强调,要加强对区块链技术的引导和规范,加强对区块链安全风险的研究和分析,密切跟踪发展动态,积极探索发展规律。要探索建立适应区块链技术机制的安全保障体系,引导和推动区块链开发者、平台运营者加强行业自律、落实安全责任。要把依法治网落实到区块链管理中,推动区块链安全有序发展。

习近平指出,相关部门及其负责领导同志要注意区块链技术发展现状和趋势,提高运用和管理区块链技术能力,使区块链技术在建设网络强国、发展数字经济、助力经济社会发展等方面发挥更大作用。

The components of an open, public blockchain are (usually):

A peer-to-peer (P2P) network connecting participants and propagating transactions and blocks of verified transactions, based on a standardized "gossip" protocol

Messages, in the form of transactions, representing state transitions

A set of consensus rules, governing what constitutes a transaction and what makes for a valid state transition

A state machine that processes transactions according to the consensus rules

A chain of cryptographically secured blocks that acts as a journal of all the verified and accepted state transitions

A consensus algorithm that decentralizes control over the blockchain, by forcing participants to cooperate in the enforcement of the consensus rules

A game-theoretically sound incentivization scheme (e.g., proof-of-work costs plus block rewards) to economically secure the state machine in an open environment

One or more open source software implementations of the above ("clients")

[1] Liu, Yukun, Aleh Tsyvinski, and Xi Wu. "Common risk factors in cryptocurrency." The Journal of Finance 77.2 (2022): 1133-1177.

[2] Griffin, John M., and Amin Shams. "Is Bitcoin really untethered?." The Journal of Finance 75.4 (2020): 1913-1964.

[3] Hinzen, Franz J., Kose John, and Fahad Saleh. "Bitcoin’s limited adoption problem." Journal of Financial Economics 144.2 (2022): 347-369.

[4] Easley, David, Maureen O'Hara, and Soumya Basu. "From mining to markets: The evolution of bitcoin transaction fees." Journal of Financial Economics 134.1 (2019): 91-109.

[5] Makarov, Igor, and Antoinette Schoar. "Trading and arbitrage in cryptocurrency markets." Journal of Financial Economics 135.2 (2020): 293-319.

[6] Sokolov, Konstantin. "Ransomware activity and blockchain congestion." Journal of Financial Economics 141.2 (2021): 771-782.

[7] Cong, Lin William, Ye Li, and Neng Wang. "Token-based platform finance." Journal of Financial Economics (2021).

[8] Gryglewicz, Sebastian, Simon Mayer, and Erwan Morellec. "Optimal financing with tokens." Journal of Financial Economics 142.3 (2021): 1038-1067.

[9] Howell, Sabrina T., Marina Niessner, and David Yermack. "Initial coin offerings: Financing growth with cryptocurrency token sales." The Review of Financial Studies 33.9 (2020): 3925-3974.

[10] Liu, Yukun, and Aleh Tsyvinski. "Risks and returns of cryptocurrency." The Review of Financial Studies 34.6 (2021): 2689-2727.

[11] Foley, Sean, Jonathan R. Karlsen, and Tālis J. Putniņš. "Sex, drugs, and bitcoin: How much illegal activity is financed through cryptocurrencies?." The Review of Financial Studies 32.5 (2019): 1798-1853.

[12] Cong, Lin William, Ye Li, and Neng Wang. "Tokenomics: Dynamic adoption and valuation." The Review of Financial Studies 34.3 (2021): 1105-1155.

[13] Pagnotta, Emiliano S. "Decentralizing money: Bitcoin prices and blockchain security." The Review of Financial Studies 35.2 (2022): 866-907.

[14] Biais, Bruno, et al. "The blockchain folk theorem." The Review of Financial Studies 32.5 (2019): 1662-1715.

[15] Cong, Lin William, Zhiguo He, and Jiasun Li. "Decentralized mining in centralized pools." The Review of Financial Studies 34.3 (2021): 1191-1235.

[16] Goldstein, Itay, Wei Jiang, and G. Andrew Karolyi. "To FinTech and beyond." The Review of Financial Studies 32.5 (2019): 1647-1661.

[17] Saleh, Fahad. "Blockchain without waste: Proof-of-stake." The Review of financial studies 34.3 (2021): 1156-1190.

[18] Chiu, Jonathan, and Thorsten V. Koeppl. "Blockchain-based settlement for asset trading." The Review of Financial Studies 32.5 (2019): 1716-1753.

[19] Cong, Lin William, and Zhiguo He. "Blockchain disruption and smart contracts." The Review of Financial Studies 32.5 (2019): 1754-1797.

[20] Lee, Jeongmin, and Christine A. Parlour. "Consumers as financiers: Consumer surplus, crowdfunding, and Initial Coin Offerings." The Review of Financial Studies 35.3 (2022): 1105-1140.

[21] Chen, Mark A., Qinxi Wu, and Baozhong Yang. "How valuable is FinTech innovation?." The Review of Financial Studies 32.5 (2019): 2062-2106.

[22] Cheng, Stephanie F., et al. "Riding the blockchain mania: Public firms’ speculative 8-K disclosures." Management Science 65.12 (2019): 5901-5913.

[23] Whitaker, Amy, and Roman Kräussl. "Fractional equity, blockchain, and the future of creative work." Management Science 66.10 (2020): 4594-4611.

[24] Holden, Richard, and Anup Malani. "An Examination of Velocity and Initial Coin Offerings." Management Science (2022).

[25] Tsoukalas, Gerry, and Brett Hemenway Falk. "Token-weighted crowdsourcing." Management Science 66.9 (2020): 3843-3859.

[26] Gan, Jingxing, Gerry Tsoukalas, and Serguei Netessine. "Initial coin offerings, speculation, and asset tokenization." Management Science 67.2 (2021): 914-931.

[27] Malik, Nikhil, et al. "Why Bitcoin will Fail to Scale?." Management Science (2022).

[28] Roşu, Ioanid, and Fahad Saleh. "Evolution of shares in a proof-of-stake cryptocurrency." Management Science 67.2 (2021): 661-672.

[29] Csóka, Péter, and P. Jean-Jacques Herings. "Decentralized clearing in financial networks." Management Science 64.10 (2018): 4681-4699.

[30] Lyandres, Evgeny, Berardino Palazzo, and Daniel Rabetti. "Initial coin offering (ico) success and post-ico performance." Management Science (2022).

[31] Arnosti, Nick, and S. Matthew Weinberg. "Bitcoin: A natural oligopoly." Management Science (2022).